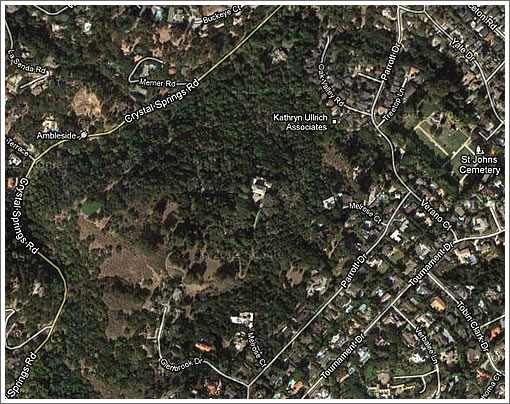

The 16,000-square-foot mansion above was built in 1918 at the center of the 47.5-acre de Guigne estate down in Hillsborough, at the end of Glenbrook Drive.

In 2002, testimony in a divorce case estimated the value of the estate at between $15 million and $30 million. And in 2009, a proposal by Christian de Guigne IV to subdivide his estate and build 25 new homes upon the property, versus 10 new homes which the town’s general plan would appear to principally allow, was floated but never came to fruition.

Mr. de Guigne has just put the property on the market for $100 million but doesn’t plan to move, he plans to retain a life estate in the property, maintaining its exclusive use during his lifetime, a little like Lord Grantham. Mr. de Guigne is 75.

Full Disclosure: The listing agent for the de Guigne estate advertises on SocketSite but provided no compensation nor information for this post.

In Paris, there are always apartments for sale under these terms, called a “viager” But you get a big discount for the fact that you are stuck with the former owner for life. He could easily live 20 years.

This is a fishing expedition.

Can anyone who’s watching Downton Abbey on TV tell me if the socketsite editor just minorly spoiler-ed Season 3 for me? I’m watching it at least a season and a half back on DVD.

Or maybe this was just one of those things that came up on Season 1 and I didn’t retain it (I’m not watching the edited-for-americans version).

Anyway, since the buyer won’t have use of the home or land, this is like futures trading for high-end real estate, no? The buyer is going to essentially bet — big time — that the property will be worth substantially more than the inflation-adjusted value of $100 million, plus opportunity costs, in twenty years time.

[Editor’s Note: No spolier. The entail has been central to the story since episode 1.]

Besides the Flood Estate, is there anywhere else on the Peninsula where one can buy so much land? It seems like these massive estates are becoming a thing of the past (sadly).

Oh to be alive in the Gilded Age. Then again, as my friend said: if you’re not rich in the Gilded Age, it’s probably going to suck.

Well, Paris viagers are my specialty actually…

Viagers can be of a 3 main types:

– 100% upfront payment and no annuity: you pay the purchase amount without anything due later. The seller keeps the usage of the place all his life. depending on the age of the seller, the purchase amount can be 60 to 80% of the estimated market value.

This is the case of the Hillsborough property.

– Standard viager: you pay a purchase amount but still owe a monthly “annuity” to the seller for all his life. The seller gets to keep the use of the place. Depending on the annuity, the purchase price is usually 30 to 60% of estimated market value.

– “Libre”: you pay the purchase amount and a monthly “annuity”, but have full enjoyment of the place at the time of purchase. You do not fully own the place until the seller passes away. They are usually 40 to 70% of estimated market value.

I purchased a 2/1 “viager libre” property more than 10 years ago in Paris as a distressed sale (very very low upfront payment and token annuity set in 1998) and still own it. The place is rented out 9 months a year as a furnished corporate rental for more than 2X the annuity. I collect the rent and get to spend 3 month/year in Paris.

Free luxury crash pad. Best deal of my life. Not for everyone.

You could always buy the property and the tenant can live in the main house while you construct and build houses on the sub-dividied land. Migth actually make some money at it along the way.

Who would have the pleasure of paying the (perhaps substantially) upwardly adjusted property taxes, the buyer or the tenant? And would “exclusive use” of the property presumably include all the land as well?

Reminds me of the story Jeanne Calment, who made that same deal for her Paris apartment, and went on to be the longest-lived person ever. She died at 122 and outlived the guy who bought her apartment when she was 90. His Widow had to continue paying the annuity. He could not have predicted it of course.

UPDATE: A Peek Inside And About A $100M Hillsborough Estate

In the US, this is called a life estate. The seller will have full control over the property during his life. The buyer has essentially no rights to the property until the seller’s death, except to prevent the seller from ruining the property’s value. So, the buyer won’t be able to subdivide or do construction while the seller is alive.

If I were going to buy this property, I would mandate that the seller undergo a significant medical exam and history. I wonder whether the seller would be willing to submit to that indignity.

@Serge — there is also another of these estates in Hillsborough: Strawberry Hill, 50 acres sited at the end of Redington Road, quite near to the upper part of the golf course of the Burlingame Country Club.

UPDATE: $60M Price Cut For Hillsborough Estate, Seller Agrees To Move