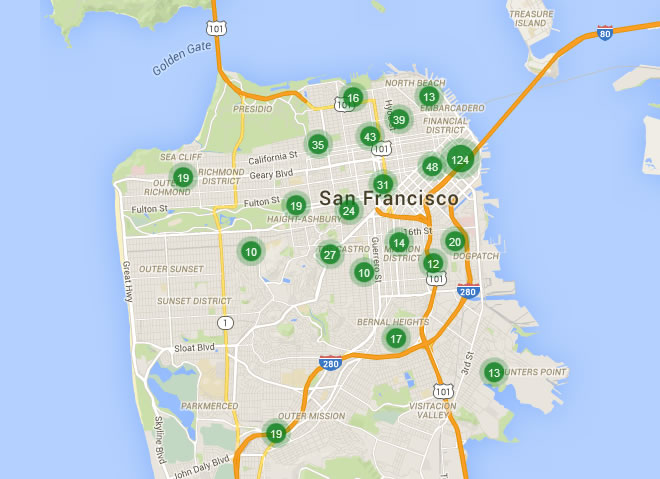

While home sales in San Francisco slowed to a five-year seasonal low last month, new listing activity has remained strong. And as a result, there are now twice as many condos listed for sale in the city than there were at the same time last year and the most active listings since late 2011.

And othe 546 condos currently listed for sale, 21 percent (114) have undergone at least one price reduction versus 15 percent (41) at the end of June last year.

Keep in mind that the numbers above do not include the vast majority of unlisted new construction units available for purchase in sales offices around town, the inventory of which bumped up by over 400 last month and now totals around 1,200.

Any news on SFH inventory vs last year?

Single-family inventory is currently running 33 percent higher versus the same time last year.

Condos are always the tail end of a market run. This real estate market is a froth fest and major price corrections are coming. It is silly to suggest anything to the contrary.

Whatcha mean by “major price corrections”? 30, 40, 50% price reductions?

I take it you’re some guy/gal looking for a deal?

It’s not going to be catastrophic, but prices will come down. When I bought my place in 2011 after the great recession it was a blood bath – California was paying me to even buy a home. I got about 20-25% off. This isn’t going to happen this time around. I imagine 15% at max. Builders will stop building, inventory will slowly disappear.

You must be referring to mr miyagi. I already know what’s goin’ on.

Right – the good old ‘just because it happened before and I got mine, it’ll never happen again!’. Are you just afraid of your property value going down?

I mean, honestly, you’re saying *literally* that something that has happened before will never happen again. Are you kidding?

I don’t think you quite understand the seriousness of the Great Recession in SF. I would walk into the palms and they literally had 25 foreclosures taped to the front glass window of the building. 2/2s bought for 950k were selling for 450k.

I’m not worried about my property falling in value – because I’m sure it will. And that’s “OK”, because I know it will definitely go back up and hit a new peak in time. But I think expecting 30%+ is probably wrong. Developers can open/close the faucet of inventory. Once property values start reducing, and risk goes up – they just won’t build a whole and wait until next cycle. You already see builders holding onto entitlement projects and waiting until next cycle or selling them. (I saw several on here the past month) They’re already starting to curb supply.

Developers will surely put the brakes on development when things slow to maintain profitability.

Construction inherently is slow where developers are forced to work with imperfect information.

Just as it took developers several years to respond to low housing inventory in SF, it will take several years to clear out the flood of new units that are already in the pipeline. Condo inventory has doubled YoY and lots of units are planned to be released to market in the next two years.

Keep in mind that construction makes up a significant proportion of our local economy. When construction stops, people are out of jobs.

Would a mere 15% price drop be enough to halt development?

Somehow I don’t think so. You might see some turmoil on the financial side if developers overpaid for land under over optimistic assumptions. Projects getting transferred to new financial backers, but fundamentally prices in SF are very high compared to the rest of the country and pretty high for SF historically. And developers don’t make money by not building, so I think it would take a much sharper decline or other crisis to halt development.

Roy, while I agree with your comment here, the flip side is that too many people here have the opposite knee jerk reaction: it happened before (2008 crash) it’ll happen again (in similar proportions.) the market can just as easily slow down, dip a bit for a year or two, and that’s it. I personally would not bet on 20-30% price declines.

Admittedly, I’m one on the sidelines that is looking to buy, but have been reluctant due to the seemingly astronomical prices and reluctance by sellers to admit the market is slowing toward a “correction”. I’ve been watching in a couple neighborhoods for the last 2 years and in recent months, it is clear that condos are staying on the market much longer than last year at this time, and most have had at least 1 or 2 price reductions. I too doubt that we’ll see something like we did in 2011, but I’m unsure how much I should expect in a reduction. In terms of 15-20% off the high of Q2/Q3 last year? Also wondering if the high number of new condo units that are planning to come online will also be a catalyst? I don’t have a point of comparison however on this – were there parallels with 2011 or is this time around different?

Wangta, nobody has a crystal ball and can’t give you specifics. I have more than one place – and I’m also considering a third, and like you, waiting for the most opportunistic time to strike and jump into the market. Personally, I’m going to wait at least 1 year.

Dude, I’m with you. No one knows for sure.

Personally, I think it’s a plateau for the appreciable future.

Calculation for SFH sideline-waiters must be: is it worth renting for 2 to 4 more years just to get a possible 20 to 25% price drop? If one can buy now, I think they should be in the market right now, or at least within the next year. No, I’m not a realtor! Wish I could buy now. For other reasons, I’m 3 or so years out (and not in SF proper anymore)

There’s a change in average price (case-shiller repeat sale style) and there’s a distribution of individual property prices around that average. Different places different neighborhoods, condo’s vs SFH…

You could have an average 15% decline with some properties doing much worse and some much better.

Im not sure if this is avalaible, but would be interesting to see a breakdown by # of bedrooms. My guess is that there are a lot more studios and 1 bdrooms on the market. Maybe 2bdrooms as well. But i tend to doubt the number of 3 and 4bdr condos has increased as they are still tough to find. Socketsite, do you have that kind of info? even anecdotal from anyone else?

On an anecdotal tangent, on the rental side it’s becoming easier. NEMA had 27 one bedrooms available, quietly slashed prices for all of them, and now has about 15. My wife and I signed a lease since we’ve been wanting to move there, but I suspect over the next year the glut of new apartments in Rincon and Mid-Market will stabilize and correct rents, even if only for an admittedly niche product (new construction amenity focused buildings in up and coming neighborhoods.)

To the extent that this higher end rental niche sees a drop in rents I’d guess it would trickle down to non-rent controlled rental units in older buildings. Insofar as some renters in those buildings would likely jump to these newer buildings if there is a significant reduction in rents in them. As you mentioned happened at NEMA.

Can I ask why you were particularly interested in NEMA as opposed to new amenity rich rentals in RH, Central SOMA and around King?

I myself noticed Nema (not wild about the building) does have really attractive kitchens, oft stupendous views (city hall, etc), and it’s central (only a few blocks from bart, etc). even groceries and a big gym across the street (and their own pool, gym, etc).

For what it’s worth, of the newer buildings/complexes in Mid-Market, it was the only one we were considering once we toured the rest. The floor plans make sense, are about 20% larger than other buildings (the floor plans in 100 Van Ness are shockingly small, we’d have to give up our dining room table for even the two bedroom plans), the amenities are by far the best and things you’d actually use, and the kitchens were great. Views are amazing from most locations, including the one we rented (skyscrapers for days, totally unobstructed and given SOMA height limits will likely stay that way), although some units have a rather dreary view of the windowless side of the Uber building. Being across from the grocery store is a huge plus for us, and while the gym across the street looks nice, the gym in NEMA is phenomenal (group classes that seem to be well reviewed, programmed solo spin classes, boxing machine, tons of cardio and weights, all exceptional equipment).

On the flip side, 100 Van Ness units were very small (we felt unusable for a couple with both living and dining room furniture, and we’d have trouble getting a king size bed into most units), a huge wait list for parking (both my wife and I need to drive as part of our jobs, as in throughout the day and not just the commute aspect, so parking was very important for us), the gym was sparse/cramped/dingy, and the amenities were just not there. Views were better from 100 Van Ness but given that so many of the NEMA units also offer good views, we were willing to pay the premium.

Trinity just wasn’t working for us, interiors on AVA were just too quirky (and no view) and Civic’s finishes were great, but small floor plans, no views, no amenities.

Ugly crown and ugly building from most angles, but if the price isn’t an objection, NEMA is hands down the best building in that cluster.

I actually responded to most of my thoughts about NEMA vs the other Mid-Market buildings below Zugamenzio’s post, but I can comment on location here.

For us, we wanted Mid-Market specifically for three reasons: view potential (which of course RH has as well), easy access to the Haight (where wife works) and an easy hop on the freeway to the Peninsula (where I work), and easy walkability to a neighborhood we love (Hayes Valley). Central SOMA had neither the height nor the neighborhood, same with King. Rincon Hill has the views but not the neighborhood. We love the scale, restaurant/bar/cafe quality, and feel of Hayes Valley and the northern stretch of the Mission, and to be able to walk to something like that trumped the newer Rincon Hill buildings.

Once we settled on Mid-Market, NEMA was simply the best run and designed building out of all the options.

Thanks.

I get the neighborhood thing. We were in SOMA near the Lumina towers yesterday and there is no sense of neighborhood. Mostly empty sidewalks (it was a Saturday) and basically its citadels sitting on walled off 8 story podiums.

We went to the Golden Gateway and EC area too. Those are on podiums but much shorter ones and more open. The shopping below the EC towers is more interesting as the podiums open up with passageways and such at ground level.

If I wanted to live near the Bay in a hi-rise with a neighborhood feel I’d take a Golden Gateway residence over anything we saw in SOMA and RH.

Given all the new units coming on-line it could be the NEMA price slashes are a harbinger of things to come. Good news for renters wanting new buildings.

Its anecdotal, but there has been a string of approved residential projects recently where the developer has chosen to sell the entitled rights/approved design rather than build. SS featured another one last week I believe. Perhaps the developers are seeing a flattening and decline in rents coming as we go into the downside of this cycle – making their projects less likely to generate the ROI they expected.

The area and restaurants around Golden Gateway is simultaneously too old and too “right out of college” for us. We’re in our late twenties so the Hayes/Mid-Market/Upper Mission offerings are about spot on with our tastes (Call us DINKS and Yuppies if you want, although neither of us is a Techie). Plus I commute to Peninsula so Mid-Market is ideal compared to GG.

That’s a nice area though and I see why many would prefer it.

@JWS – I did not mean my comment as a criticism of the NEMA area. For us a view of the Bay would be number one. Personal preference.

Either way, the commonality is the desire for a neighborhood feel in the “big city”. That is why I find the area around RH and the Lumina towers problematic. To me it was a missed opportunity to create something special. A new neighborhood. Granted, not easy to do by any stretch.

So NEMA is now close to 100% leased? Do you know how the former AAA building is doing as to its rentals?

It’s hard to build new luxury construction and pencil it for rental. Last few years were an anomaly for SF: very low interest rates, very high rents, plus the lending environment. Next wave of new projects in the city will be mostly for sale luxury condos (with the requisite BMRs), I predict. The days of building market rate rentals will vanish real soon. (And good ridence; don’t need more rental competition.)

How much did you end up leasing the 1br for? Did they do the one month free trick, or something else? I’m also curious if you can negotiate their advertised rates lower- what I see on CL- or if they’re sticking firm to them. Appreciate your comments.

We got the sense that rates were negotiable before the price drop, although to what degree I do not know and now that they’ve just slashed prices and seem to be flying off the market, I don’t know how motivated they are to go further. For us they took money off first month’s rent (not the full amount), and the security deposit was extremely low ($99) if you have good credit, and parking rates ended up being lower than advertised in the lease agreement. None of this was negotiated by us…we were actually prepared to negotiate down to a price, but then NEMA slashed rents to below that price anyway so we snatched up a prime view unit that we wanted before somebody else grabbed it.

Thanks

why not say the actual price? is there a non-disclosure?

I was here when the dot-com burst affected prices in general…..but there was also a lugubrious recession, and i get the impression Twitter, Dolby, etc, are more substantial than the “dots,” so I would guess less of a % price melt-down than circa ’10-12, but then, i’m not from the world of finance nor real estate.

Dot com was only a brief dip because the Fed was able to blow another bubble. With interest rates already at zero today, we are in a completely different scenario.

Would be interesting to see Socketsite provide similar analysis for East Bay market that you have been doing for SF market in terms of year to year comparisons of # of listings, price reductions, etc. Sort of need some larger context. Due to the regulatory supply constraints in SF, the pricing in SF often takes on the kind of pricing situation you see in markets with formal supply quotas (with the equilibrium price shifting to the left of where it would otherwise be absent the quota). But even in SF, it may be that prices have run out of rich people. If its regional wide its one thing (in terms of price reductions and/or increasing supply), if its just buyers shifting from SF to other markets because SF has gotten too over-heated, might be another.