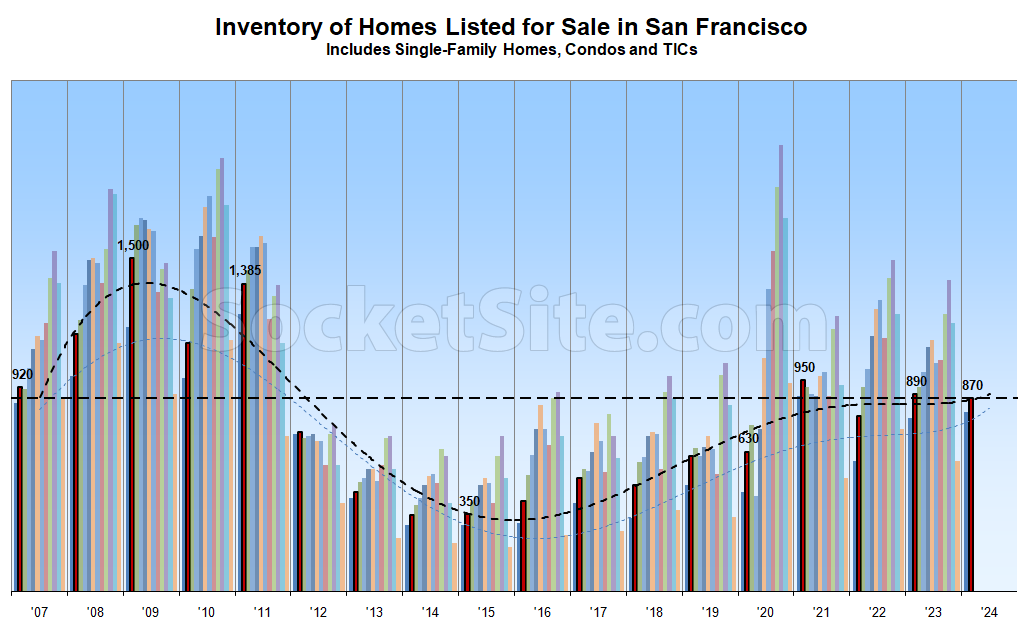

As we projected, the net number of condos and single-family homes listed for sale in San Francisco (i.e., inventory) continues to climb, having ticked up another 7 percent over the past week, effectively even with the same time last year, and poised to erase a short-lived year-over-year deficit in inventory, driven by seller capitulation and a sudden normalization of mid-six percent rates.

And as such, inventory levels are close to 40 percent higher than prior to the pandemic, nearly 50 percent higher than average for this time of the year and 150 percent higher than in 2015, despite misreports of “supply constraints” or low inventory levels, with pending sales 6 percent lower than at the same time last year and still down 50 percent over the past three, the average price per square foot of the homes which are on the market and in contract both down 10 percent from peak, and the percentage of homes on the market with an asking price that has been reduced at least once starting to tick back up.

We’ll keep you posted and plugged-in.

Going to be very interesting to see how interest rates affect sales. I don’t think we’ll see drastically lower rates, but I do expect more inventory. How are things looking for our friends in the East Bay?