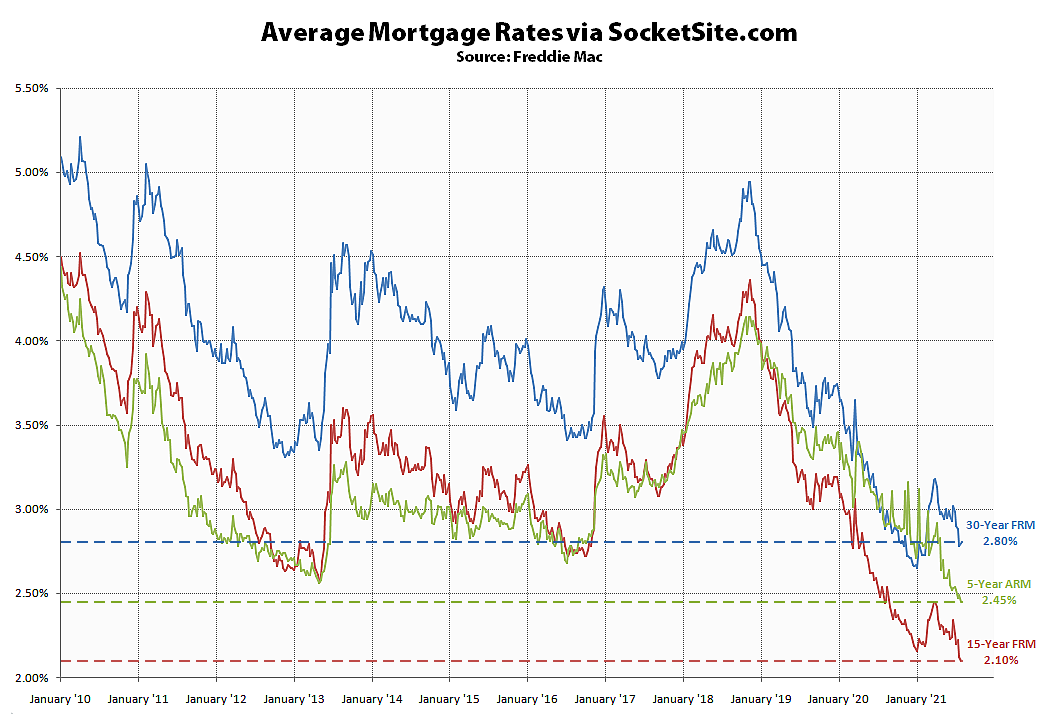

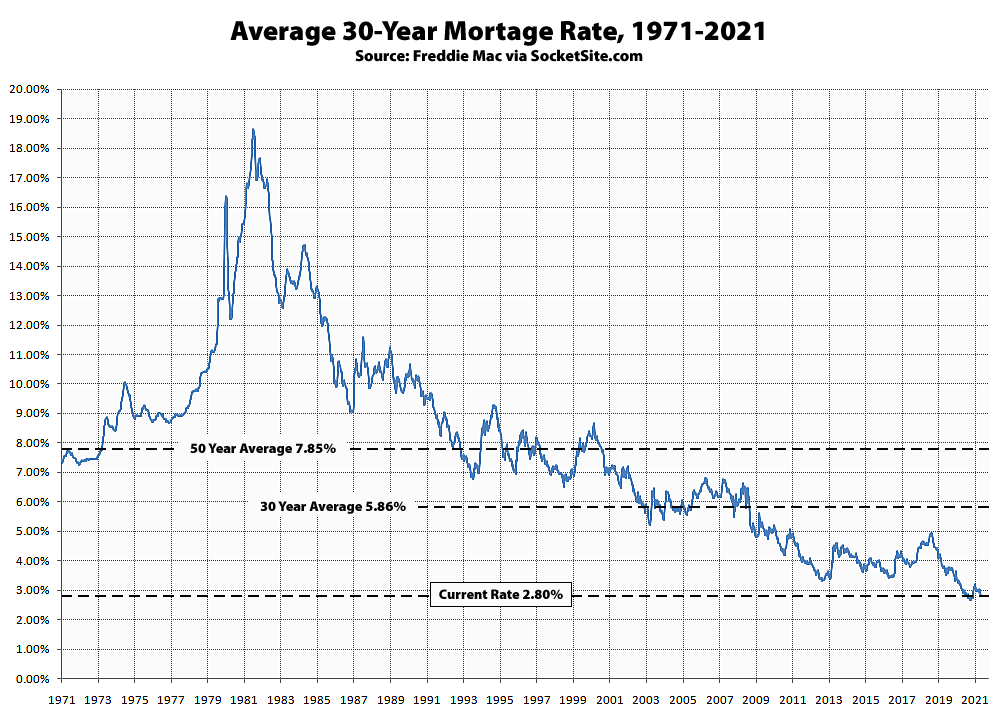

While the average rate for a benchmark 30-year mortgage inched up 2 basis points (0.02 percentage points) over the past week to 2.80 percent, it remains 19 basis pointsd below its mark at the same time last year and within 15 basis points of its all-time low rate of 2.65 percent recorded in January.

At the same time, the average rate for a 15-year fixed-rate mortgage, which has dropped 35 basis points over the past four months, inched down 2 basis points over the past week to 2.10 percent, which is 41 basis points below its mark at the same time last year and an all-time low.

But once again, despite the marked drop in rates, purchase mortgage activity is down 18 percent on a year-over-year basis in the U.S. to a 14-month low.

I’m going to retry a question I asked years ago but did not get a satisfactory answer. Are there any negative effects to the USA economy of holding interest rates low for such a long period of time? I don’t think there is a historical precedent, at least not in the USA. This is assuming that the Fed is intentionally influencing interest rates to remain low.

I think you can infer that the inflation in housing prices is the main driver of the reduction in labor mobility, which in turn is depressing GDP growth below its potential levels.

Thanks. That makes sense. And it follows that housing inflation can lead to inflation across other markets.