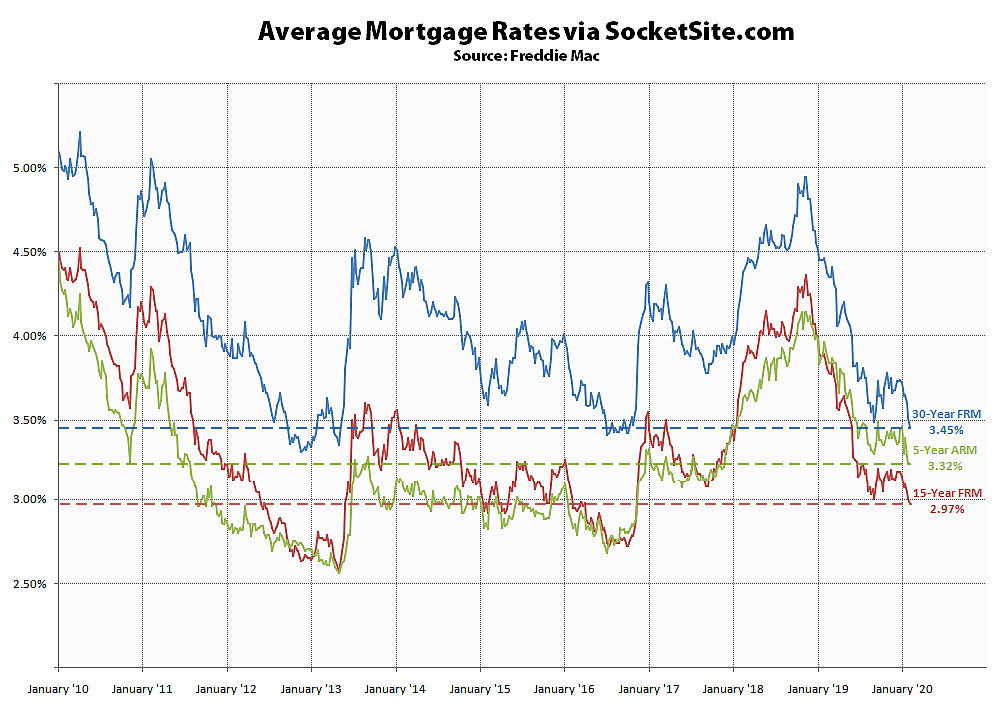

Having dropped another 6 basis points over the past week, the average rate for a 30-year mortgage is now down to 3.45 percent, which is 96 basis points (0.96 percentage points) below its mark at the same time last year and the lowest average rate since the fourth quarter of 2016, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched down another 3 basis points to 2.97 percent, which is 87 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable has ticked up 8 basis points to 3.32 percent, which is 59 basis points below its mark at the same time last year with an increased inverted spread of 35 basis points between the 15-year fixed and 5-year adjustable rates.

And while the Fed had signaled its intention to leave the federal funds rate unchanged over the next year, and then to start raising the rate in 2021, the probability of another rate cut by the end of 2020 remains around 80 percent, with a zero (0) percent chance of a hike, according to an analysis of the futures market.

As always, look at 10 year Treasuries, not whatever the Fed may or may not be “signalling.”

Mortgage rates are going lower.

If the economy is as good as the asset prices are suggesting, why are we not at 7% rate?

Because consumer inflation is still low and will remain so until wages increase a lot. We raise rates to prevent inflation and we lower rates to prevent unemployment. We’re still not fully employed – too many workers on the sidelines.

That’s amusing, but “we” don’t do anything of the sort. The Fed’s dual mandate is a myth to pacify the rubes; the Fed _will_ raise rates to curb inflation when it eats into bank loan profits, but it never lowers rates or keeps rates low for the sole purpose of decreasing unemployment.

Unemployment is currently lower than it’s been in FIFTY years. True, the current methodology includes part-time work, gig jobs, and drops job seekers after two years of searching, and most of the new jobs are poor-paying service jobs, but by the Fed’s measure, we’re close to or at full employment and we’re still within spitting distance of ZIRP.

A better answer to ST’s question is that this is an extended engineered asset bubble. Raising rates would end buybacks and slay the unicorns, and crush other assets like real estate. The billionaires who call the shots would lose a lot of wealth. That is the reason why interest rates are still so low.

Great conspiracy theory – thanks for taking a break from zerohedge to enlighten everyone. What about the religion of the billionaires who control everything? Is there anything more you want to add?

You’ve missed the point that rates will stay low until we see consumer price inflation which will need the support of wage inflation to blossom into a problem. We’re not there yet.

You’re both missing the point about negative interest rates in 1/3 of the fixed income market. Say the Fed decided to raise US rates, how would that affect the $ and economy? Also remember to factor-in stealth/quiet QE.

Look toward Japan, and you’ll see the future of the rest of the world.

In case anyone forgets, Japan’s stock market is STILL 30% below their 1990 level….

1990 is the wrong starting-point for Japan. Research the evolution of BoJ policy, and resulting gains in NKY.

@hundo – You raise several questions and then tell other people to go do research. What’s your point?

Negative interest rates around the world are the result of central banks racing to the bottom to spur their own economies, along concentrated savings (institutional asset holders) and a dearth of safe return investments.

Japan may be some kind of precursor, if only to demonstrate that low rates can persist for a very long time (without any band of hypothetical nefarious billionaires pulling the strings). But Japan’s demographic profile is also different than the US. Do you think the US is going into a huge downward spiral like Japan in the 90’s? What is your point?

Point? Refer to the graph below that I posted two days ago. Interests rates aren’t “supposed” to be whatever they were when you learned to calculate NPV. Interest rates have been heading lower for centuries, Japan, through their discovery of QE (thanks P.K.), learned to accelerate the trend. Rates (and proxies) will go far lower for far longer than most people expect. We live in a world awash in liquidity, and little suggests that will change any time soon, if ever.

(and Editor, the Fed doesn’t set interest/mortgage rates…influences from Mr. Market play a far larger role. But believe what you will.)

The editor said nothing about the Fed controlling mortgage rates nor did anyone else say where rates “should be.”

I agree that interest rates may remain low for an extended period. By all accounts they have been low for a long time. We are gradually aging out of the Biden/Trump generation of leadership for whom the inflation of the 1970’s and 80’s was a formative experience. People in charge will take a lack of inflation as the normal state of the world. So things will keep going lower until they don’t. Venezuela and Zimbabwe have both experienced hyper-inflation in recent years. Of course those are silly countries led by amoral autocrats bent on self-enrichment. (..Insert joke here..)

But the inflation won’t really start until wages start going up a lot, which I said at the outset. If we really are at full employment, broad wage increases are the next likely step to keep the economy growing. Let’s see what happens. Assuming the economy will continue indefinitely in the same state has not historically been a very safe bet.

Did you read that article? Even if you believe that they are accurately representing interest rates from 700 years ago, they downtrend they found was tiny.

“Today’s graphic from Paul Schmelzing, visiting scholar at the Bank of England (BOE), shows how global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) throughout the past eight centuries.”

That’s 1.9 hundredth of one percent per year.

Why not 0.19%?

What an interesting graph!! Of course I won’t believe it for a minute – at least not until I’ve seen a few knowledgeable/thoughtful people’s critiques of it – but I can’t but help admire the chutzpah.

As this site has been dipping its toe in the macroeconomic pond, consider this:

The U.S. has a strong labor market with weak economic growth. That’s due to low productivity growth, caused by a shift to low value-add jobs. Low productivity growth leads to low rates, and low wage growth leads to low inflation expectations. All this helps explain low Treasury rates, and suggests we could well see these low rates continue much, much longer.

Rate increase, schmate increase, ain’t much going to be happening with interest rates for awhile until this CoVid2019 is under control. If rates go anywhere it’s most likely down. World GDP is going into a tailspin for the foreseeable future. Chicoms have pretty much guaranteed that one, can you spell Pandemic?

Rabobank saw China’s “dialectic that has no comfortable Fichtean synthesis to the thesis and antithesis” and concluded that “things are going to get nasty for economies and markets – especially with official WHO word that a vaccine is 18-months away.”

Today: “Jennifer Zeng reported that a company in Suzhou reopened, and immediately at least one CoVid2019 case found. As a result, the company’s 200+ employees couldn’t go home and were immediately placed under quarantine…”