The unemployment rate in San Francisco jumped from 2.1 to 2.7 percent in June as the number of people living in the city with a job dropped by 1,600 to 550,600 while the labor force increased by 1,600 to 565,600.

And while there are still 113,900 more people living in San Francisco with paychecks than there were at the start of 2010, the year-over-year grown in employment of 1,500 (0.27 percent) was the smallest since 2009.

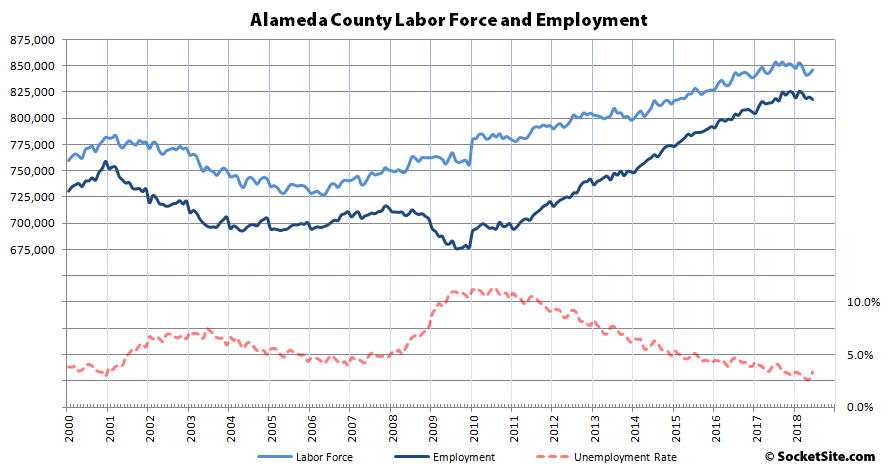

In Alameda County, which includes the City of Oakland, the estimated number of people living in the county with a paycheck dropped by 2,300 in June to 818,200, which remains 2,700 higher on a year-over-year basis and 125,400 above its mark in January of 2010 while the unemployment rate has ticked up to 3.3 percent.

Across the greater East Bay, employment slipped by 4,200 last month to 1,360,900 but remains 4,400 above its mark at the same time last year while the unemployment rate ticked up to 3.4 percent.

Up in Marin, the number of employed residents slipped by 900 to 136,300 which is 1,500 lower on a year-over-year basis and the unemployment rate ticked up to 2.6 percent.

And down in the valley, while employment in San Mateo County dropped by 1,500 to 438,700 in June, which is 1,200 above its mark at the same time last year, employment in Santa Clara County actually increased by 3,000 to a record 1,023,300, which is 18,100 more than at the same time last year while the unemployment rate ticked up to 2.9 percent with a seasonal gain in the labor force.

“San Francisco NEARS negative growth”? (emphasis added): given that a perusal of the charts shows several mos of (generally) downward motion, I’m correct to assume SS will hold off on calling this until there’s actually a Y-on-Y decline?

The chart above does NOT suggest that employment in SF is flat or declining. Just to re-emphasize as I have in the past, that chart say nothing about the trend in actual jobs in San Francisco, it only tracks employed residents. Those two are very different things. Employed residents could be declining while employment (ie actual jobs/workers) continues to rise. Jobs in SF are held not just by SF residents, but over 40% of them are held by residents of other counties. And over 20% of employed SF residents work outside of SF. Employed residents and employment are apples and oranges.

I think the chart includes the 20% of SF residents that work outside the city. Given that this is a real estate site, I think the idea is that the chart captures all the people who work for a living and are (presumably) in the SF housing market as renters or owners.

I disagree: it very definitely “suggests” it – particularly given similar declines in other areas from whence SF employees may come, and the fact that – if your numbers are right – 80% of working SFn’s work in SF; it doesn’t “prove” it.

There is always some seasonality in this charts. E.g. employment tends to spike up in September once recent graduates move to the city to start their first jobs.

The Bay Area saw a net loss of 5200 in terms of people employed and in the labor pool. For contrast, the state of Washington saw a non-farm gain of 4100 – most of those job gains in the PS area. Washington has a population similar to that of the BA. People in the labor pool living in SF/the Bay Area with no job have a tough row to hoe and likely will move out of the area if they don’t find work relatively quickly. And that goes to the anemic population growth in the BA. The increase in residents in SF is slowing and could turn negative as those in the labor pool w/o a job leave the area to find work.

Slow population growth and stagnant (if not decreasing) job growth are two red flags for RE investors as they evaluate building/investing in a region. Those are key factors which portend limited upside profit potential on a project. Add into that the surging construction costs and one has the situation now occurring in SF where entitlements (including major ones) are being abandoned/put up for sale. Projects no longer pencil – the reason Avant backed out of their 1270 Mission residential high-rise. There are a number of markets much more lucrative for developers/investors at this time. The slowdown in new project proposals in SF tells the tale.

Your calculations are incorrect. While Bay Area employment dropped by 5,900 from May to June, the labor force actually increased by 18,200. And on a year-over-year basis, the labor force has inched up by 7,500 while overall employment increased by 23,700.

Yes, I miscalculated. Employment dropped by 5900 and not 5200. As noted the YOY SF jobs increase of .27% was the smallest since 2009 and the overall BA YOY increase of 23,700 was sluggish. Looking at the graphs one question is will SF see flat job numbers for the next 8 years (with intermittent ups and downs) as it did from 2002 – 2010. Developers and banks lending them money for projects are looking at this data, and other data, and basing development/lending decisions on it – didn’t the One Oak developer abandon the project as they couldn’t get financing? It appears the BA could be in for a prolonged period of economic stagnation and be too risky – not pencil at this point in time – for many institutional and private investors.

San Francisco/Oakland/Hayward received 1/3 of all venture capital in America in 2016, plus another 10% in San Jose, the evidence seems to show that the BA is doing well enough.

Venture capital ranking does not correlate with job or population growth. Seattle is growing jobs and population much faster than the BA and it is lower on the VC rankings. Cincinnati isn’t even on those rankings and yet last month added 9000 jobs (greater Cincinnati).

The claim was “the BA could be in for a prolonged period of economic stagnation and be too risky – not pencil at this point in time – for many institutional and private investors”. While that may be your opinion, venture capitalists, who are all private investors, don’t think so. The BA is receiving almost half of all VC money in America.

On the other hand, when the BA economy can be believably compared to the Cincinnati economy, our real estate prices will plummet.

“San Francisco/Oakland/Hayward received 1/3 of all venture capital in America in 2016”:

IOW, much, if not most, of the Bay Area tech economy is based not on profits, but on speculation. Meanwhile, over the last two years, the flow of venture capital into the Bay Area has gone from a torrent to a trickle. Crazy thought experiment here, just going out on a limb: how might the closing of the VC spigot affect local real estate?

I don’t think there’s any doubt that closing the VC spigot would be terrible for Bay Area real estate. Fortunately, that hasn’t happened: Bay Area still dominates U.S. venture capital industry but cracks may be showing.

Increasing by 13% is a torrent to a larger torrent.

I think you can argue it both ways. The Google, Facebook and Apple plus others are very very profitable businesses with a huge pile of cash and thousands of employees. These companies are way beyond speculation, keeping adding jobs in Santa Clara and solid performers that stand up to any other company in the county.

On the other hand, you definitely got your share of businesses that suck up VC based on speculation and a hope that somehow they find a paying business model or convince enough people that they do to go public. In that regard, I think the region benefits hugely from the speculation more so than any other region. You certainly don’t see it in St Louis or Cleveland.

Maybe another way to argue is that San Fran is at its max in infrastructure to support anymore people coming into the city for jobs (Caltrains still isn’t electrified & BART still needs a lot more new cars for either to create additional capacity0 and you wonder how Santa Clara can keep up the trend where as Oakland & Tri-Valley will simply bump along until more square footage for more jobs is built out (Oakland has the lowest office/commercial vacancy in the country)