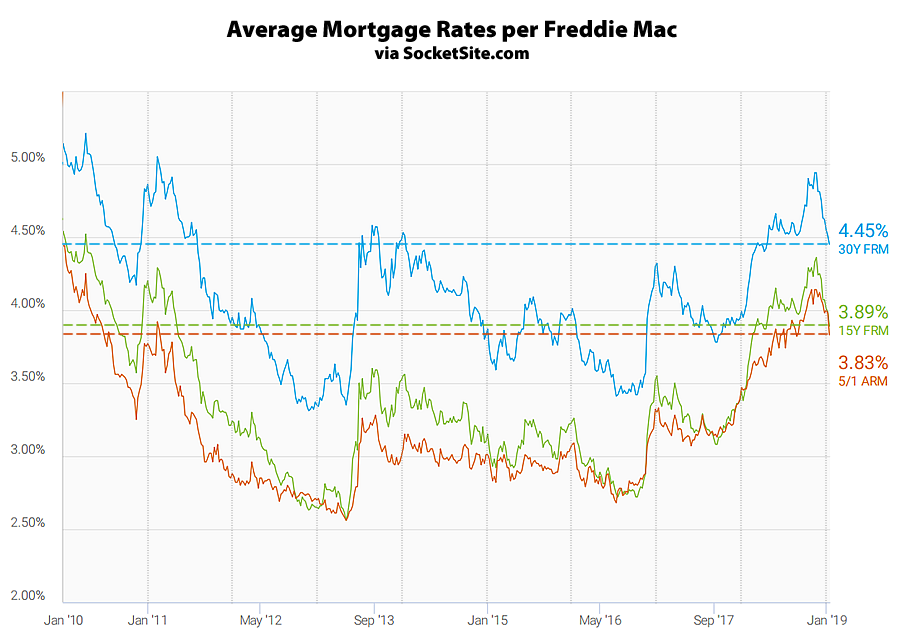

Having shed 6 basis points over the past week, the average rate for a benchmark 30-year mortgage has dropped to 4.45 percent, which is 49 basis points below the 7-year high of 4.94 percent it hit this past November and a 9-month low but still 46 basis points above its mark at the same time last year, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has now shed 47 basis points since mid-November, including 10 basis points over the past week, and now measures 3.89 percent (which remains 45 basis points above its mark at the same time last year), while the average rate for a 5-year adjustable dropped 15 basis points over the past week and now measures 3.83 percent, which is 37 basis points above its mark at the same time last year.

With the drop in rates, purchase mortgage activity in the U.S. jumped 17 percent over the past week and application volume is now running 4 percent higher versus the same time last year, according to data from the Mortgage Bankers Association.

And while the Fed has signaled expectations for two rate hikes in 2019, according to the futures market, traders are currently wagering against any more rate hikes over the next year.

Wouldn’t jumbo rates (which are lower than conforming) be more appropriate for San Francisco?