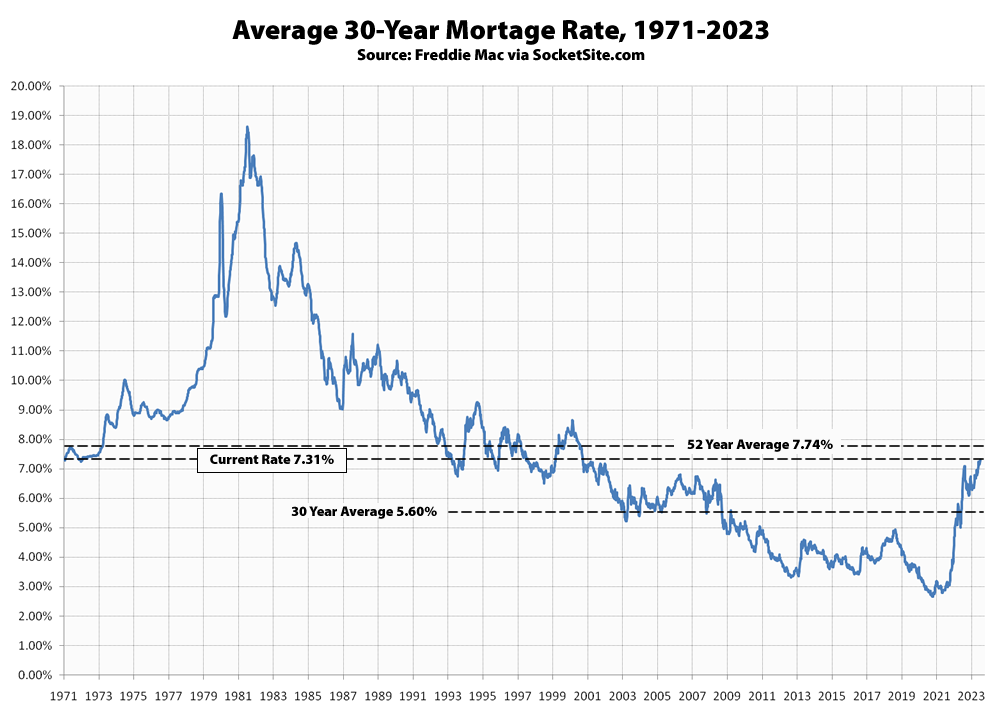

The average rate for a benchmark 30-year mortgage ticked up another 12 basis points (0.12 percentage points) over the past week to 7.31 percent, which is 61 basis points higher than at the same time last year, 466 basis points, or 176 percent, higher than its all-time low of 2.65 percent two years ago, and the highest average rate since late 2000, according to Freddie Mac.

Keep in mind that the current 30-year rate is still below its long-term average of 7.74 percent and not historically “high,” with the probability of an easing by the Fed by the end of this year holding at 0 percent, versus a 35 percent chance of another rate hike.

At the same time, the average rate for a 30-year fixed jumbo loan has jumped to 7.34 percent, which is the highest average rate in over 12 years, according to the Mortgage Bankers Association.

SS is mostly residential. But rising rates are also hitting commercial side hard. If you can’t get behind the paywall at chron there is news about wave of defaults hitting office properties in SF now.

Appears to be a reference to More S.F. office buildings are defaulting on mortgages as real estate pain spreads, datelined yesterday:

Two of the buildings mentioned, 995 Market St. and 222 Kearny St., were previously partially leased to “once high-flying co-working firm WeWork, which is now in danger of bankruptcy.” The Bryant St. property was previously largely leased to a tech firm that left in 2020.

I don’t have any feelings of sympathy for local landowners who chose to lease to a company like WeWork instead of local companies in need of office space at a cheaper rate. It was obvious to most informed observers that WeWork was going to fail eventually, their business model was fatally flawed and commercial landlords should have known this at the time and passed. I applaud these properties going back to their lenders if the current owners can’t or won’t lower rents and mark their assets to market.

“It was obvious to most informed observers that WeWork was going to fail eventually”

Well, then clearly those who leased must have been uninformed: have you no sympathy for the intellectually challenged ??

(and as a side note, the claim in the story – that the defaults “raise the risk that more buildings will be surrendered to lenders” doesn’t make much sense: it may well indicate that, but it’s not like all the loans in the city are tied together)

I think that the savvy “players” in the S.F. commercial office space game thought to themselves, “well, this company’s business model isn’t going to work out, but while it lasts, I am happy to take SoftBank’s money from them by leasing to WeWork until I sell the building with them as a tenant at the top of the market.”

Dont hold your breath waiting for biotech to come running to the rescue. Lab space vacancy rate climbing up to 15% in SF.

Today’s fixed 30 banker rate hit 7.72%. Seems rates are headed to the moon I tell you…to the moon. I’m old enough to remember 18%. IMT commercial office vacancy in the core downtown hit a new all time record of 33%. Starbucks closing 7 stores. And the hits just keep coming.

For that small group of owners interested in refinancing, the national average 30-year fixed refinance interest rate is already > 8 percent.

I’m also old enough to remember double digit interest rates for mortgages, but home prices were much lower then. Too bad we didn’t have the Case-Shiller index gathering and reporting data back then so we could show that chart to pundits who say “the current 30-year rate is not historically high” over and over again.