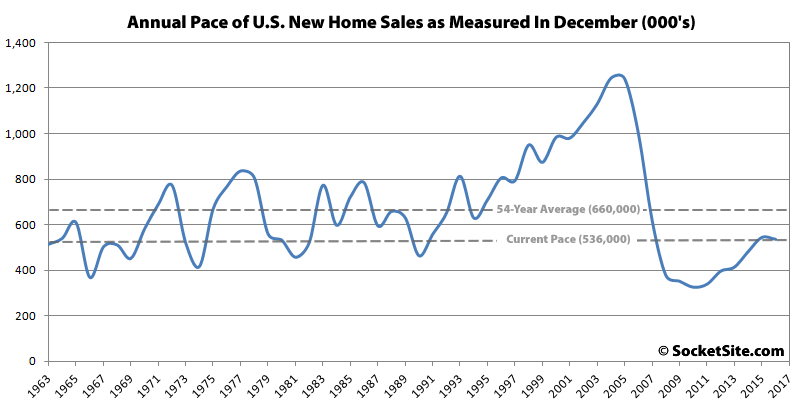

The seasonally adjusted pace of new single-family home sales in the U.S. dropped 10.4 percent in December. And with a pace of 536,000 annual sales, the rate was 0.4 percent lower on a year-over-year basis, a sharp drop from 17.7 percent higher on a year-over-year basis the month before and 24.3 percent higher on a year-over-year basis in September.

In addition, last month’s pace was 18.8 percent below the long-term average for December (660,000) and nearly 60 percent below the record-high December pace of 1,242,000 sales as set in 2005.

At the same time, the number of new single-family homes for sale across the county ticked up another 4.0 percent to 259,000, which is the most available inventory since the third quarter of 2009 and 10.2 percent higher versus the same time last year.

In the West, the pace of new single-family home sales slipped 1.3 percent from November to December but remains 2.0 percent higher versus the same time last year (versus 13.7 percent higher on a year-over-year basis the month before).

Since none of our resident permabulls have stepped up to explain how rising inventory and declining sales are positive for RE values (come on guys you are slacking!) I thought I would mention that China imposed a new round of capital controls Jan 1, this time specifically targeted at foreign real estate purchases. Agents in London are already reporting an impact on sales.

China macro speculative flow has no significant bearing on SF sales and that is also a racist comment BTW

/s

The fact that the Chinese government financially represses their own people by restricting foreign currency transactions is both a fact that affects real estate and not racist.

Now, the orange haired elephant in the room is what US policy is going to do to RE. Cali has been losing people to other states for a while now and positive foreign migration has made up for negative net domestic migration. And so you see this and that should worry you.

Plus there’s no love lost between Cali and the current administration. They’ve got a Republican congress and no need to butter up the state for 2020 because it’s a lost cause for them.

Make no mistake government policy has a huge effect on RE, whether or not your agree or disagree with those policies.

For Pete’s sake, unless you’re LL Cool J, don’t cal it Cali. No one here calls it Cali, OK?

It’s not racist because I am not making any value judgment, just stating a fact. If I were in China, I would also be trying to get my cash out.

I’ve posted links here before about how foreign buyers affect SF real estate, but they were deleted, so if you are really interested you can use your magic internet machine to learn all about it. And it’s not just the numbers but their high motivation that affects the market, foreign buyers are often the ones who come in and offer 35% above asking price and drive up the comps.

If they are that motivated, why not levy an extra tax to partially offset the negative effects on local affordability? In fact, China itself has a tough tax on foreign buyers, and other countries like Australia, Canada, Switzerland, Mexico, and Hong Kong also tax foreign buyers. But in crony capitalist America, the bankers, realtor lobby, and other powerful interests who benefit from sky high housing prices won’t go for it.

That would be called a pricing problem

If you’re skeptical about Chinese money invested in S.F. real estate, take a look at the chart embedded in this article (which admittedly is not about S.F. Real Estate) with the caption Top five target markets for Asian investors in 1H 2016.