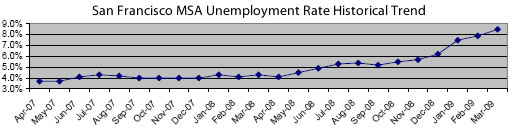

The unemployment rate for San Francisco County has moved from 6.5% in December, to 8.0% in January, to 9.0% in March. The unemployment rate for the San Francisco MSA hit 8.5% in March (up from 7.5% in January) with Marin at 7.4% and San Mateo at 8.3%.

∙ Monthly Labor Force Data for Counties: March 2009 – Preliminary [EDD]

∙ Unemployment In The San Francisco MSA Ticks Up To 7.5% [SocketSite]

This will clearly have a positive impact on sales as those newly unemployed people will now finally have the time needed to shop for a new home

Where do they track people like me that went from working 60 hours a week to less than 30?

here you go chuckie:

and by the way, this is the bigger story in this recession (so far)

http://www.calculatedriskblog.com/2009/04/part-time-for-economic-reasons-hits-9.html

This is an extremely fast drop in the u/i rate. If it is sustained for another couple of months — i.e. it is not a seasonal “blip” or something unusual — it means San Francisco is getting into the deep weeds last, but is getting in very deep. And the City will in no way escape the very hard recession hitting rest of state and nation.

The Mayor’s office has said strenuously and often that City would somehow avoid the hard recession – someone can citation that here — but that chance is remote now.

Biotech , clean tech, etc. may not be a hedge against a falling economy after all.

This will hit rental apartments hard, and commecial office market hard; i dont know impact of condo and SFH sales.

Boy, that is bad. I just saw that California’s unemployment rate is now the highest on record (since 1976). SF is still better than the state as a whole, but things continue to worsen, here and state-wide.

I would guess this will affect the rental market more than the resale market, but both will be hurt.

My guess is that this is the bottom. Financial is getting stabilized and tech is rebounding. But the rent will continue to slide since the employment won’t improve either, at least for a few more quarters. In the long run, I think the last a few years will prove to be an exception rather than the rule as far as rent is concerned.

Self correcting number: unemployed people can’t afford to live here for long and will move to cheaper areas, making our problems someone else’s problems pretty soon.

Unemployment is tracked by city of residence, so the problem takes care of itself.

Uh, oh, I just figured out why my own comment above is incorrect.

The move outs of the renters should have happened before the number ever got to 10%. This isn’t the dot com bust, where all people laid off are renters, and are just flying out of the city. The most likely reason the numbers are so high so quickly, is that these are homeowners getting laid off, who can’t move out of the city. They are literally trapped in their own homes, can’t refinance, and can’t sell.

Wow, that’s a REALLY bad number.

At a recent party I was amazed at how many people I knew had just gotten laid off (in fact, the week I was laid off in February seemed like the bloodbath week). Generally, these were white-collar professional people, but not in advanced tech, finance, or biotech. Many of these folks are long-term residents who rent, but I know of many other people (myself included) who have finally decided that enough is enough and are leaving the city (in my case, I’ve been laid off from every job I’ve had in the city, with one exception, and racked up a record three layoffs in three years). I think this will have a significant effect on the rental market; I know, for example, that my landlord is facing the problem of having to rent our apartment at or below the original amount we started paying two years ago. I think it’s fairly likely that rental prices are about to slide significantly, perhaps back to post .com levels.

@Phil, I am not sugar coating this…

Perhaps you should analyze why you were laid of from every job for last 3 years, instead of blaming the city and citing that as the reason to leave SF ?

We love San Fran Frisco Man !

I’m surprised that everyone is suggesting that this will hit the rental market much harder than the resale market (or even that it won’t affect resales much at all). Most folks who bought homes in SF in the past 3-5 years didn’t have the income to actually support the huge loans on those homes *even when they had jobs.* You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year. And most of the people with these gigantic loans weren’t even making that much. Layoffs are going to force sales and these folks aren’t going to have the luxury of keeping unrealistically high listings up for 90 or 180 days. There will be some delay as laid-off people deplete their savings, but this will move things.

(Though I agree it will affect the rental market as well; agreed that renters are generally more portable.)

“You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year”

That’s subjective.

“You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year”

That’s subjective.

“Well, in our country,” said Alice, still panting a little, “you’d generally get to somewhere else — if you run very fast for a long time, as we’ve been doing.”

“A slow sort of country!” said the Queen. “Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

You can definitely support an $800K mortage on $200 K a year. Let’s say the loan is interest only at 5.5%. The payment would be $3,667 per month and taxes and insurance would add about $1,050 per month. That’s $4,717 per month total and represents only 28.3% of your gross income, well within any mortgage company’s approval range. Let’s say you take home 60% of that $200K, allowing for taxes and other deductions. That gives you $10,000 per month, leaving you with $5,283 of disposable income. Unless you are spending carelessly, you should be able to survive on that easily.

@ anonn: “You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year”

“That’s subjective.”

Fine, I’ll restate — even though I was already positing the absurd in suggesting someone with a piddly $200k annual income would be sitting on $200k liquid for a downpayment to begin with. But whatever. I’ll restate:

You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year assuming you also want to eat (at home; never at a restaurant; not even for lunch), pay your utilities, make any contribution at all to a 401k, and have any money at all left over to cover yourself if/when you get laid off or take a paycut (that was, you may recall, the basic point of my post). Not to mention actually have some scratch to enjoy life in the city that’s *so great* to you that you’re spending every last penny just to have a roof over your head there.

And you definitely can’t do it if you have one or more children. We couldn’t do it without stretching ourselves on more than double that income with 2 children.

To pretend that a 5/1 purchase price/income ratio is really tenable is ridiculous. Even 3/1 seems crazy to me, but I’ll grant you that it’s “subjective” at that point (and mainly depends on whether you have kids).

“You can’t support an $800k mortgage on a $1M home if you’re only making $200k/year”

Wow, I didn’t realize I was doing the impossible for the last 5 years. And also managing to save for retirement. And not live on credit cards. And take 4-5 trips a year.

It is easily doable. What an absurd statement.

If you actually pay principal then your monthly goes up another another $875/month and suddenly your DTI goes up to 34%. Better have reserves or hope neither earner loses their job.

Jack, who is handing out 5.5% jumbo loans?

I was 5/1 price/income (4.6/1 mortgage balance/income) when I bought my place. I’m at 4/1 mortgage balance/income now. Must be the no-kids thing that makes it seem easy.

BernalDweller, do you have any children? Like Shza pointed out, that can significantly impact what you can afford on 200K income. Our income is almost double that amount, and $1MM (700-800K mortgate, assuming 20-30% down) is the absolute maximum we would spend on a house. Our one son costs us: over 40K for the nanny, 7400 for pre-school tuition, $$$ for summer camp, plus college tuition fund, and of course food/clothes/toys/etc.

waiting2nest, $7400 for pre-school? You got a deal! We paid more than that for part-time (mornings only) pre-school a couple years ago. Yes, BernalDweller is stretching way beyond what I would be comfortable with even if he/she has no kids. With a kid or two, that’s impossible (unless grandma and grandpa are kicking in support).

BernalDweller, if you’re happy with a relatively ascetic lifestyle and never plan on having kids, then all power to you (though I don’t know why you’d want to live in Bernal if you didn’t have kids). Your point, anonn.

But don’t misrepresent your resulting lifestyle. Those 4-5 “trips” clearly aren’t real 1-week vacations ($20-40k in aggregate) or you’d be spending yourself into the red every year.

I agree with Trip. Our older son’s preschool is around $18k/year — but it is year-round ($1425/month). The nanny is an additional $32k or so. So $50k/year in childcare.

But to return to my original point. Fine — someone like BernalDweller is comfortable enough stretching to pay down a mortgage that’s 4x income. Maybe he truly doesn’t experience it as a stretch. But (and I don’t wish this on you, BD) if he loses his job, he’s a forced seller who drives prices down. Unlike someone with that same mortgage who’s been making $600k/year this whole time (or $400k with no kids). And unlike someone who bought the same place in Bernal 10 years ago for $350k.

shza, I think your original point has been illustrated by this thread. There clearly were many (most?) in SF who stretched to buy their place in recent years in a credit-fueled bubble. Assuming some percentage of the rapidly rising ranks of the SF unemployed are in that group, they really will have no choice but to sell (or walk away) relatively quickly.

I’ve got to chime in here. We lived in SF with a young child for probably never much more than $130K per year all-in cash outlay (on average), so I guess roughly $180-200K pretax equivalent. I felt like we lived like kings. 3 cars, housekeeper, nanny for a period, nice 2800 square foot 4/4 house w/ocean view in a safe, family neighborhood, private preschool for 2 years (a bit cheaper than yours, though, Trip), at least 4 vacations a year, etc. Never even gave a thought to budgeting and always tried to be generous with family and friends.

Of course, we were just renters. ROFL at how hard everyone struggles just to “own” a place here. SF is not nearly wealthy enough to support these prices, not even close. A reckoning is coming, and it’s not going to be for the banksters, that’s for sure.

BTW, if it weren’t for my current “supercar fetish” I think living in Tiburon would cost us even less, especially as my neighbors are picking up the freight for a pretty wonderful public school (as an ardent anti-government guy, I was all prepared to be unimpressed with the local public school and teaching staff, but I have to say it’s really pretty good, fingers crossed ;)).

LMRiM, I obviously agree with your point about struggling to “own.”

But it would be completely impossible today in SF to live the lifestyle you describe in your first paragraph on a $130k outlay (or anything close). Rent on a big place like that (4-5k/month) plus nanny ($30-40k) & preschool ($15-20k) already get you to almost that figure before you get around to actually having a lifestyle (or a car) (or a vacation).

Renting is definitely the more rational choice in the current market and I’m quite happy to be doing it. But the advantage isn’t quite as great as your non-inflation-adjusted anecdote would suggest.

And you can still live like that in SF if you rent (in fact, rents are coming down)! This, of course, is why housing prices will continue to decline . . . a lot.

@shza:

No kids here, we’re gay and we don’t want them – hell, we can barely stand them. But the original assertion said nothing about kids, so it sounds like a big qualifier to the argument now. But trust me, our life is hardly “ascetic.” LOL. If you only knew!

As for the jab about Bernal, it’s clear you don’t like it. So don’t live there. We like to keep it friendly and down-to-earth, so I don’t think you’d fit into the neighborhood very well anyway. My partner and I love Bernal and the friends we have there.

Too bad about the 40K nanny, but you get no sympathy from me on your kid costs. They are completely over the top. And boo hoo about the summer camp costs. Didn’t know summer camp was a requirement these days.

Not true that you can’t do it today, shza. I lived in Monterey Heights 8/2002 thru 7/2008 for $3100/mo. Nanny was $2K per month cash (we’re a Spanish speaking household, so didn’t need an English-speaking nanny). Preschool (3 days per week, though) was $6K.

Now, admittedly, neither my wife nor I work anymore, so we had lots of time to spend with the child (later, kids). We have modest tastes and needs I guess, and like I said I’m just rough estimating the $130K figure. But we did go to Hawaii at least 4 times in those years, and skiing a few times per year….

About rents, my advice has always been to lowball. Our place was asking $4K in 2002, and we got it for $3100. Asking rents around there seem a little higher today, but not by much – I’m guessing similar discounts can be attained. Here is a place that might fit the bill if they would agree to come down another $1K not more than a few hundred yards from where we lived:

http://sfbay.craigslist.org/sfc/apa/1125430326.html

(They’ve already come down from $5200/mo wishing rent and it’s been advertising for months)

So, BD, that’s fine if you don’t like kids. But please explain how you can live this extravagant lifestyle with an $800,000 mortgage on only a $200,000 income. Round numbers for your budget would be fine. Sorry, but it can’t be done, even with no kids.

Yikes, you folks are overspending on child care too!

“Day nannies” cost 30-40k? Crickey, I’ve got in-laws in manhattan who pay that for a live-in nanny.

We pay about 5k a year for preschool (tho it’s only 4 days a week, half day, but still seems a bargain pro-rated).

We live in the east bay foothills, is it really that much cheaper over here? I didn’t have kids when I lived in SF, so I never investigated what SF childcare “really” costs.

Well, you don’t have cars, extra bathrooms, or heat, so that should help 😉 😉 😉

People, people, please try to avoid swinging from one extreme to another. 80% of life happens somewhere between “ascetic” and “extravagant.” I never claimed extravagance.

Here’s my annual budget:

Pre tax PITI: about $60K.

2008 Fed and CA income tax paid $35K

Health insurance: $8K

Retirement/savings: $25K

Groceries @250/wk for two: $13K

Utilities (we have both a dish and cable…hubby is a sports nut! about $8.4K.

Car insurance: $2K

And the remaining $4K/month we pretty much blow as we see fit, or spend on the house/garden, or whatever. Well, actually, we usually wind up saving it until we want a new toy. Just replaced our 4 year old iMac with a new 24 inch…sweet!

I should add that I’m not overly worried about retirement, for reasons that are none of your business. But I live within my income and easily so, including my contributions to savings and retirement.

BD, ironically, I actually live in Bernal. My comment was “I don’t know why you’d want to live there if you didn’t have kids.” I stand by that statement. It’s great for us, but I would have stayed in Dolores Heights if I didn’t have kids. (Though of course that would be unaffordable for you if you’re obsessed with “owning.”)

You can keep saying your lifestyle’s not “ascetic” but it sure would be for me. After $50k in annual childcare costs and $75-100k to savings, we’re netting about what you do on $200k. So we’re essentially living on the same net as you once you account out the kids.

On that money, we can afford a low rent (under $2500), good groceries, the occasional take-out, 1-2 “trips” a year, and going out to dinner maybe 4 times (a YEAR). Hardly lavish. If we were paying double our rent on a mortgage, we’d be shopping at safeway and brownbagging our lunches — not to mention never taking a vacation.

The argument has gone from ‘You can;t afford that house on your income’ to ‘ why are ypu living in my ‘hood without kids..’

Ah, now it makes sense. BD can support a 4x income mortgage and a lavish lifestyle by cheating on his taxes. Got it.

Here’s what you’re supposed to be paying on $200k:

Annual Gross Pay

$200,000.00

Federal Withholding

$50,466.10

Social Security

$6,621.60

Medicare

$2,900.00

California

$15,952.29

CA SDI

$997.36

Net Pay

$123,062.65

So, shza, that’s where we differ. You aspire to a very lavish lifestyle, expensive groceries, etc, and you are willing to rent to get those things. I prefer the stability of ownership – I hated renting, always did when I was younger. Creepy controlling landlords, no say over your surroundings…yuckity yuck.

In the end, it’s just different strokes, right?

shza…you’re really being obnoxious. I don’t live paycheck to paycheck, and I told you what I PAID in taxes, after I file my returns! That’s very different from withholding! I actually looked at my return to give you the figure!

LOL. You need to learn some tax planning.

BD, this will be my last response.

You clearly failed to read my last (two) post(s).

The entire point of my 5:58 was that I essentially live on what you do (or would, if you paid your taxes) and it’s not lavish at all. I regret characterizing our groceries as good, given that we spend the same on a family of 4 as you spend on 2 people.

If I aspired to a lavish lifestyle, I’d be spending that extra $75-100k rather than saving it, obviously.

But anyway the mystery is solved. When you pay less than half of your due state, federal and payroll taxes, you can afford more mortgage debt. Just don’t get audited (or laid off).

I’m a peanut, too!

…someone with a piddly $200k annual income would be sitting on $200k liquid for a downpayment to begin with

Hey.. I don’t appreciate you calling 200K “piddly”. Nowadays, that’s like insulting someone’s manhood. I make substantially less than this, and have more than 200K liquid assets. 200K is a lot of income — way, way more than the average SF home-owning household.

it takes all the running you can do, to keep in the same place.

Brilliant! Making 200K is a rare and special occurrence. Enjoy it (while it lasts) and use it to your benefit.

If you automatically infer that that income will remain (or even grow) and borrow against a large multiple of it, then your high income is actually working against you.

Finally, the same thing is true for nannies, private school, expensive private lessons, and a lot of other commitments that the wealthy make; that most people are just fine and happy without — that most of you were fine and happy without, when you were growing up.

Earned wealth should give you the freedom to indulge, but once you believe it’s necessary, then you’ve let your income trap you, and the larger the income, the more powerful the trap.

I hate to insert myself here (well actually I don’t). BernalDweller, your taxes paid generally should be more or less equal to your witholdings. Unless you’re claiming a whole lot of bogus deductions (in your case, accounting for more than *half*). That’s the whole point of witholdings.

But if your situation is more like you’re living on dividend income/trading income (not “paycheck to paycheck”; hence your lack of worry about “retirement”) and paying at a lower capital gains rate, no payroll taxes (as you seem to indicate), etc., then it was pretty disingenuous of you to make your initial response about how easy it is to carry a big mortgage on an income of $200k/year — in a thread about layoffs.

“200K is a lot of income — way, way more than the average SF home-owning household.”

Yes, but the average home-owning household bought a long time ago and paid well less than half of what the average SF home costs even now on the bubble’s downside. It’s not like there are a bunch of people making $60k running around buying homes today (or maybe there are — but there sure shouldn’t be).

Yes, but the average home-owning household bought a long time ago and paid well less than half of what the average SF home costs even now on the bubble’s downside.

Credit prop 13 in part for making that possible. And that’s one of the many reasons why real values in SF will inexorably be pulled downwards. The region is nowhere near so productive nor so wealthy as the marginal prices paid recently would indicate. The valuations are not going to survive the generational turnover. In the long scale of things, it’s probably only been 20-25 years that valuations have been out of whack with productive capacity (increasingly so over the last 10 or so), and that’s really not such a long time in the end to project out another 30 (just to pick a “mortgage-friendly” number).

Finally, the same thing is true for nannies, private school, expensive private lessons, and a lot of other commitments that the wealthy make; that most people are just fine and happy without — that most of you were fine and happy without, when you were growing up.

Earned wealth should give you the freedom to indulge, but once you believe it’s necessary, then you’ve let your income trap you, and the larger the income, the more powerful the trap.

Truer words were never spoken imo. It’s part of the reason I left the hedge fund world when I hit my “number” 10 years ago, and that I didn’t let my “number” increase as my earnings did. I grew up pretty poor (parents never got out of high school and we lived in an apartment in a not too nice part of the bronx in the 1970s), but honestly I don’t see a huge difference in terms of happiness between my friends from those days and my friends from my hedge fund days (one of whom is at least a “half-billionaire”, lol). Resources to my mind are only valuable insofar as they confer freedom and security, so why endanger those by constantly running up the tab and turning what should be a relatively worry free existence into a stress-filled rat race?

i’m really blown away by how much people think they need to live on. shopping at safeway is the cheap way to shop????? ever heard of costco?

dual income no kids (dinks) should easily be able to pay $6k a month on a $200k combined income. and if i’m going to spend $60k on kids per year, then one of the two $100k salaries can quit their jobs and actually raise their child the best way. you could even home school.

we americans spend far too much money on so many frivilous things… and that includes cars and clothing. how many pairs of shoes do you really need? can’t a Camry get you to the same places a Lexus can? or for that matter a Corolla?

and if you’re paying 100% of what you think you owe on taxes, you need to fire your accountant and get some decent advice. some really, really simple tax advice that is LEGAL will save you a boat load of money.

by the way, my latest buyer bought a home for under $900k on a $130k salary that would have sold for just over a million last year. of course he sold the condo he bought in ’97 so he had $400k to put down. yup, real estate is a terrible investment.

My god we’re off topic here. Personally, I think we’re nowhere done the end of the layoff process.

bernaldweller, can I have the name of your financial planner? I pay double what you in taxes on roughly the same income.

LMRiM, given your supercar fetish, I take it you are a UK Top Gear fan?

and now, back to real estate, the UE number will have a big impact in two ways: potential loss of income in 2-earner families and buyer psychology. the latter effect is strong as I am sure our agent friends can attest to.

with uncertainly about your reserves (that and downward pressure on salaries are what layoffs create)and an inability to plug a large, positive annual appreciation number into the rent v buy calculator, it is hard to pull the trigger on a purchase unless you enjoy burning the money. even a year ago, the psychology of “buy now or be priced out forever” was radically different.

“200K is a lot of income — way, way more than the average SF home-owning household.”

what’s the average HHI of the top 35% since that’s the home ownership rate in SF???

and can we also take out all of the 2nd homes since those households presumably count at zero income? and retirees?

and with maybe 5% of homes changing hands each year, what is the average HHI that is actually chasing those homes?

And here is my last post in this thread.

I do not have any investments other than my retirement, and I generate ZERO investment income to live on. My taxes are less because my interest and property taxes are deductible. It’s not rocket science, people. And I have never incurred a penalty for failing to pay my quarterlies. The implication (hell..it wasn’t even implied, it was stated as a “fact”) that I am somehow cheating is ridiculous to anybody who knows anything about tax law. I take no “bogus deductions.” Kudos to those that love giving their money to the government. You are not obligated to maximize your tax liability! In fact, you should be minimizing it. And a small clarification to Mark. The purpose of withholding is to come out as close to your liability as possible, which I do. I do not get mondo refunds each year. I’m usually within a couple of thousand either way.

So, Mark, nice try, but you are so very wrong. And guess what…I did get laid off last year! Luckily landed on my feet, but have the savings to fall back on in case it happens again. So stop your preaching.

I did read your posts, shza, and was just trying to respond. Your dismissal of shopping at Safeway as something so distasteful that you actually admitted it on a blog is very telling. That is what I was responding to. Once again, I never said I had a lavish life. We’re comfy…that’s it.

i’ve had several buyers tell me non-chalantly “oh, my job is safe, no chance i’m getting laid off”. i have no idea how they know. maybe hubris, maybe they know they’re the sharpest knife in the draw at their company.

and at the lower price points buyers are telling ME it’s a great time to buy, i’m not calling them up. if you can buy a $650k place (that might have been a $750k place last year) with 4.7% money then rent vs. buy looks pretty good. and the trade up i just described… cashing out on a huge run up in a condo to get into a depressed price on a home… that was a call to me, not a call from me. if hangs on for 10 years like he did with his condo, he’ll probably do well again (although many on here obviously won’t agree with that)

angry renters aren’t the ones you should survey if you want to figure out who the heck is buying, where the money is coming from, what their HHI is, and what their psychology is. since no one here trusts agents, you clearly can’t ask us. so stalk an open house buyer and quiz them outside. you might end up with a slighly more balanced opinion. then again, most of you won’t. you’ll still wonder how anyone can possibly live on $200k a year.

Earned wealth should give you the freedom to indulge, but once you believe it’s necessary, then you’ve let your income trap you, and the larger the income, the more powerful the trap.

Amen Robert. We have doubled our income since we bought out house seven years ago, but our expenses, except for child care are the same. It is nice to have the flexibility that living below your means allows. My wife is taking this year off to have a child, for instance.

You can keep saying your lifestyle’s not “ascetic” but it sure would be for me.

$4000 a month in spending money is ascetic? There are many families in SF who live on that alone.

And BD’s taxes pretty close to me. Remember he has about $60k in deductions. Federal taxes on $140k, for a married filing jointly is $27k/yr. I notice he did not include SS tax, nor the cost of transportation, though he did include auto insurance.

dub dub, we pay $1200 for a potty trained child at a well-regarded, but not fancy day care. It was $1600 month when she was not potty trained. This seems about average, though the waiting list is a year long, so maybe they need to raise their prices or something.

When I hear people argue that they can’t afford a 1mil home in SF on 200k income because they have to spend 40k on a nanny, I’m not sure whether to laugh out loud (my instinct), shout in rage, or cry in disgust.

But I will say that San Francisco, for all that makes it great (and there is much there), sometimes feels like it is getting more and more out of touch with reality, in many more ways than one.

rr, if you are making $400k/year HHI, then both parents are almost definitely working too many hours for day care to be a feasible solution. We pay $35k/year for 60 hours/week from our nanny. It’s hardly crazy; in fact, it’s below-market. You should leave your “outrage” to yourself.

And BD’s taxes pretty close to me. Remember he has about $60k in deductions. Federal taxes on $140k, for a married filing jointly is $27k/yr. I notice he did not include SS tax, nor the cost of transportation, though he did include auto insurance.

******

Yeah, but BD can’t file married filing jointly, nor does he receive the deductions and credits for children.

I’m not saying that the 800/200 can’t be done (it seems not too difficult without the expense of children or extravagance), but BD’s numbers and story smell fishy.

wow never thought would hear the words Top Gear on this post.

any views on Clarkson then?

REpornaddict: how about brilliant? but, then, after discovering the show two years ago, I compulsively watched every episode courtsey of the interwebs. Maybe my name should by TGaddict or Supercarpornaddict.

Did you see the episode where they drove muscle cars across CA starting off at SF?

its shown on BBC America too, I think

I haven’t read all the posts, but I’ll chime in quickly for a data point.

My half of our taxes (we file separately):

My AGI was just a tad over $200k

My Federal Tax was $44,207

My State tax (lower than CA) was $13,347

My Social Security was $6324

My medicare witheld was $3015.43

Total taxes: $66,893

I have many deductions including an FSA account, full 401k withdrawal, mortgage deduction, work deductions etc etc etc.

But I hit AMT.

although I am willing to be proven wrong, I have a hard time believing that anybody could legally pay only around $35k of a tax as a single filer in the state of CA, unless they forgot to do their AMT, or if they are not an income earner.

(ex: if all their income is based on long term capital gains or they’re a principal in a Private Equity thing or if they’re a cheating small businesser or something)

===

but that still leaves me with over $10k/month to “spend” how I see fit.

P+I on a 800k mortgage is around $5k.

taxes is likely another 1100/mo

insurance is probably a few more hundred/mo

So you’re looking at around $7000/month in mortgage.

(if you have to do interest only then you can’t afford the house… you’re renting the house)

that leaves you with at least $2500/month. many san franciscans live on less than that total per month!

I would say an $800k mortgage on $200k salary is doable, but it is somewhat risky and is a stretch, and you will have to make sacrifices elsewhere. most SFers that I know do it by underfunding their retirement.

but BD evidently has something up his/her sleeve, and thus doesn’t need to worry about retirement (perhaps a rich parent?). that obviously changes the argument.

anyway:

I agree that BD’s taxes don’t smell the sniff test

but I also agree with his/her assertion that one can pay for an 800k mortgage on a 200k salary.

(I would never do that, but I’m very cautious)

oops:

I figured out a possible way I could be proven wrong.

If one of the two partners claimed the full mortgage deduction on only his/her taxes, it might do it.

because I think the mortgage deduction is not impacted by AMT if it is on your primary home.

We only pay around $13,000/year on mortgage interest so it’s not a big deduction for us.

it wouldn’t matter for me though, because for every $ increase in mortgage interest I pay, it’s one more $ that I can’t deduct elsewhere due to that AMT again.

ex SF-er — you are on to something. A single person can deduct a $1M mortgage. A married couple can deduct a total of $1M. Two unmarried folks can together deduct $2M total in mortgage.

It’s another form of the marriage penalty that the government hits nails a dual-income couple in multiple ways.

BD may not get the child credit, but that is dwarfed by the ability to fully deduct a mortgage (not that BD is doing that, because their dwelling is on a $800K mortgage apparently) up to $2M.

And there you go. That may explain a lot here. From a financial standpoint, gay marriage would be a disaster!

I love this thread!! I love understanding the math of all this stuff, in case my future changes.

[I take home more than 1M and am single, gay (and obviously unmarried), and haven’t found myself scraping by just yet.

don’t have a kid though, thinking about getting a dog.

I’m all for living life simply, and totally agree with Robert’s points above. People use money as a means to lock them into bad behavior that they feel they should be involved with.

Anywho, great thread.

I agree. This is one of the more interesting threads in a minute, IMO. My personal two cents, and I know this is not for everyone, but a lot of seasoned real estate people will tell you that the “trick” is to buy a multi unit and live in one unit. Not for everybody, I know. But the tax advantages are very good, and the additional revenue stream can make a huge difference in any of these fleshed out synopses. Last, think about it. How many people already live in flats?

There is a way the renters-waiting-to-buy can “bank” a chunk of the huge financial advantage from renting right now. A partner of mine was elevated to partner two years ago — thus his income has just about doubled. His wife (also a lawyer — works for a non-profit and does not earn much) is pregnant and was bugging him to buy a place since they can now easily afford it. They live in a great SOMA loft right now — renting since 2002 and pay $2300/mo. They would need to spend about $1.5M-$1.8M to get what they are looking for in today’s housing market. He is not going to catch a falling knife and is insisting they wait a couple of years, and she was not happy about it (more specifically, her mother was not happy).

So about 6 months ago, they came up with a compromise. They are saving about $3500/mo. directly by staying in their place, and they figure that they are avoiding about $5000/mo. in losses from dropping property values (that’s way too conservative in my view — probably close to double that). They don’t live lavishly — no desire to do so — but he told her she can spend another $5000/mo beyond their usual expenses and he won’t say a word about it. No strings. Valentino dress? Go ahead. French Laundry? Go ahead. Last minute Hawaii trip for a 3-day weekend? Go ahead. New 60 inch TV? Go ahead.

They’ve had a blast. They actually don’t spend nearly $5000/mo extra, but probably $3000-$3500. That is just free money to live it up because they decided to hold off buying now. And they are still coming out way, way ahead compared to owning.

Mortgage deduction benefits are greatly overstated. In this market, where prices are rapidly falling but renting is still half the cost or better, there are a lot more enjoyable ways to use money than limiting tax exposure with a declining asset.

“They’ve had a blast” — indeed! But I’m on pins and needles as to whether they will be able to turn that consumption spigot off later. Hopefully they are disciplined traders 🙂

Who is handing out 5.5% jumbo loans?

I just got a $1.5M loan at 4.5%, 5/5 arm. had to put down 30%, but the loans are out there…. u just gotta look 🙂

but a lot of seasoned real estate people will tell you that the “trick” is to buy a multi unit and live in one unit. Not for everybody, I know. But the tax advantages are very good.

******

What are the advantages, generally speaking?

Two examples quickly sprung to mind when you mentioned this scenario, and it made me wonder just how big the tax advantage was in this situation.

One, a young single male acquaintance of mine owned a two flat building in lower Pac Hts and rented out the lower one to “hot chicks” (this was during the .com boom so he had a large pool from which to choose) with “hot chick” friends. There were a lot of small parties in one flat or the other. He always talked proudly about the financial benefits of his situation, but he was always tuned out given the other distractions.

Two, a close family member lived for a while in a “garden apartment” in a three story Edwardian in Ashbury Hts in the early part of this decade. There were three rental units, and the owners (both retired lawyers) lived on the top floor. She could never figure out why the owners, who had recently bought the property, would choose to live in a situation like this (shared backyard, occasional squabbles btwn tenants, possibility of being stuck with an awful tenant via rent control, etc..) given the fact that they were in their 60s, retired, and, by all indications, financially set for the rest of their lives.

Lower rates is a big advantage. I do this, and have just locked in at 4.875% P&I for 30 years.

we will probably move out of there next year – the place will cashflow now (including interest, taxes, insurance – and some contribution to principal too) – but will be able to keep the 4.875% rate for the future.

but it will, I think, be cashflw negative for taxes purposes – due to depreciation – so there will be accounting losses there which we will be able to offset in the future.

I am not sure if there are any other significant financial advantages – would be happy to hear some. Of course, one practical advantage is that you don’t have to travel to the property each time there is aproblem, something needs fixing etc.

This is certainly not to everyones tastes of course, – both from the landlords and tenants side – but has worked out well so far. Being able to take advantage of the higher rate limits for 2unit meant we refied into a non-jumbo in Jan this year. I had not expected the place to cashflow positive so quickly.

“He is not going to catch a falling knife and is insisting they wait a couple of years, and she was not happy about it (more specifically, her mother was not happy).”

Ouch. sounds like the in-law from hell!!

Well, flatly, depreciation + cash flow is the answer. All other typical scenarios apply. If you can get it to the point where your flat is equivalent to what a similar rent might cost, you’ve won. If you like the place, that is. My monthly is about 2K factoring insurance and taxes. I have a two bedroom, two level unit with exclusive backyard use, nice cityscape+ Bay +GG bridge tower views, and a two car tandem garage. And it’s because I got a multi unit that I inhabit. But I’m a r.e. professional, I got it offmarket, I feel as if the seller could have gotten 150K more if she would have hired an agent, etc. However, in my opinion, this scenario really is the chief quote unquote “deal” that the downturn has revealed for SF so far. Especially once these high limit FHA loans kick in. Seventy K down to get a 1.4M property that’s producing exellent rent roll? That was so unheard of the last decade. The multi unit market is about to get hot. And it’s down to the USG. IMO, get in now if you’re so able. The subsidy is going to get subsumed by demand, and quickly.

Hey Anonn,

Just for my own understanding — It seems to me that your PITI (+ setting aside 1%/year for maintenance) should be about 10K/month — before any tax deductions. Is this true? If so, how much are you renting the other unit(s) out for? — Thanks!

Robert, I would be happy to share any and all information with you if you like. This is not the proper forum. Just email me if you know how to reach me.

“get in now if you’re so able. The subsidy is going to get subsumed by demand, and quickly.”

You heard it here first: Buy now or be priced out forever.

“You heard it here first: Buy now or be priced out forever.”

No, that would instead be a paraphrase which is your own unique brand of bullshit.

You know what Tipster? You win. See ya. Good job. You’re really very, very worthwhile. What is it that you do again?

Robert,

About rental activities, anonn is right that there are substantial tax benefits in many cases because [rent] – ([depreciation (at the crazy buy-rent multiples in SF)] + [expenses]) will typically produce tax losses while still generating positive cash flow. This has the effect of “subsidizing” the effective cost of the retained unit in which the owner lives.

However, it’s important to note that this is generally only available to people who qualify as “real estate professionals” under the IRS passive activity loss rules, and not for people working W-2 jobs in other fields.

A limited benefit (up to $25K to offset active income) from rental activity is available for everyone regardless of business status, but as a practical matter has limited benefit in high cost SF because of income phaseouts (starting at $100K, and the benefit is completely phased out by $150K).

Additionally, tax loss depreciation of course reduces the basis in the property and therefore on sale, and so this reduced basis will be “recaptured” at generally unfavorable recapture tax rates (compared with capital gain). Again, this is not as great a concern for real estate professionals as they are going to stay in the business and will typically roll their adjusted basis into a new property through a 1031 exchange (deferring recapture issues).

I’ve got family members involved in this area, so I have some familiarity with the rules and “tricks of the trade” (which I won’t go into here ;)). Obviously, people should consult a tax professional before deciding on any strategy, but reading the basics first will answer most questions. Start here (especially pp. 4-5):

http://www.irs.gov/pub/irs-pdf/p925.pdf

I hope that helps!

Ahh, thanks. Initially, it didn’t seem to pencil out.

I’ve been getting interested in income property, but in Phoenix where I have family, and also as a suggestion for my parents as retirement income. You can find cap rates of 10% or more there, and I know the area well. I don’t think the deals are going away anytime soon, though, as more inventory keeps getting added to that market.

If you can get it to the point where your flat is equivalent to what a similar rent might cost, you’ve won.

——

Shouldn’t that be the norm? If I have to “get it to the point”, it sounds like a not too smart investment.

***********************

producing exellent rent roll

——

You’re assuming the rent roll remains excellent after the SF rental market completes its plunge?

***********************

IMO, get in now if you’re so able. The subsidy is going to get subsumed by demand, and quickly.

——

Do you realize that any advice or opinion you give immediately loses credibility when you add a statement like this? I realize you “eat what you kill”, but still…….

Thanks, Lmrim. That was more the type of response I was seeking.

It seems the scenarios above made financial sense more from the rental cash flow as opposed to any tax advantages, as no “real estate professionals” were involved.

No problem, Robert.

I also think that income producing property in places wher cap rates are compelling is a good bet long term, and I have been looking a bit into it myself (more because I am looking to get my brother started in a business he’s already inclined towards for when he retires with full pension from the police department when he turns 43). The numbers become even more compelling if you engage in some “creative” tax accounting/record keeping I imagine. What’s the worst that can happen, they make you Treasury Secretary? 😉

OT – BTW, thanks for your investment thesis/outlook on one of the other threads. It is not so disimilar to my own, except my base case inflation view is a bit more subdued than yours. I posted something about my views back in Feb – if you missed it and are interested, see my posts in this thread, especially February 21, 2009 7:46 AM; February 21, 2009 10:19 AM; and February 22, 2009 7:26 AM:

https://socketsite.com/archives/2009/02/a_rental_market_anecdote_from_a_pluggedin_san_francisco.html

About prop 13, I agree with you that the value has been fully baked-in, but I suspect the effect has been larger than you imagine in SF and other resource-constrained areas of CA over the past 30 years. I still owe dub dub a write up but as usual I am having trouble being succinct. You know the old joke: “If I had more time boss, it would have been shorter”, lol.

To help illustrate the tax implications of a mortage in CA I ran the following in TurboTax for a single filer, 200K AGI.

Scenario 1 – no property tax, no mortgage interest

42K base federal tax

3.5K in AMT fun

14K state happiness

and 10K of SS, Medicare and CA SDI goodness

for a total of 70K

Secnario 2 – 10K in property tax and 55K to our friends the bankers

24K base federal

4K AMT

8K to Sac

and the same 10K of assorted safety net payments

for a grand total of 46K

Note that interest is much more AMT friendly than state and property taxes, so in this range your 65K in house payments are saving you 24K in state and federal taxes.

“You’re assuming the rent roll remains excellent after the SF rental market completes its plunge?”

Let us be clear. Who is assuming what? Me, or you?

Do you realize that any advice or opinion you give immediately loses credibility when you add a statement like this? I realize you “eat what you kill”, but still…….

Deride away. Disregard away. I am sharing things, and you know something, I’m not sure why any more.