Once again, this data only reflects properties that were listed and recorded as sold on the SFAR Multiple Listing Service. And as always, while a change in average (or Median) sales price might be a fair measure of the market’s appetite, it’s not necessarily the best measure of actual home/condo appreciation or performance. It’s just another data point.

∙ San Francisco Home/Condo Sales: Historical Context [SocketSite]

∙ Expectation Setting: San Francisco Appreciation [SocketSite]

∙ NAR Home Price Analysis For San Francisco [SocketSite]

CONGRATULATIONS!! CNBC appearance.

Socketsite,

Do you have information prior to “96?

You can see that data going back 20 years, in the tables on pages 5 and 6 here:

http://www.sfpulseofthemarket.com/pulse_of_the_market.shtml

And from that source, the average annual sales price increase has been 8.7% for single family homes, and 7.4% for condos, over the past 20 years.

Well, so much for “prices never go down here” and “you can’t lose money on real estate.”

Malcolm’s data shows that the median Bay Arean buying a median home in 1990 had lost $80K in value by 1994 (even more adjusted for inflation).

Dude, your math is off.

From 1990-1994, the average single family home lost 33k in value, and the average condo lost 12k in value.

And as for “You can’t lose money in real estate” and “prices never go down here”– aren’t these straw men? Who said you can’t lose money in real estate?

Of course prices can go down here. Of course you can lose money on real estate in SF. The recession of the early 90’s was a monster.

The issue I take with many of your posts is that you’re overcome with schadenfreude. You desperately want the world to come crashing down around all SF homeowners so you can benefit. And I’m telling you — it’s not going to come to pass in the way in which you envision (which seems to be picking up a million-dollar SFH for $300K in a foreclosure auction).

The reason, as ever, is simple. People want to live here. More people want to live here than do live here. This is unchanged for many, many years. It doesn’t appear to be changing now. Though there are unfortunate consequences for people who should be able to afford living here but cannot (cops, teachers, etc.), it doesn’t change

Will prices fall here? It’s an interesting question. There’s room for correction. There’s a “flight to quality” for certain. Will there be a precipitous decline? Almost certainly not.

But it is interesting how badly you want others to suffer exclusively for your benefit. I’m a homeowner. I have owned it for a couple of years and plan to own it for 4-5 more. I don’t want or expect a windfall. Neither do I have an exotic mortgage. I put down 20%. I am improving the place that I bought. It’s inaccurate an troubling that some people characterize every SF homeowner as an over-leveraged idiot with an interest-only mortgage and a desire for windfall gains. Some of us work our asses off to live here and live well. I don’t see where that’s a bad thing.

But that’s just me.

Amused: It’s not just you, and thanks for your thoughtful, on-target post that speaks for me and, I’m sure, many others.

You desperately want the world to come crashing down around all SF homeowners so you can benefit.

I think I’d be happy if the 50% or more people who jumped into the market using liar loans or I/O arms or other loans that allowed them to overbid on the price of a home and worry about the consequences later (like when they try to sell) fell out of the market. Sure that would cause prices to fall, but that would only hurt the idiots who lent the recent homebuyers the money to overpay in the first place.

And it would help the hardworking honest, financially prudent who balked at competing against the financially irresponsible, idiots who didn’t think their loans would ever reset.

No one wants anyone to suffer. And if suffering means you only make 5% per year on your home rather than 50% per year, I guess I’m OK with making people suffer.

You don’t seem to have any problem making those who can’t afford a home without resorting to irresponsible financial shenanigans suffer, so if you are trying to prevent suffering, maybe you can start with them.

tipster: my thoughts too!

I’ve been working, saving, planning, only to be stuck out of the market by people willing to bet it all on a liars loan (ie: FRAUD, which besides stupid and dangerous, is ILLEGAL) or interest-only option-arm, running up prices in the process.

Being financially prudent shouldn’t preclude people from having homes. It should be the opposite. Once these less responsible “owners” are shaken out by resets and foreclosures, we’ll see a much more balanced market and more financial responsibility, which is a GOOD thing.

This is an interesting discussion.

I don’t think too many people are going to weep for the worst of the flipper/speculators. Reasonable people agree that people who make bad choices have to live with the repercussions of those choices.

The interesting part is the suggestion by tipster above that people like me “don’t seem to have any problem making those who can’t affford a home without resorting to irresponsible financial shenanigans suffer…”

It seems the implication (accusation?) is that anybody who has bought a home in SF is complicit in creating the market conditions, and is therefore OK with making honest people suffer.

That’s a really weird POV. Then again, I live in Disrict 6, and I’m sure Chris Daly (Mr. Bought a BMR and Then Gave Myself a Big Raise) agrees wholeheartedly.

amused – If I’m overcome with anything, it’s economic fundamentalism, not schadenfreude. I’ve often posted myself that real estate does not crash, it falls over time. And I’ve also made the comment that if prices do correct dramatically, the unfortunate circumstance will be that many hard-working homeowners, such as yourself, may get hurt along with flippers/speculators if they are over-leveraged (which you obviously are not, so cheers to you for doing it the right way).

I’m not some alarmist running around screaming that the sky is going to fall. I’m a person evaluating what’s driven home prices here so high recently (since ’98/’99) and trying to decide whether it’s a good time to buy. Believe it or not, I’m not “priced out” or a “bitter renter,” and could buy a nice home here if I wanted to. But that doesn’t make it a good decision or value. Plus, because of my job, I tend to move every 2-3 years anyway so even if prices do fall, I probably won’t be around to benefit from it.

I believe that the market has broken from fundamentals and needs a sizable correction (15-20%, not 50%) to bring it back into equilibrium for normal working San Franciscans like you and me. If it does happen, it will take years, like previous corrections.

My earlier post was a stab at Realtors ™, who routinely throw out gems like “they’re not making any more land!” to induce commissions.

Finally, if you’re looking to lambast someone who enjoys watching people suffer, blame real estate investors and speculators. Their blind greed and desire to become instant millionaires instead of “working their asses off” has made real estate unaffordable for the vast majority of people in this city, the state, and large parts of the US.

I realize people get sensitive when I make predictions that imply they may lose home value in the next few years, or bought at the wrong time, etc. Sorry – I’m not trying to attach your equity. And I’m not controlling the market, just predicting what it may do. And I could very well be wrong, and studios will sell for $1 million here by 2010.

And tipster, thanks for the defense. Good to know I’m not alone in my predictions.

What is a ‘liar’s loan’? I’ve never heard of such a thing.

I believe they are talking about the many many people who overstate their incomes on loan applications. It seems that during the last couple of years there was less verification on loans for expensive condos than for someone that was going to purchase a new car. In my own office I know pretty much what most of my team’s incomes are and I am amazed at how much money they were able to borrow for new condo purchases. My income is double most of theirs and their house payments for the most part are more than mine.

A “liar loan” is commonly called a stated income loan. You go to a mortgage broker and tell them how much you make without having to prove/verify your income. Bank lends you the money, but at a slightly higer rate than a traditional loan.

They were designed for the self-employed, who routinely show little to no income to avoid taxes.

Hey, it’s simple supply-and-demand. Places with restrictive building policies have higher housing costs. Period. Rather than blame the buyer, you should blame your Mayor and Board of Supervisors/City Council.

But at least here in San Francisco, we have a bunch of people who don’t understand this concept and hence we get a big porn studio in the Mission.

Lovely.

Oh, stated income. Yes, that was suggested to me at one time. Doesn’t make any sense to me. I was told that as long as I ‘stated’ an income that would not be unreasonable for my field it would be acceptable. So if I made 80,000/year but others in my field made 120,000 I could state the 120,000 figure as my income. Of course there is still that tricky issue of how to make payments when my income is NOT 120,000….

Exactly. Which is why foreclosures in California are now at an 8-year high and rising.

Again, don’t shoot the messenger – I don’t make this stuff up, I pull it from public data sources like DataQuick.

“I could be wrong studios will sell for 1million by 2010”

London $5900sf

N.Y. $5300sf

Hong Kong $3900sf

SF $1200sf

SF is a WORLD class city for a world class market.

“I put down 20%. I am improving the place that I bought. It’s inaccurate an troubling that some people characterize every SF homeowner as an over-leveraged idiot with an interest-only mortgage and a desire for windfall gains.”

If all you have is 20% down, you should not even be owning that home. What are you going to do if you miss a few payments – loss of job or other situation? People here can’t even afford earthquake insurance (a few hundred $ per month) – but they have to “own”.

real estate chick: I found examples of much cheaper properties in a few seconds:

Here’s $857/sq. ft. for luxury living in Manhattan:

http://newyork.craigslist.org/mnh/rfs/268423688.html

Here’s $2,800/sq.ft. in Hong Kong:

http://hongkong.craigslist.org/rfs/268024338.html

I appreciate that there are many cities in the world much more expensive than San Francisco. I would also mention that San Francisco’s economy is a fraction the size of London’s, New York’s, or Hong Kong’s. We’re definitely world class, just not as world class.

But on that note, what about Tokyo real estate price trends?

Anonymous at 4:21… A 20% down payment is standard and, in many cases, it wouldn’t make financial sense to put down more than that even if you could. Anyone who is fiscally responsible–renter or owner–has 3 to 6 months of emergency cash reserves. I’m not aware that renters are any less subject to the consequences of job loss than owners are.

There seems to be an underlying current entitlement from people who feel that they deserve to own a place in San Francisco just because they such hard workers (or at least call themselves hard workers).

Sure. I admire hard work and all that. But the market is what it is. I’d like to buy a Porsche 911 myself because I work so hard, but I can’t afford it. I’m not going to cry about its unaffordability, though.

SeeHsee at 4:47.. I have never understood that concept. If I have the cash to pay off my house, why would I pay an 80% mortgage on the house? At 6.5% interest rate, my money not spent on the house and invested in the market needs to earn at least 6.5%. And that does not seem to be a sure bet at all. So what’s wrong with paying off debt? (A concept unknown in the US)

Dude: Please read the following from Socketsite’s own “about Socketsite” postings:

“If, however, you simply feel the need to single-mindedly debate (and we use that word loosely) the merits (or “superiority”) of buying versus renting (or vice versa), or the impending crash (or boom) of the local real estate market, then you’re probably wasting your time here. (Might we suggest the real estate forum on craigslist?)”

Anonymous at 4:47:

First of all, you have to consider your overall financial situation and what options you have for savings, investments, etc. Additionally, you need to consider your income level and what types of tax breaks might be advantageous for you. So, if you only plan to finance a home for 5 years or so, you might actually benefit from making a lower down payment and having more money available for other types of investments and also getting the tax incentive for the write-off on mortgage interest. (In the earlier stages of your loan, nearly your entire payment is interest and is therefore tax deductible.) If you actually have enough cash to pay for a home without any financing or loan, you’d probably want to look for high-yield investments and tax breaks. In this market, paying cash for a house provides neither.

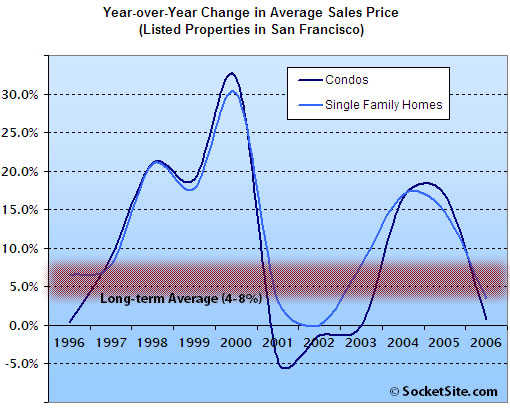

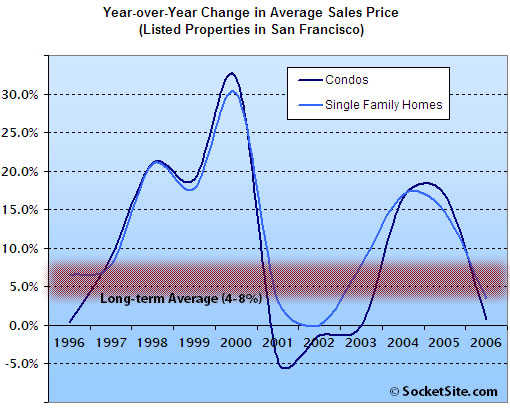

Funny how people can look at that graph and find evidence of a collapsing market. When the trace is above the line that means that prices went up. So over the last decade the average single family home price did not go down. For two of those ten years the average condominium lost some value, but over the next two years it increased by about 15% each year. I don’t see much else here except that this decade saw the creation of a real estate rift in our little city.

To Anonymous at 4:21…

Thanks for the concern, but tying up more cash when interest rates are so low is not wise. If I can’t do better than 5.85% annual returns (which is the interest on my mortgage) with my investments, I have other problems. And then there’s the whole tax benefit from the interest.

Putting down 20% ($240,000) in cash with more in reserve doesn’t exactly scream “fire sale”, now does it?

“If, however, you simply feel the need to single-mindedly debate (and we use that word loosely) the merits (or “superiority”) of buying versus renting (or vice versa), or the impending crash (or boom) of the local real estate market, then you’re probably wasting your time here.”

I don’t believe I was doing either. This is a thread about the mean sales price in the last decade, no?. I was making observations/predictions based on the data shown. Then people got upset because they didn’t like my prediction.

Average prices in Manhattan/New York are around $1,000/SF (first paragraph):

http://www.millersamuel.com/reports/pdf-reports/MMO4Q06.pdf

The article you were quoting was referencing the absolute highest sale prices in the best areas of each of those respective markets, not average prices.

But it is interesting how badly you want others to suffer exclusively for your benefit.

Any homeowner can sell any time they want to. If they suffer, it’s their own choosing. It’s not like the market will drop 50% in one day. It’s not like the data on how many stated income I/O loans, numbers of resets approaching, numbers of foreclosures rising, lenders filing for bankruptcy, etc. isn’t out there for every homeowner to see.

Every homeowner gets to choose. If they suffer, it isn’t anyone’s fault but their own. I don’t want any of them to suffer. I just hope they get out before it’s too late.

Because of my work, I deal with a lot of people who are way more wealthy than I am. They are also very savvy. None of them has a mortgage. And if they build something new, they never take out a construction loan.

High yield investments are risky investments. That means you can lose your money. It’s perhaps worth it if you realize the full yield but if you are balancing it off against interest payments on a loan the only actual yield you are receiving is the difference, which is not high enough to justify the level of risk.

“SeeHsee at 4:47.. I have never understood that concept. If I have the cash to pay off my house, why would I pay an 80% mortgage on the house? At 6.5% interest rate, my money not spent on the house and invested in the market needs to earn at least 6.5%. And that does not seem to be a sure bet at all. So what’s wrong with paying off debt? (A concept unknown in the US)”

Don’t forget the tax benefits. You may be only paying 4% after tax, which should be pretty easy to beat with relatively low risk. That adds up over time and little things like this is what many peoples wealth is made of.

Regarding interest only option loans. I bought my first place back in 2000, saw rates climb like crazy, saw the value of my condo go under for a while (2001-2002, scary) and still made out fine. Don’t get me wrong, interest only loans are NOT for everyone and can be abused rather easily. But its also not a doomsday loan that everyone will bail out of over the next 1-2 years when rates reset.

Salarywoman: Are you suggesting that no one should own unless they can pay cash for their home? There is no right answer for everyone. And those wealthy enough to build or purchase without needing loans are at a different financial level than many of us, and have a different set of circumstances to deal with (which require different solutions). Perhaps I used the term “high-yield” too loosely. As Anonymous at 2:34 AM points out, when you get to an income level where tax breaks are advantageous, being able to deduct mortgage interest is big help. For me, however, this is more of a renting vs. buying question than a purely investment-related one. If your sole intent is to leverage your assets, then the tax advantages of a mortgage loan may not be the answer for you. But, if you’re debating renting vs. owning (and factoring in that in today’s market, there may be a premium paid for owning), the mortgage credit deduction should be considered along with your loan payment, properties taxes, insurance, and HOAs.

Annoyedmouse, I don’t think that graph is adjusted for inflation.

When you consider inflation, those “increases” can be 0 to negative. (obviously, the larger increases of the boom years wouldn’t)

And inflation is hard to measure, since the official numbers are kind of jacked by the government agency reporting:

http://www.financialsense.com/stormwatch/2005/0624.html

What is clear from the graph is that the market has cooled off a lot.

SeeHsee,

No, not at all.

What I am suggesting is that a mortgage is a liability, pure and simple, and therefore something to treat with caution. I do think that people get carried away with the idea of being able to offset their mortgage interest with investment gain. One thing to remember is that if you compute the tax savings in with the mortgage interest (thereby reducing it to only 4%, say) you must also include the tax hit on any investment gain.

But diversification is important to any investment strategy, so owning some real estate, wether mortgaged or not, is usually a good thing.

Anon @ 8:45,

What is clear from the graph is that the market is cyclical.

Agreed that any mortgage is a liability, first and foremost, and a pretty big one at that. I remember signing my loan papers and one of the signing documents among the mound of paperwork was a calculation showing that if I paid the standard amount over the 30 year life of the fixed rate loan, that my total payments would be 2.5 times the loan amount. That is real money out the door and not inconsequential. On the other hand, I know a lot of people with a lot of money who DO take out mortgages (up to the $1 million tax deduction limit) on their house even though they don’t need to in order to get the tax deduction AND to diversify their holdings. Once you take out the tax savings, the real rate that you have to beat for an alternative investment is closer to about 4% for a typical 6.5% loan – a number that is not hard to beat over the long term in the equity markets.

Did anyone else catch the article in the Friday business (page C4) of the NYTimes that quotes National Assoc. of Realtor’s own chief economist David Lereah saying that in 2005 ” 40% of the market represented purchases of second homes and investors buying homes looking to resell them for a quick profit”. I think with the amount of “Liars Loans” in California, with the highest percentage being in Orange County (of course), and a market that has never had such a high percentage of speculators, we are looking not at a “housing market” but possibly a speculative bubble. This is not going to be a typical “wave” or correction.

Anon @ 12:18, Jan 26,

The real rate you have to beat is 4% (or whatever) AFTER TAXES. So most people can just about break even with a low risk investment.

But high earners have another problem. At a certain point (I think it is yearly income of 150,000.00 whether single or married filing jointly) itemized deductions start to be phased out in 3% increments up to 80%. So if you are a high earner your get deduction for mortgage interest is pretty small. This means you would have to pull in about 1.8 times as much from your investment as your interest payment just to break even. In your 6.5% mortgage example, you would get no deduction for the mortgage interest and so would have to pull in something like a 12% taxable return or a 6% non taxable return to break even. I’d really like to have this problem. Then I might be able to pay cash for my residence(s) too.

The Bush tax cuts were going to change all that and phase out the deduction phase out, starting in 2006. But you can imagine how long that will last. And a good thing, too.

I guess, for most of us, the best thing you can say about mortgages is that they function like an enforced savings accout. At least you (usually) end up with some equity.

I take it you are talking about the AMT (Alternate Minimum Tax)- very good point. And good point to clarify that the 4% is the after tax number you need to beat. But I’m not getting the logic on the 1.8 multiple on your mortgage cost for high earners. So let’s say there is no tax benefit to the mortgage, so it’s say 6.5% – wouldn’t you just have to beat that by your marginal tax rate which would be 35.5% to 39.1% for high earners or roughly a 9% return taxable? And not to confuse the issue more, but aren’t investment gains taxed at a lower rate of 15% rather than at your marginal tax rate? (or are they lumped in with the higher gross number in AMT cases)? So how does that affect the calculation? My head is swimming – I need to do more research on this.

Anon 12:39 It all depends on your investment. Fixed income like bonds will be taxed at your marginal tax rate i.e. counted as ordinary income. Same with short term gains. Assuming your investment is a mix of fixed income and short and long term capital gains, you need to make around 9-10% before tax before you recoup your 6.5% interest on mortgage (assuming you are hit by the AMT). And 9-10% is not a sure bet in this market.

I am just surprised that nobody who is in the market for a 1.x Million $ condo seems to be hit by the AMT (you are the first one to even mention it). This tells you how ridiculous this market is i.e. how overextended people are.