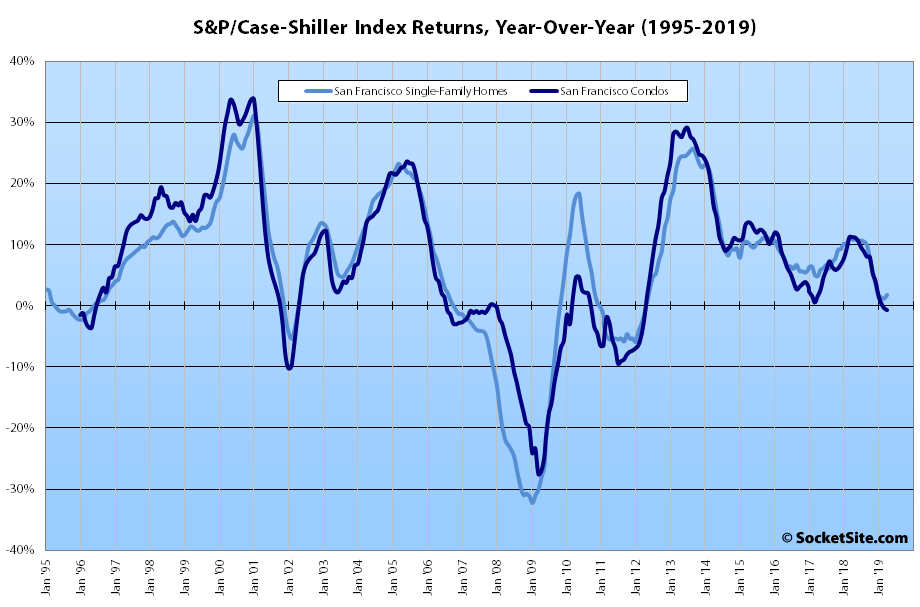

Having ticked up a downwardly revised 2.0 percent in March, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up 1.6 percent in April.

And while the index remains 0.4 percent below its peak in the third quarter of 2018, it’s currently running 1.8 percent above its mark at the same time last year and is up 4.2 percent since January.

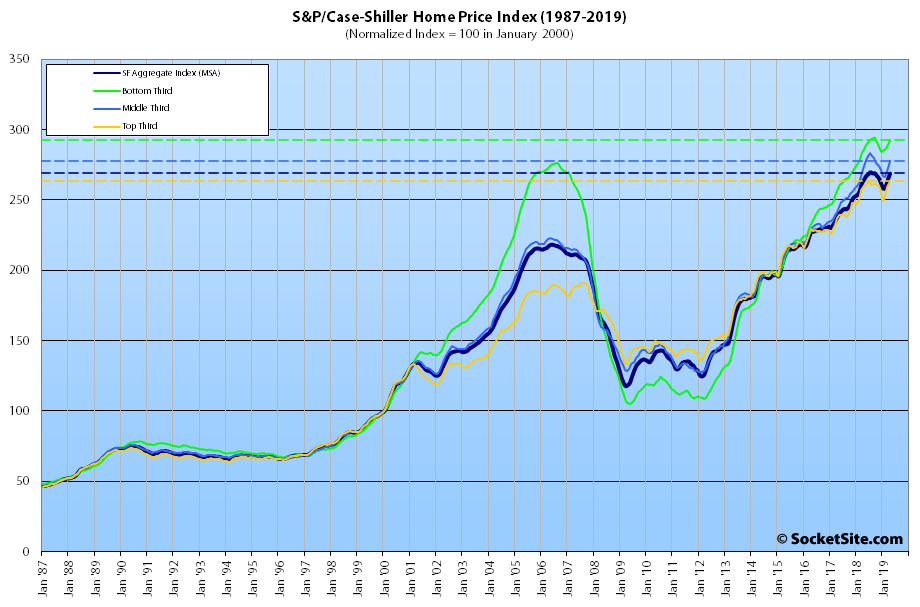

At a more granular level, the index for the bottom third of the market ticked up 1.6 percent in April for a year-over-year gain of 2.3 percent (versus a year-over-year gain of 11.0 percent at the same time last year). The index for the middle third of the market jumped 2.7 percent in April for a year-over-year gain of 2.0 percent (versus a year-over-year gain of 12.8 percent at the same time last year). And the index for the top third of the market ticked up 1.6 percent in April for a year-over-year gain of 1.5 percent (versus a year-over-year gain of 9.4 percent gain at the same time last year).

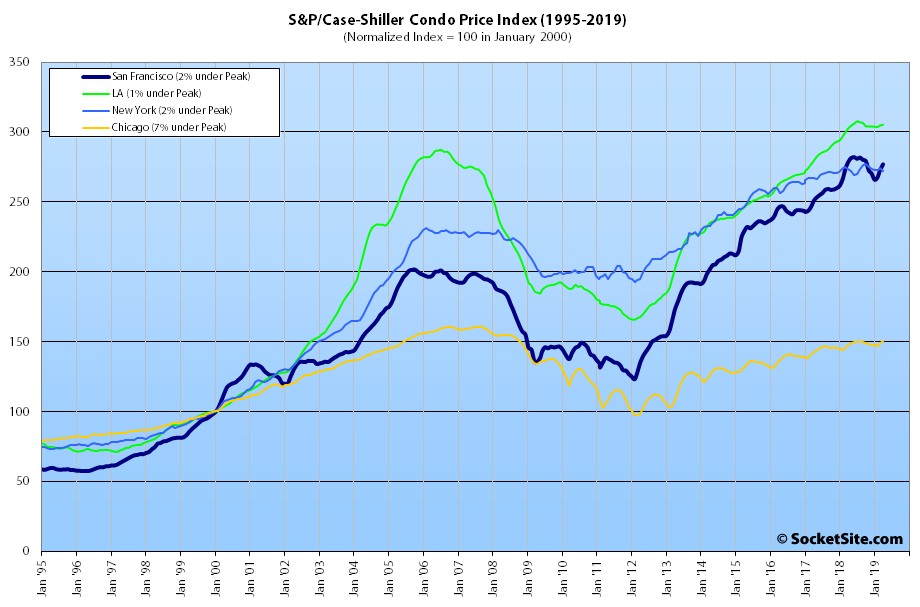

And while the index for Bay Area condo values ticked up 1.5 percent in April, it’s down 0.7 percent on a year-over-year basis and 1.8 percent below its peak in the second quarter of last year.

As we first noted last year, Las Vegas is still leading the nation in terms of home price gains, up 7.1 percent on a year-over-year basis, versus a national average of 3.5 percent, followed by Phoenix (up 6.0 percent) and Tampa (up 5.6 percent).

And at 1.8 percent, San Francisco ranked fourth to last in terms of year-over-year gains for the top 20 metropolitan areas in nation, outperforming Los Angeles (up 1.5 percent), San Diego (up 0.8 percent) and Seattle (the year-over-year gain for which dropped to 0.0 percent in April).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Seattle dropped? I would be interested to hear Dave’s reaction to this.

they built a lot more housing, and more supply helps ease prices. pretty simple, right 2 beers?

Well, he always predicts that SF Bay Area RE prices will follow inflation whereas the Seattle RE market will appreciate much more rapidly in the coming years.