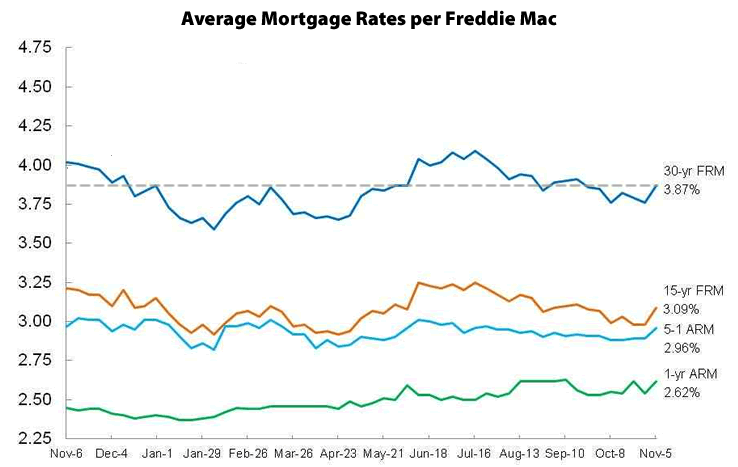

The average rate for a conforming 30-year mortgage increased 11 basis points over the past week to 3.87 percent, up 28 basis point from the 3.59 percent low for the year in February but 15 basis points below the 4.02 percent average rate at the same time last year and below four percent for the fifteenth week in a row.

At the same time, with Federal Reserve Chair Janet Yellen having recently referred to a December rate hike as a ‘’live possibility,’ the probability of hike in the Fed Funds rate by the end of the year has jumped from 30 percent three weeks ago to 56 percent today in the eyes of the futures market.

The benchmark 30-year rate, which hit an all-time low of 3.31 percent in November 2012 and a three-year high of 4.58 percent in August 2013, has averaged around 6.7 percent over the past two decades.

Many believe SF prices will flatten and then start up again in the spring.

I am an outlier on this. I think they will flatten, pull back some (not a lot) and stay relatively flat for awhile.

SF is one of just a handful of cities at historic low affordability levels and, if rates go up, that increase will make SF even less affordable.

On a side note, a local Caldwell Banker realtor sends me a home price update each month. A CB algorithm which is based on comps I’m sure. For the first time in years it dropped. The estimated price range of my home. By a small amount. Just 25K, but that was interesting.

Ya keep forgetting, expensive prime areas decouple (to a certain extent) from a typical affordability matrix. Why? 1- you have many move up buyers who already have a lot of equity here. 2- cash foreign buyers. 3- tech money (not only start up lottery winners, but also stock options in large firms). 4- world class destinations attracts those with money from all over the country to move here.

All these factors add up. This ain’t no working class town no more, where the prevailing wage reflects the average home price.