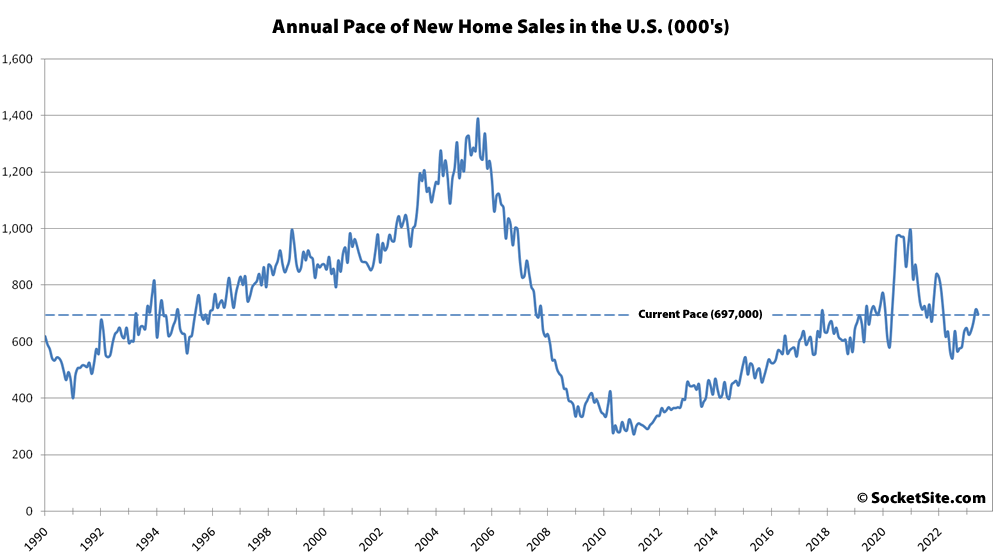

Having jumped nearly 20 percent in May after an upward revision to 715,000, the seasonally adjusted pace of new single-family home sales in the U.S. slipped 2.5 percent in June to an annual rate of 697,000 sales.

While the pace in June was nearly 24 percent higher than at the same time last year it was 4 percent lower than in June of 2019, prior to the pandemic having hit, with a median sale price of $415,400, which was half a percent lower than in May; 4.0 percent lower than at the same time last year; and 16 percent below a peak of nearly $500,000 in October of last year.

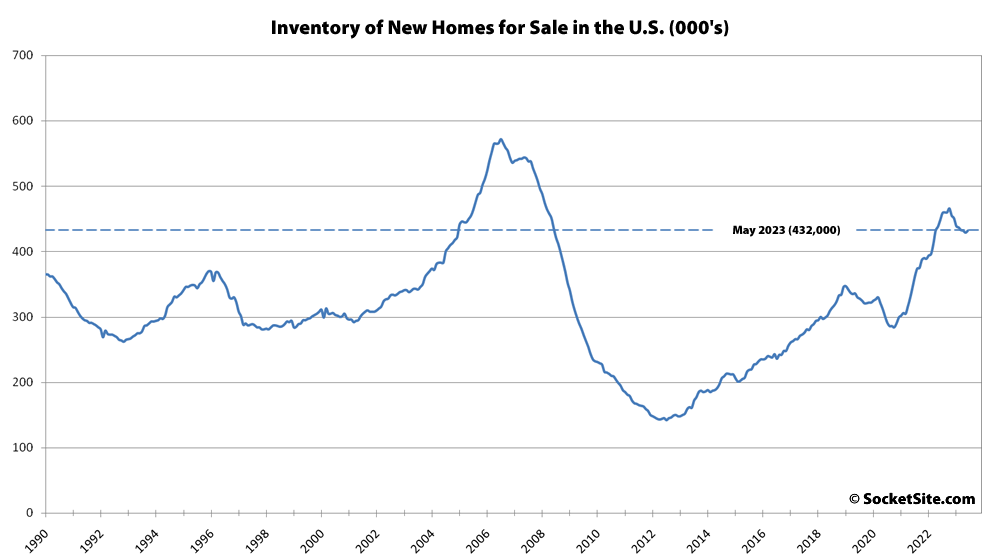

And while inventory levels ended the month around 4 percent lower than at the same time last year they inched up around a (1) percent from May and were 30 percent higher than prior to the pandemic having hit.

Interest rate hike today makes current rates at 22 year high.

From a Sr. Research Analyst at John Burns Research and Consulting last week:

I look at that more from the standpoint of the U.S. having a surplus of real estate agents.

Perhaps some of those underemployed realtors in the Bay Area will take advantage of the current tight job market that Jerome Powell keeps mentioning during FOMC Press Conferences and switch careers into one of the service jobs in the “hotel, restaurant and drinking establishment sector” that are being created at such a rapid pace and marginally providing an ongoing excuse for The Fed to keep raising interest rates.