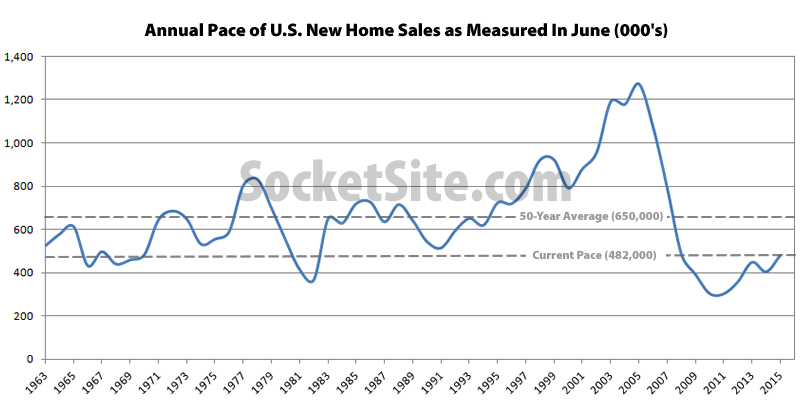

The seasonally adjusted pace of new single-family home sales in the U.S. suddenly dropped 6.8 percent in June to an annual rate of 482,000, the slowest pace in seven months. The current pace remains 18.1 percent higher than at the same time last year but is 25.9 percent below than the long-term average of 650,000 as measured in June.

The pace of new single-family home sales in June peaked at 1,274,000 in 2005, 164 percent higher than last month.

And in terms of inventory, the number of new single-family homes for sale across the county is currently 215,000, up 3.4 percent from May, 8.2 percent higher versus the same time last year, and the highest June inventory since 2009.

In the West, the pace of new home sales fell 17.0 percent from May to June but remains 10.9 percent higher as compared to the same time last year.

Eventually, the worm has to turn. And we are far closer to the start of the next business cycle recession than we are far from the last one. Current business cycle probably only has 12 – 18 months of steam left.

Multifamily sector is starting to hit hyper-supply phase nationally. Cap rates in MF & CRE sector have gotten silly low. And the prices for home sales have gotten to the point where the ratio to median incomes is getting attenuated again (and not to mention the return of homes selling for way over list, offers with no contingencies, all-cash sales, etc.)

The last 10 years have been a disaster for the middle class. They can not afford to buy housing. Deals like the Trans-Pacific Partnership have led to the US Gini coefficient index falling to levels not seen since the 1930’s. Local markets like San Francisco are doing well now but building “affordable” housing units at $888,889 each is not sustainable – no matter how high our tech boom goes.

On July 22nd SocketSite reported “Record U.S. Existing-Home Prices, Pace Of Sales Highest Since 2007”. Was that post incorrect, or is today’s incorrect?

In today’s post it is noted that sales this June are up 18% from last June. What more do you want?