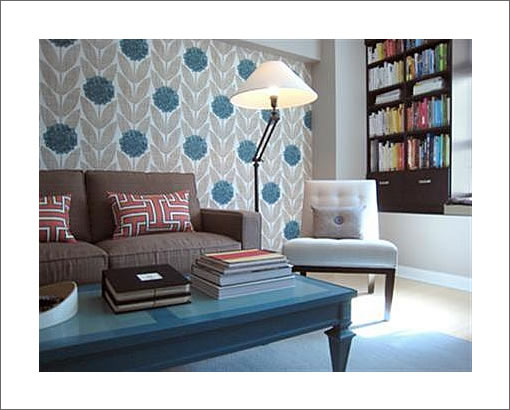

While 300 Berry #514 has been “lovingly decorated…with artwork, wall coverings, custom paint colors and fine appointments” we’ll still call it a “green” apples-to-apples pair of sales to be.

Purchased for $565,500 in August 2008, the 664 square foot Arterra one-bedroom is back on the market and listed for $499,000 in 2010.

∙ Listing: 300 Berry #514 (1/1) 664 sqft – $499,000 [MLS]

I have 15 clients waiting to pounce on a deal like this. And only $750 psft! Arterra is much nicer than the Brannan where they can’t even get $600 psft, because it’s more convenient to 280. Convenience: it’s what today’s buyers want.

you can use all the hip custom paint colors you want, you’re still stuck with that ugly suburban granite in the kitchen.

I think the decor is just fine.

but this in the end is still a very small unit (664sq ft) in a nabe in transition.

it has the problem that a lot of SF RE has IMO… prices that are too high.

this is basic entry level housing. it thus needs basic entry level pricing… yes even in SF.

You can convince me easily that a house that is worth $5M in Minneapolis will go for $12.5M in SF…

but the prices of these bare bones starter places really need to come down. it’s one step above dorm living, but with nice interior design. it should be priced as such.

Creative camera angles that will put you into shock if you actually go see it in person.

Plenty of competition to this place…

Does anybody who makes the comments on this site recognize that people own these properties and that your negative, deragatory comments as arm chair architects are simply catty, unwelcomed and just downright mean. We are trying to get our economy back, like my mother always said, if you can’t say something nice, don’t say anything at all.

Anne, are you the seller or someone in the agent’s office? Getting our economy back involves being realistic about asset values and working off a pile of debt that never made sense. It doesn’t really sound like you understand economics, so please don’t tell us how to save our economy, but then again, maybe that comes with the territory when listing a small condo for $499K, after purchasing for $565.5K.

Anne,

Self-delusion got us in to the bubble. Sticking your fingers in your ears and pretending every unit is a unique and beautiful snowflake isn’t going to get us out of it.

These comments aren’t that harsh: it’s a cute space (you have great furniture), but not worth 500k any more. Unfortunately, you can’t wish that problem away. Best of luck with the sale.

Anything over $625psft is a

waste of money. There are better properties out there for that price in better areas.

I represent neither the buyer nor the seller but I am realistic that people hanging out on this site all day making totally mean and deragotory comments are of very little value. Get a job and a shrink, why all the pent up anger about a property you have neither seen nor own?

These Arterra units are indeed small, but the floor plans are fairly functional given the size.

Last year, I was really interested in the 1BR+den units. The den isn’t really much of a den, but it does make for a decent workspace or dining area behind the kitchen. Some of these units, on a higher floor, were going for low- to mid-$500K. This was last April.

Personally, I think the owner went a bit crazy with the colors. At least for my taste. Other than that, I do like the finishes in this building. And the HOA dues aren’t bad either, especially for a high-rise.

Anne, the only person on here who sounds angry is you.

Its a free country (and site) Anne, let er rip team!

“why all the pent up anger about a property you have neither seen nor own?”

If you truly have no affiliation, we could ask you the same question.

I have zero anger about the property, I love it. As an interior designer I think it looks fabulous and I am not the one posting mean comments. I simply think that people should be supportive and if they don’t like a place, don’t buy it. My gut is that this site if full of unemployed people who live in ratty apartments and make negative coments about homes they can’t afford! San Francisco is an expensive city, if you can’t handle the real estate prices move to Fresno.

I’m sorry, was the question why am I angry when a lot of people bought real estate at unsustainable prices because of some combination of hype, greed and ignorance and then some of my money is used to bail both them out and the people who made money at both the front and back end of the deals with the net effect that unaffordable prices remain unaffordable?

Just checking.

Anne, if you check out the last SocketSite Reader Survey (https://socketsite.com/archives/2007/06/the_average_socketsite_reader_is_anything_but.html), I think you’ll find that your assumptions are wrong. Good luck selling this place.

“this site if [sic] full of unemployed people who live in ratty apartments and make negative coments [sic] about homes they can’t afford!”

Ahh, the old “bitter renters” line. Move to Fresno and all. And I’m sure Anne is being completely sincere that she has absolutely no connection with this place. I think the consensus here (so far) is that this place is put together well, except perhaps for the kitchen counters. The beef is about the ridiculous price for such a modest place in a not-so-great neighborhood.

Anne, stick around for a while and pay attention to the wide variety of viewpoints and information provided here. You’ll see that your initial gut impression is all wrong. I can’t tell for certain, but from my initial read of your style and use of language, you sound like you are quite intelligent and could make valuable contributions here. Moreover, I’m not aware of any other interior designers who chime in, so from that standpoint (and I concede I have zero talent in that area) I would love to hear your input on places.

Awesome decoration job ! Too bad that’s not what’s up for sale here.

It’s not “mean and derogatory” to suggest that a place like this, which is nice for someone with relatively minimal housing needs, should probably sell for a price somewhere in the 400s.

This person bought in a bubble. This person then did a nice job of decorating a very small apartment. This person is now selling in the midst of an ongoing crash in RE prices.

In Madrid, and in Spain more generally, RE folks are among the first to point out that prices need to fall further to regain the market. Better to get the bloodletting out of the way quickly. WHoever bought this can go through the foreclosure process and recoup a credit rating in about 5 years.

Properties like this one need to be priced appropriately. IMHO, that would mean somewhere in the 400s, based on the likelihood that it would fetch a rent below $2000/month. I’m guessing somewhere around $1800.

Anne,

If you didn’t know about this site, you may not realize why the property is sitting on the market. If your only source of (mis)-information is realtors, you may be expecting multiple offers because interest rates are low and there isn’t as much new construction.

Even $400k is quite a stretch for 662 sq ft.

I wouldn’t describe the neighborhood as “not-so-great”, I think a milder “not-so-special to demand $750/sq ft” is more appropriate.

Hey – I resemble that remark. I am unemployed (by design) and renting (also by design).

And yes, while this property is mo’ better priced I still don’t think you can rent it at equivalent pricing. The loan amount looks marginal but then you have to deal with that ugly $425/HOA.

isn’t commenting on these properties the purpose of this blog?

sf is expensive, we all know.

but it still has to answer to economics, and ultimatley the prices will be what the market can bear, and the cream will rise to the top.

this is an overpriced conso froma price/sq ft perspective. the staging is just fine. if you did it, you deserve to keep your job. however, the condo is a domritory room and it seems odd that a human being would be willing to pay half a million dollars to live in a dormitory room in a B-/C+ neighborhood. Comapred to other lareger 1bdr condos you cang et in other areas, this is overpriced.

Why is it that people (like Anne) always say that if you don’t like the prices here you should “move to Fresno”? Why not Portland, Chicago, San Diego, or Austin? Why not New Zealand or Australia? There ARE other less expensive places outside of San Francisco besides FRESNO!

I suggested Fresno because the negative comments on the site come from individuals who RENT apartments with low ceilings, have multiple roomates and wall-to-wall-carpeting. Do you really think these people have Passports and travel abroad?????

To follow-up on my last post. $500k for 662sqft is crazy.

Properties are, and have sold right on Berry Street for $600psft. Even one of the units last sold, it was a 2/1, sold for a much more reasonable price than this.

Prices have come down between 25-30% from peak. That would put this at around $425k. I could make the argument that it should be even less, now that it is a “pre-owned” condo, and the premium for owning a brand new space, was in the original amount paid.

anne dear, why don’t you leave these good people alone and go help your mother with the dishes, there’s a good girl.

Typical socketsite response: 500K, no way. It should be 25K only IMO….wait, it is conveniently located to the freeway, only 15K now. Don’t you know prices have dropped 250%?, and are expected to drop another 500%? But rent vs. buy still does not compute…oops, forgot about the interest tax breaks. My rough calculation is that they have to give the property to me for free..only then would I consider taking it. I am the king of the world! I know SF real estate. I am so cool. Please like me.

Socket Site bitching

All from renters with bad taste

Says “Anne” politely

I think the word “lovingly” is overused.

I find this

followed by this

and this

absolutely precious.

+1 parody troll. Fine work, sir.

*golf clap*

“Any bookies out there want to give me odds on the probability that “Anne” is fluj/anonn/kennyboy at the local Starbucks taking the piss out of everyone?”

Nah, flujie isn’t that good at hiding his personality. But whoever’s doing yahdude has got his fluj impersonation down.

Actually who “Anne” reminds me of is ester. I miss ester. I wonder how she’s doing?

@Embarcadero

Properties like this one need to be priced appropriately. IMHO, that would mean somewhere in the 400s, based on the likelihood that it would fetch a rent below $2000/month. I’m guessing somewhere around $1800.

Below $2K/month? The Edgewater down the street has a 535sqft 1BR for $2051/month, with no parking:

http://sfbay.craigslist.org/sfc/apa/1709983645.html

And a JR 1BR at the Beacon with parking and utilities included for $2300/month:

http://sfbay.craigslist.org/sfc/apa/1711862987.html

I think this Arterra unit can easily fetch over $2K/month as a rental. Maybe even $2300/month.

@SFRE

Properties are, and have sold right on Berry Street for $600psft. Even one of the units last sold, it was a 2/1, sold for a much more reasonable price than this.

Price/sqft is cheaper for a 2/1 than for 1/1, all else being equal, as kitchens and bathrooms are the most expensive part of a unit. The additional sq footage in a 2/1 or a larger 1/1 is just bedroom/closet/living space, which is cheap in comparison.

Prices have come down between 25-30% from peak. That would put this at around $425k.

August 2008 was not the peak. Prices have already fallen by then.

Slightly larger, much higher floor, sold for $550K last month ($793/sqft):

http://www.redfin.com/CA/San-Francisco/300-Berry-St-94158/unit-1605/home/21966624

Comparable size, higher floor, sold for $499K in January ($762/sqft):

http://www.redfin.com/CA/San-Francisco/300-Berry-St-94158/unit-920/home/23425176

Realistically, I think this unit will sell easily at $450K-$475K. $499K might be a stretch, though.

Actually, thinking about it, 400K is a bit of a stretch if the apartment only fetches about $1800 on the rental market. With taxes, HOA and maintenance, it will likely cost the owner about $2500 per month at that price ($1800 mortgage payment @5.60, + $425 HOA + 325 taxes – some modest tax savings + maintenance; +/- appreciation on the $80K down payment). It almost pencils out as slightly more expensive than renting at $400K, but that presumes upside on the condo’s value.

I’m not so sure about that assumption, but I’d now say high 300s up to 400K is pricing that might be viable.

but this in the end is still a very small unit (664sq ft) in a nabe in transition. [snip] This is basic entry level housing. it thus needs basic entry level pricing… yes even in SF. [snip] it’s one step above dorm living, but with nice interior design

After re-reading my post I clearly see my scathing commentary.

ROFL.

that said: I’m glad we have Anne and yahdude here, look how lively this thread got because of them.

would this entry level starter home in a transitional nabe with nice interior design have garnered 37 responses without Anne? There is literally little to talk about with this place! To be precise, we now have one post per 18 square feet!

that should be the new metric in the SF RE market. Posts per square foot.

My guess is that would make ORH the reigning RE champ in SF, but I could be wrong.

I suggested Fresno because the negative comments on the site come from individuals who RENT apartments with low ceilings, have multiple roomates and wall-to-wall-carpeting.

Do you think the sellers here are really going to be better off after locking in their $100k+ loss? Or do you actually believe they are just buying something bigger now?

Not only is anne typing with his/her reptilian brain, but he/she’s wrong.

high ceiling

no roomie

hardwood floor

I will add:

– prime SF

– 1/3 cost of ownership compared to current market.

But I saw a wonderful 2/1 condo for sale for 850+ last week-end with wall-to-wall WHITE wall-to-wall carpeting! Suckers welcome.

As someone that owns a place with low ceilings, wall to wall carpets and roommates I must say Anne needs to heed her own advice and stop insulting people especially if she is going to do so in a way that misses the mark and hits us long suffering owners who she is supposedly championing. Thanks but no thanks Anne, stop insulting me while trying to defend my honor.

I find that Anne reads best in the voice of Margaret Dumont.

Dan-Aykroyd-as-Julia-Child comes in a close second.

I think Anne is Margaret Thatcher … or any of that generation of people who maintained “if you keep your own corner of the world swept, you will improve your lot.” Bosh.

“Nah, flujie isn’t that good at hiding his personality.”

No disagreement there, we all know his personality was um… singular.

Just that with the “Anne” persona being so laughingly contrived, and with everyone on Socketsite just having been reminded of flujie’s pitiful inability to hide his personality on another post, and with his hissyfit about leaving, etc.., well something about “Anne” and the timing of her appearance smells a little fishy, that’s all.

Not saying that it’s flujio (nor even that it is more likely him than not), just that I wouldn’t put it past him.

As someone who lives in Fresno (hey, I resemble that remark!), but wants very much to live in SF, I love this site. The give and take between responders is great. The opinions can get heated, and sometimes a little catty. It all makes for great reading. It’s very educational, too, for us who do live in the hinterlands of California.

“well something about “Anne” and the timing of her appearance smells a little fishy, that’s all.”

It’s the owner.

Anyone who seriously believes that this unit will only fetch $1800/mo as a rental and $400K as a condo is out of touch with the 1BR rental/condo market in SF.

Personally, I think all that brown looks like crap, literally. When is that trend going to go away? Love the wallpaper, though.

@joh: I agree. A similar (albeit larger) rental at the Avalon or Edgewater would be around $2,200 (including parking).

How can anyone justify this property at a price above $425k?

^ ask the buyers who paid well over $425K for similar units in recent months.

That is ridiculous.

How can other properties on 235/255 Berry sell for $600psft, yet this one would sell for over $750psft.

There is a 25% larger 1/1.5 at the Brannan that is selling for $529k – a much more significant building. Same goes for units at the Infinity.

Furthermore, prices have dropped more than 12% since this unit was purchased.

I’m not saying someone won’t buy, I’m just saying it would be stupid.

JOH, I think you’re a bit optimistic about asking rents versus effective rents.

Even if this place rents for $2000 (which I think is very optimistic), it doesn’t justify a price much further north of 400K.

I am not making any representations about what people will actually do, just saying what makes financial sense to me. FWIW, I have two friends who live nearby – both in 1/1s, both with parking, and they pay about 2200 for much nicer places (bigger, views, décor probably not as nice). In both cases, asking rents were about 2500. I know because I helped them relocate here.

IME, it’s the norm rather than the exception to negotiate rents these days. This just based on my role as a manager helping others relocate to the area.

Anne’s got to be the owner – or the owner’s agent. We often hear arguments on the merits of a place, or lack of them, but never this appeal to not be “mean” except when it’s someone personally involved. And the petty insulting of the critics? Please. Show us why the pricing is appropriate, instead.

Anyway, put me down as a fan of the wallpaper. And I agree with those who say $/sft should be higher in a 1BR. I had some design work done on my last place, resulting in some fairly aggressive contemporary styling. When my agent saw it he said “well, people will either love it or hate it”. Someone loved it, apparently, and I’m convinced it added $10K or more to the price. Probably reduced the number of offers, though! So this unit may work out OK for the seller, or at least not as badly as she(he?) fears.

@Po Hill Jeff: I agree that $/sft should be higher in a 1/1, but how much higher do you think it should be – 5%, 10%, etc.?

Unit 417 sold for $415k in march….

I admit, I am not a fan of Arterra but I do not see anything wrong with the unit. The owner’s did some nice upgrades that I think works for the unit.

As for pricing, I do not think they are far off. The smaller the unit, the higher the PSF. Take a look at an unit that recently was recently listed at Clocktower. Listed at $499k and now in contract. I’m assuming the contract price is a little below. Close to the same size. You can argue what is better, a rehab loft in a historical building or a newer “green” building.

Of course the area surrounding Clocktower is better since it’s in South Beach.

Something to consider is parking. As in deeded parking. One Hawthorne, The Montgomery charges $300 for parking. Beacon, Palms, One Rincon Hill has parking fees. Blu has a stacker. For those wanting a condo down by the park with deeded parking, there’s not that much options anymore in terms of new developments. A deeded space has to worth at least $35k?

@Billy: There is a 1/1 at the Cloctower for $459k

did his flujness split the blog again?

anybody can direct to the thread where it happened?

Anne Dear, don’t you have pillows to chop!

Bernalkid – It’s a couple of threads down: the pine street property.

Billy Blanks – Clocktower is one of the nicest buildings in South Beach and many of the units there were upgraded significantly. Not a comp to Arterra.

bb: unit 417 may have sold for $415K in march, but that unit is only 660 square feet. This unit is 664 square feet. The extra 4 square feet (2’x2′) may not seem like much, and I don’t know the exact layout, but hypothetically if it was missing from the center of the bedroom, it would make that space unuseable, so this unit could be worth far more.

Besides, it has been a whole month since then, and lots of Realtors are proclaiming that prices are up since then (pay no attention to the Case Shiller data on the other thread that states prices are falling).

So you can see where Anne is coming from, that her pricing 20%+ higher than a comparable unit from just last month, is completely reasonable (hey – 85 square feet of wallpaper is expensive) and how rude the remarks that it was overpriced really were.

SFRE: (re $/sft) – good question! I wonder how we would calculate that… It seems like it has everything to do with desirability of 1BR vs. 2BR, i.e., it’s totally market driven. Ideally we would find a recently constructed building where the 1BR and 2BRs sold at roughly the same rate (i.e., balanced demand), and then compare $/sft for them to get a rough ratio.

thnx tippy

I guess we could start to look at the Arterra to see the difference in $/sqft between a 1 and 2 bedroom, and then take a look at some other developments such as ORH or Infinity.

I don’t have that data handy, but maybe someone does.

Arterra took over 3 years to offload their units though.

https://socketsite.com/archives/2006/12/arterra_300_berry_hits_the_mls.html

@SFRE,

There is a 25% larger 1/1.5 at the Brannan that is selling for $529k – a much more significant building. Same goes for units at the Infinity.

Compare the HOA dues. The Brannan may be more significant for you, but some buyers might be attracted to the LEED certification Arterra has.

@Embarcadero,

I am not making any representations about what people will actually do, just saying what makes financial sense to me.

$499K for this unit doesn’t make financial sense to me either. But it just might for some buyers, which is all that matters to the seller. It will go for well over $400K, if the seller is willing to let it go below asking.

@bb,

Unit 417 sold for $415k in march….

@ Tipster,

unit 417 may have sold for $415K in march, but that unit is only 660 square feet. This unit is 664 square feet. The extra 4 square feet (2’x2′) may not seem like much, and I don’t know the exact layout, but hypothetically if it was missing from the center of the bedroom, it would make that space unuseable, so this unit could be worth far more.no deeded parking. It’s a very gloomy unit:

http://www.arterrasf.com/pdf/City_Townhome_7.pdf

@Billy Blanks,

A deeded space has to worth at least $35k?

829 Folsom charges something like a $50K premium just to have parking rights in one of the assigned spaces. Despite the less desirable location, I’d say a deeded space on Berry is easily worth $70K, partly due to the fact that street spaces are highly competitive there.

@SFRE,

There is a 1/1 at the Cloctower for $459k

Are you referring to this one?

http://www.redfin.com/CA/San-Francisco/461-2nd-St-94107/unit-C123/home/1742499

Have you seen the unit? While the building is nice, this unit is one of the most depressing 1BR units I’ve ever seen. It’s terribly gloomy — you can’t even see out of the window from the living area, as the bottom of the window is about 8 ft above the floor. The stairway takes up a significant chunk of the 639 sqft. And of course, parking is leased. Personally, I would choose this Arterra unit over this particular Clocktower one any day. Of course, the location at the Clocktower is nicer, but I don’t see the point of buying a place I’d be depressed in all the time. Maybe as a pied-a-terre.

I think that “Anne” (whoever she or he may be) is personally invested in this condo sale in some degree. Possibly she is the interior decorator, the interior decorator/stager/listing agent, or the interior decorator/stager/listing agent/broker/seller, Then again, perhaps she is an owner of a similar floor plan in this building who wants to sell when this one closes escrow.

you think? @RSVP

How did you come up with that conclusion after reading 60+ comments?

Wonder why the innocent bystander didn’t come back to dole out more insults today…

“A new home is no longer a symbol of status and upward mobility, but a millstone to be shed at the earliest possible opportunity. The industry is facing an insurmountable PR challenge; how to take a “sow’s ear” and stitch it into a Gucci purse. Good luck with that. Low interest rates and federal subsidies alone won’t do the trick.”

(From CNBC Realty Check)

Anne, renting no longer something to sneer at.

“A new home is no longer a symbol of status and upward mobility, but a millstone to be shed at the earliest possible opportunity. The industry is facing an insurmountable PR challenge; how to take a “sow’s ear” and stitch it into a Gucci purse. Good luck with that. Low interest rates and federal subsidies alone won’t do the trick.”

I actually disagree with this.

RE is definitely somewhat out of favor right now, as an INVESTMENT. However, RE is still very much sought after as a housing option… just not as much as during the biggest RE bubble of American history.

I have learned one thing: NEVER underestimate the American consumer. They will consume far longer than you can imagine. The thing restraining them now is j-o-b-s.

If/when the jobs market improves then the housing market will improve. Too bad our leaders didn’t understand that. Instead they are trying to jumpstart housing FIRST to jumpstart the economy… they were convinced of this path by the banks and banking shills.

thus: although the super rich got super richer, the upper middle, middle, and working classes got much poorer. Lower income means lower ability to consume… especially on high priced products like RE.

RE WILL come back when jobs return. will it ever go back to the 10-20%/year persistent gains we saw in the mid-00’s? no, probably not. There are massive demographic challenges for housing (as the boomers retire they will start to divest housing assets as well as stocks/bonds/other investments). We likely have a multi-decade secular downtrend coming our way.

however: that doesn’t mean that RE has an insurmountable PR challenge.

I would say instead:

Owning a home is still the American dream, but it is tempered by housing prices that are out of whack with income and wealth. when housing prices and income/wealth realign the dream can re-commence. as long as we play games to artificially inflate housing then it will remain out of reach.

housing as a so-called risk-free investment is dead for now. but never underestimate the American consumer, or the foolishness of “investors”. look at China’s real estate bubble! it’s already way out of control less than 1-2 years after the bubble pooped!

“Below $2K/month? The Edgewater down the street has a 535sqft 1BR for $2051/month, with no parking:

http://sfbay.craigslist.org/sfc/apa/1709983645.html“

Well, asking and getting it are two different things. We all know how notorious craigslist is for wish prices. Though it’s getting close to be a busy season for rentals, I wouldn’t pay more than $3/sf, especially for this location. The rental market is still down compared to a year ago when 1 or 2 months free rent was common.

Edgewater is not a good comparison. It seems to be run by slime balls.

They SPAM craigslist hourly so 1/2 the listings for Mission Bay are theirs’. They change their prices daily since they have a policy against negotiating. Multiple times I have seem them list a low price online to draw you in, then they say they just leased it out(within hours of the posting), but have something else that’s more expensive. Edgewater merits it’s own thread.

Anyways, I think a newer 1BR with parking will at least get $2k/month. For something this small though, it would be hard to get up to $2.1-2.2k/month though.

At $2.1-2.2k/month this place is still overpriced.

I bet this space can be rented for $2800 fully furnished, if parking is included.

The rental market is not on fire but it’s been heating up. I had a friend who passed on 1 bedroom for $2,800 and now he’s still looking…

Whoops.. forgot to mention the 1 bedroom was at Infinity for $2,800. Parking included, no views but had all the great amenities and a little den in the unit.

In other words, he didn’t pay the $2,800 they were asking? For a building with MANY more amenities?

Rental prices have dropped compared to last year, but it seems that there’s been a slight uptick in asking prices recently. I don’t have any numbers to prove this, but just from looking around at 1BR apartments, it certainly seems that way to me.

Of course, I am aware that asking is not getting, but from what I’ve heard from others recently, rental prices aren’t as negotiable as before.

If this is true, perhaps it’s because more people are renting as more homeowners get foreclosed on…

Speaking of foreclosures (and off-topic), my friend’s parents live out in the east bay ‘burbs in a decent community. Up until recently, homes were occupied by single families with 2, maybe 3 cars per household. Now, many of the homes have 4 to 6 cars per household due to extended familiy members moving in. I suspect that perhaps those who were foreclosed on or who lost their jobs are moving back home with their parents or with extended families.

Joh, yes, off topic, but that phenomena is very true. Not just foreclosures, but lack of work is leading people to double up. It’s been widely reported that more college graduates are moving back in with their folks, and I know several cases anecdotally. The timing of the census this year is going to be interesting…I think we’re going to see a surprisingly big jump in household size and extended families cohabitating.

Anne wrote:

Prof: Class, I’m going to replace the midterm exam I was going to give next week with the following problem. Prepare a written response paper by class time on Monday. Suppose we did a back-of-the-envelope calculation and decided that at time t zero, in order to pay either the lowest practical rent or mortgage, utilities, reasonable clothing expenses, usual household expenses, save a reasonable amount in a 401(k) for retirement, etc., that one would need at absolute minimum a salary of $80,000 to live, not merely subsist, in San Francisco. Further suppose that all residents of San Francisco with per-capita household incomes below that amount, because they are rational economic actors, decamped for Fresno.

Discuss what would happen to the living standards of the remaining residents of The City By The Bay. Be sure to relate your answer to this chapter’s discussion of the demand curve.

curmudgeon wrote:

We don’t have to wait for the census results. From the Mortgage Bankers Association study:

And it’s not at all that far off topic for a discussion of a less than 700 sq. ft. apartment which in normal times would probably be purchased by someone with a high-paying job but who’s not quite settled down yet.

Just found the hydrangea print paper – http://www.orlakiely.com/uk.cfm/house/living/WFBP6H-500/4168/_/

I’m wondering what the Edinburgh street index has to do with the kitchen.. And I’m also wondering where I can get one of those posters for myself 🙂

Just to show a MUCH better deal than this unit at the Arterra.

There is a 1/1 at the Infinity with more square footage [Paul Hwangs listing], at 20% less $399k vs $499k. You would silly to buy this place for $100k more.

SFRE – Couldn’t find the listing on Paul’s website. Do you have the square footage and unit number?

The square footage is 730. Here is the listing.

http://sfbay.craigslist.org/sfc/reb/1718204305.html

SFRE, the listing you linked is for the Metropolitan…

Sorry, I misread it then. Still a much better deal than the 1BR at the Arterra.

Sorry, I misread it then. Still a much better deal than the 1BR at the Arterra.

Again, there’s more to prices than price/sqft.

Just because the asking price for the Met unit is $399K doesn’t mean that the seller would accept an offer at the price. I predict it’ll go for more if there’s nothing wrong with this unit. For all you know, it could be offer-bait.

And the craigslist ad doesn’t mention the unit number or floor, which can affect it’s value quite a bit (views and all that).

The HOAs at the Metropolitan are pricey. More ammenities for sure, but $657 HOAs just don’t justify the extras for many. I personally wouldn’t pay over $200 more per month for the additional ammenities.

@joh: I would certainly swap $100k for $200/mo higher HOA fees.

And unit 514 at the Arterra has no views or anything, so at worst they are similar.

And I highly doubt its bait/switch.

FYI, The 1 bedroom at Infinity is in contract after a week or so. $100k more in price. $200 more in HOA.

“FYI, The 1 bedroom at Infinity is in contract after a week or so. $100k more in price. $200 more in HOA.”

Any square footage or unit number details? Without specifics the data is essentially meaningless, as the unit could be 200 square feet larger.

SFRE,

I would certainly swap $100k for $200/mo higher HOA fees.

Again, asking is not selling. You’re already assuming the unit at the Metropolitan will sell for $399K. And I didn’t say bait/switch. I said offer bait. Meaning they list it at a cheap price to get potential buyers interested. Not saying that’s the intent, but it is very common practice these days. Get back to me when they actually sell that unit at the Met.

And the Arterra #514 may lack views, but at least it’s on Berry St. Not great, but not bad either. What about the unit at the Met? Without a specific unit number, you can’t only make assumptions.

I found the listing for the unit at the Met, and guess what? It’s a short sale (and it’s on the 2nd floor):

http://www.redfin.com/search#lat=37.7880305112352&long=-122.39795207977295&market=sanfrancisco&max_price=400000&min_price=300000&sf=1,2&status=131&v=5&zoomLevel=16

Not only is your Met unit a short-sale, but it’s on the 2nd floor. Ever been in any of the 2nd floor units at the Met? The ones facing 1st St are literally at street level or just above, which as you know, is bumper to bumper during the afternoon commute. Based on the Google Streetview pics, most of the remaining 2nd floor units look quite unappealing, view-wise.

Good luck to anybody who thinks they can get it for $399K. Heh.

Having personally live on Berry St., I can say that it is one of most pedestrian unfriendly streets in the city. Aside from smelling like pooh most of the time (not from homeless, but from sewer problems and the creek), its an undesirable location.

I understand where you are going with ‘offer bait’, but you are right that we will need to check in when it sells.

Some people prefer Mission Bay, others will prefer Rincon Hill. Just because you don’t like MB doesn’t mean others won’t. Recent Arterra comps that I linked to above suggest the asking price of #514 is within reason. The asking price of the 2nd floor Metropolitan short sale unit, on the other hand, is irrelevant to this discussion.

Asking price on short sales is a useless and an unreliable indicator of the market, as the bank still has to approve the final sale price. Take this from someone who has made offers on many short sales at or above asking and didn’t get the property. Hell, I’ve even been the highest bidder in several cases, and in two instances, the banks chose to foreclose rather than approve the short sale.

Short sale asking price = offer bait

$499k for this place = idiot bait

Price has been increased to $519K:

http://www.redfin.com/CA/San-Francisco/300-Berry-St-94158/unit-514/home/23455371

^ The price increase was a failed strategy. No one could have predicted… Now asking $495k: http://sfarmls.rapmls.com/scripts/mgrqispi.dll?APPNAME=Sanfrancisco&PRGNAME=MLSPropertyDetail&ARGUMENTS=-N922542905,-N246811,-N,-A,-N23964984

No doubt the 4% “Price increase” was to try to tap into the no money down crowd, with 3.5% offered to be rebated as “closing costs” and an extra half of one percent to the buyers realtor.

“Who cares what you pay if you can buy with no money down!” Of course, the speculators who thought this way have largely run for the hills or are fighting 5 foreclosures already and don’t need a 6th.

I’m confident she’ll end up funding closing costs at whatever lower price she ends up selling it at. Either she will, or the bank that forecloses will…

Very sad for her. Sadder still for whoever buys it…

A better sense of the space here:

http://www.youtube.com/watch?v=EJ-gon-BNaQ

Despite raising its list price from $499,000 to $519,000 in May, the list price for 300 Berry #514 has been reduced four times since, most recently to $485,000. Once again, purchased for $565,500 in August 2008.

In an attempt to keep an 81 day old listing fresh, the list price for 300 Berry #514 has been reduced another $3,000. Now asking $482,000.

Slowly moving down towards Fresno pricing…

The list price for 300 Berry #514 has been reduced another $7,000. Now asking $475,000.

Now that these condos have little chance of appreciating in the next 5 years, buyers are looking at them from a rational point of view:

1 – How much would it rent for?

2 – How much would it cost to own?

3 – Would you find this unit on the rental market?

That one is a no-brainer.

Maybe $475K was the magic number. 300 Berry St #514 is now contingent.

http://www.redfin.com/CA/San-Francisco/300-Berry-St-94158/unit-514/home/23455371

The $399K Metropolitan short-sale unit is also contingent, since May:

http://www.redfin.com/CA/San-Francisco/333-1st-St-94105/unit-N202/home/1321058

Very curious as to what the sales amount is. That is, if they actually close.

Looks like $699k was the magic number for 300 Berry St #1111 (bought for $660k in 12/2008).

http://www.redfin.com/CA/San-Francisco/300-Berry-St-94158/unit-1111/home/23455517

The sale of 300 Berry #1111 as referenced by a reader above closed escrow on 8/17/10 with a reported contract price of $675,000, up 2% from December 2008 and $716 per square foot for the two-bedroom.

Anyone have the specs of #1111?

300 Berry St #514 is now “Off Market.”

As I predicted, the Metropolitan short sale unit (333 1st St #202) sold last week for well over the short sale “asking” price (aka “offer bait”). Sure it took a while, but it was a short sale after all.

Asking $399K

Sold for $445K

If this unit is indeed 730 sqft as mentioned above, then that’s $609/sqft

http://www.redfin.com/CA/San-Francisco/333-1st-St-94105/unit-N202/home/1321058

“300 Berry St #514 is now “Off Market.” ”

So I wonder how “Anne” is doing. Property Shark doesn’t show any loans so I guess she has hunkered down to ride out the storm.