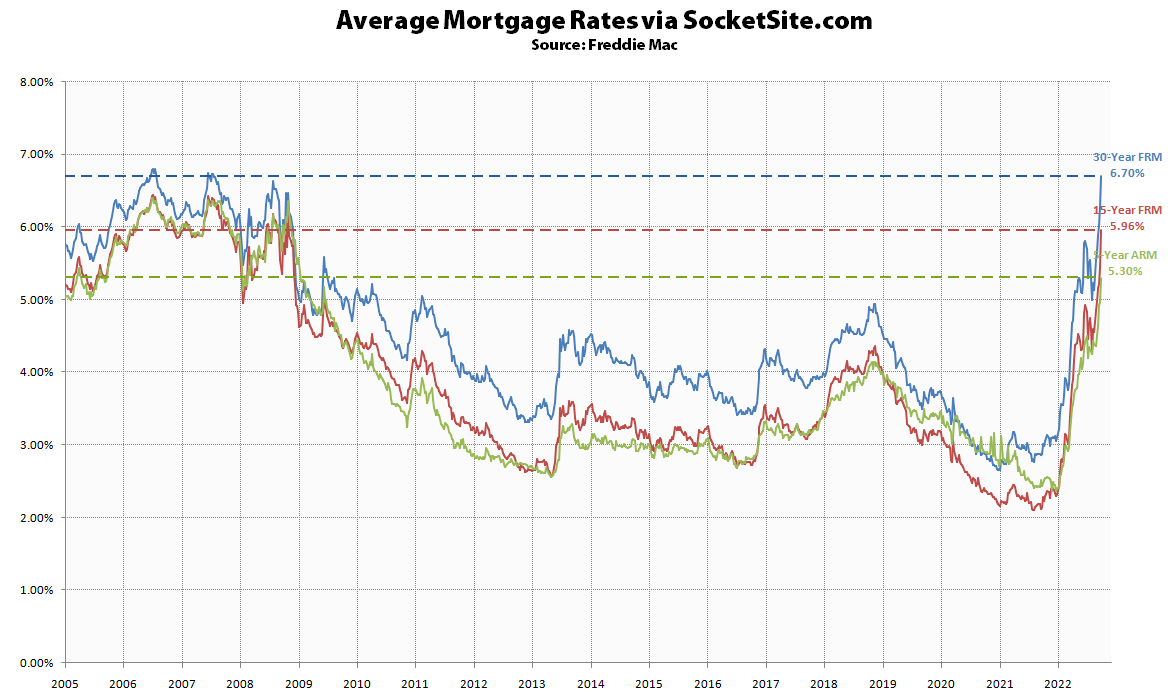

The average rate for a benchmark 30-year mortgage jumped another 41 basis points (0.41 percentage points) over the past week to 6.70 percent, an average rate which is 123 percent higher than at the same time last year, 153 percent above last year’s all-time low, and the highest average 30-year rate since mid-2007 and fast approaching a 20-year high.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) jumped to 5.30 percent, which is not only 114 percent higher than at the same time last year but double the average 30-year rate on offer early last year, with the probability of the Fed raising rates by at least another full percentage point (100 basis points) by the end of this year now holding at around 98 percent.

We’ll keep you posted and plugged-in.

UPDATE: While the average rate for a benchmark 30-year mortgage inched down 4 basis points (0.04 percentage points) over the past week to 6.66 percent, it remains 123 percent higher than at the same time last year, 151 percent above last year’s all-time low, and within 14 basis points of a 20-year high.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) has inched up another 6 basis points to 5.36 percent, which is 113 percent higher than at the same time last year and more than double the average 30-year rate on offer early last year, with the probability of the Fed raising rates by at least another full percentage point (100 basis points) by the end of this year having ticked up to 100 percent and mortgage application volume having plummeted.