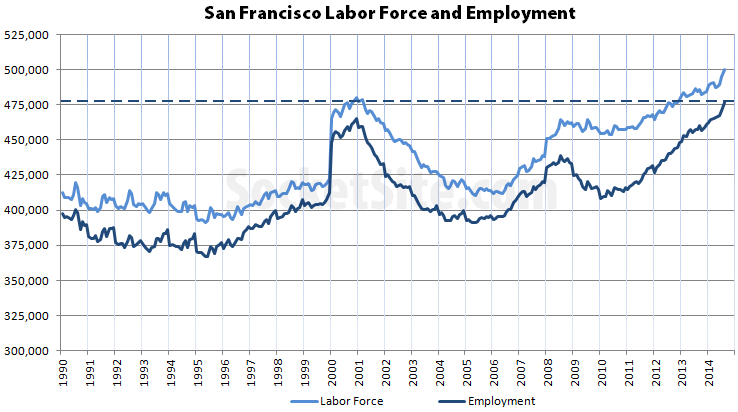

Employment in San Francisco has reached another all-time high as the number of San Francisco residents with a paycheck jumped by 5,500 last month – the largest increase in a single month since the end of 2009 – and now totals 476,300 with an unemployment rate of 4.7 percent, according to California’s Employment Development Department.

That’s 19,200 more people employed in San Francisco than at the same time last year. And that’s and 10,800 more people than were employed in the city at the height of the dot-com peak in December 2000 when the unemployment rate measured 3 percent based on a labor force of 480,000 versus 499,700 last month.

The unemployment rate in San Francisco topped out at a little over 10 percent in January of 2010 when 68,600 fewer San Francisco residents were employed than today.

The unemployment rates in Marin and San Mateo dropped in August as well, to 4.2 percent and 4.3 percent respectively, as did the unadjusted unemployment rate for California which dropped from 7.8 to 7.4 percent.

All those new residential towers can’t come on line soon enough…..

But few can afford the new residence towers. Even with decent incomes by Bay Area standards.

they still help because of shifting high-end demand away from other existing housing.

I would agree if the new units are rentals – with condo’s, looks like at least 20% of units in multi unit buildings are bought and held by investors, which does not help the crisis. It’s a waste of a unit that could go to a local worker, take their car off the road, etc.

I think in most cases investors (or second home owners) are compelled to rent out the unit, so it doesn’t hurt rental inventory.

If anything, investors with second homes are more considerate landlords and charge less than large-scale rental management companies who have the resources to best devise pricing models to maximally extract money from tenants.

“bought and held,” meaning, rented out during longterm holds. that’s not a problem.

Last time I checked 20% doesn’t equal 100%.

Last time I checked 20% of a shortage is a very significant number. Last time I checked, I personally see many overseas buyers not rent out their units. can’t say exactly how many, though.

You claimed that new units were not shifting high-end demand away from existing housing unless they were rental because ONLY 80% are being bought by non-investors. That’s a ludicrous claim.

Please explain why it’s “ludicous” to believe that 80% is as good as 100% – that is my assertion, that it is not nearly as good, particularly when the numbers constructed are already far too low . You could have asked me to explain my assertion before throwing out insults. But that’s your style, I understand. Strange.

I didn’t say that 80% was as good as 20% You claimed that 80% was no better than 0%.

True. I got tired of ridiculously priced 1brs so I’ve looked at higher end 2brs only to find they were priced even more ridiculously. So I finally found and settled with a reasonably priced 1br. (Yes, there are a few of those if you look hard). That’s a reasonably priced one that could have gone to someone else had higher end ones were more reasonably priced. Funny thing is, all those higher end units are still sitting after a month.. All actions are at the lower end right now.

I wish they would normalize the pre-2000 years. The graph makes it look like 2004-2006 was a return to “normal” 1990s levels, when in fact it was not.

This may have been discussed in a previous monthly employment report post, but what happened in 2000 that shows an ~50,000 employment and labor force correction?

I’m assuming this was a decennial census related correction, and not “real”. I know people have brought this up before, but I don’t recall the explanation.

this must be why the traffic has gotten so much worse over the past 2 years. we have to find a better way to get cars moving through thoroughfares within the city. getting to the freeway is just horrific.

I so remember when employment levels dropped in early 2001, you had Dot.com companies implode all over the Bay Area ..

Building new high-end units doesn’t “shift demand” away from existing housing. You are laboring under the delusion that housing follows conventional, textbook, ceteris paribus S&D models, but, empirically, housing has quite different — and unexpected — S&D curves.

We have decades of global housing market data to show that building exclusively or near-exclusively high-end housing, puts upward price pressure on __all__ housing.

lol, love to see this “data”.

Well, you can put all the artificial upward pressure you want, but the price won’t maerialize if there is no demand. If higher priced houses put price pressure on lower ones, that’s probably because builders shift resources to higher end ones leaving lower end market high and dry. And that would be because there are more demand there and more profit to be made. When the demand dries up, they’ll shift back to thelower end ones that the great huddled masses clamour. In other words, housing market should obey the traditional S&D just like everything else.

Each new unit priced higher than the average (mean or median) that comes on the market in a neighborhood, raises that average, and that becomes the yardstick for both resale and new construction. There are many factors which cause housing to deviate from standard S&D curves. Housing markets are about as far away from Smith’s idealized open market as possible. Just one factor: as housing prices go up in an economy lacking other viable assets, investors (i.e. speculators) pile in, driving up prices even further. Developers respond to this by building even more high-end housing, and even more speculators pile in, as this looks like the best place to park their money. Take the speculators out of the SF housing market, and it would be dust.

Rentals are different, because they are more dependent on local jobs. Speculators might buy rentals, but speculators don’t rent rentals, for re-rent, because that is generally prohibited.

Rental prices depend on the local job picture. Housing prices depend on mortgage rates, epic Wall St liquidity (courtesy of the taxpayers), a market that coddles gamblers, and a limited number of other, more productive, investment opportunities.

I have yet to see developers clamoring to build lower end housing in SF for profit. How many businesses do you know operate at a loss. Building more housing or creating incentives to unlock some of the available housing which landlords sit on is a good thing in the long run. Then you create a less burdensome and efficient local government, followed by privatization of schools.

In SF maybe. Land is awfully expensive here. But that’s still a function of supply/demand/cost/price. And landlords are not idling perfectly good properties as if they have money to burn either. So I don’t know where the ones to unlock will come from. If the market is not building for low income people, then it’s really the government’s job to build for them, allocate for them or subsidize them somehow. Demanding landlords to unlock nonexisting units won’t solve the problem for sure.