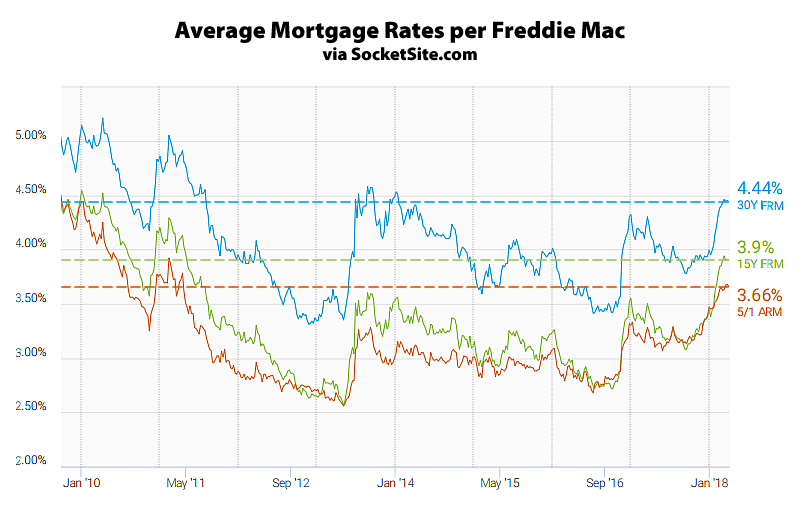

With the impact of the Fed’s predicted rate hike last week having already been priced in, the average rate for a benchmark 30-year mortgage has been holding around 4.44 percent, which is 30 basis points higher on a year-over-year basis, an increase of 51 basis points since the beginning of the year and within 14 basis points of a 5-year high (4.58 percent), according to Freddie Mac’s Primary Mortgage Market Survey data.

At the same time, the average rate for 15-year fixed mortgage is holding around 3.90 percent, which is 51 basis points higher on a year-over-year basis, while the average rate for a 5-year adjustable slipped one (1) basis point to 3.66 percent but remains 48 basis points higher on a year-over-year basis and within 11 basis points of a 7-year high.

And according to an analysis of the futures market, the probability of the Fed’s next rate hike happening in June is currently running around 80 percent with the Fed having signaled a total of seven (7) more hikes over the next three years.