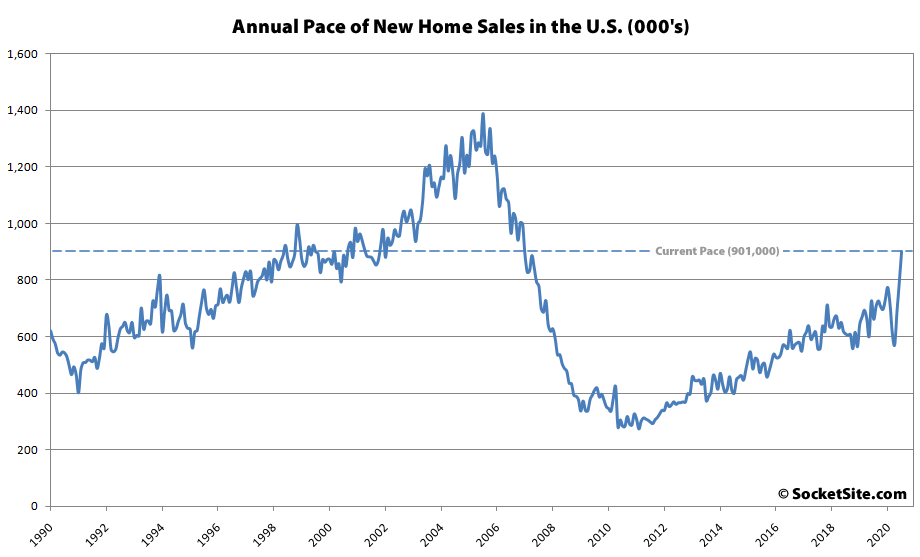

Having rebounded in June, the seasonally adjusted pace of new single-family home sales in the U.S. jumped nearly 14 percent in July to an annualized rate of 901,000 sales, which was 36.3 percent above its pace at the same time last year and the highest pace in 14 years.

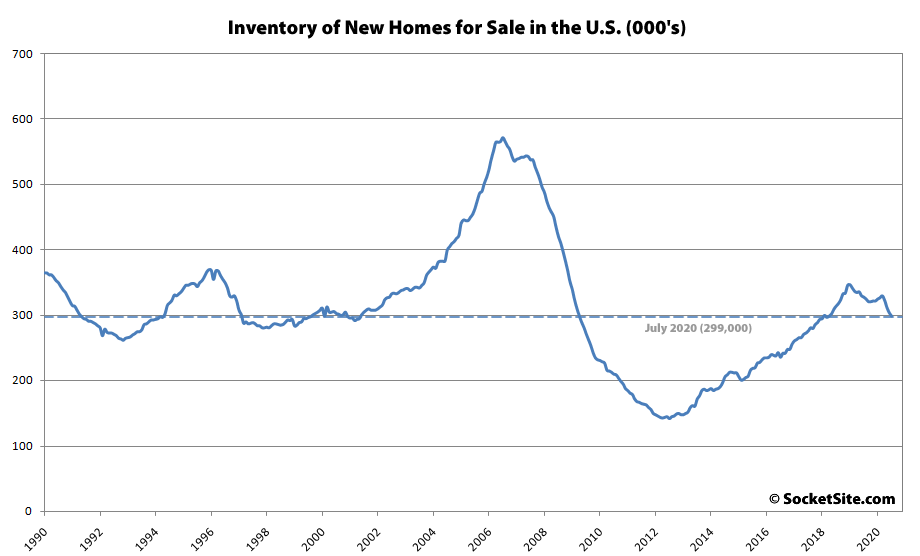

At the same time, the median price of the homes which sold last month ticked down 1.9 percent to $330,600 but was still up 4.8 percent on year-over-year basis, driven by an increase in the share of lower-end sales, while the inventory of new single-family homes for sale across the county ticked down 1.6 percent to 299,000 homes, representing 8.8 percent less inventory than at the same last year (which is a stark contrast to inventory levels in San Francisco).

Nonsense! San Francisco properties are still appreciating. Case in point: 219 Brannan Street 17K (name link) purchased for $1.76M [in September of 2000] just sold for $1.89M. After selling fees and taxes, they made almost (Dr. Evil Voice:) ten *thousand* dollars.

Of course, the whopping $500 per year they made each year was offset by the inflation loss in value of their downpayment when they got it back, resulting in a net loss of about $50K on a 20 year hold.