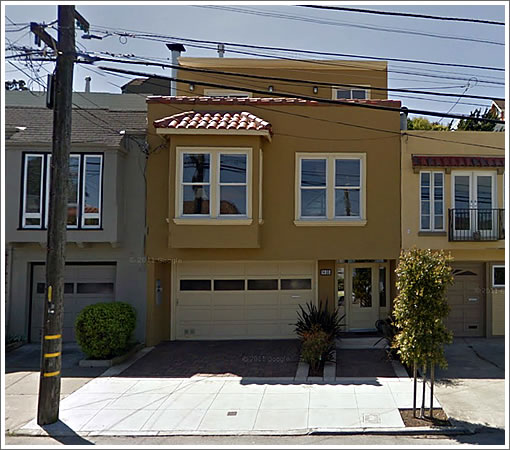

Listed for $2,195,000 in 2008 and $1,895,000 in 2010, the single-family Noe Valley home at 1430 Diamond has returned to the market in 2012 listed for $1,795,000.

In general, the smaller the home the higher the price per square foot, and at 2,900 square feet, 1430 Diamond is well above the neighborhood average. That being said, having been listed at $619 per square foot in an area when the average home is currently trading at closer to $900 per square, a reader can’t help but wonder if this is another example of pricing well below market to generate traffic (while “wasting a lot of people’s time and attention” and “breaking many hearts”).

With the observer effect now in play, if you think you know Noe, now’s the time to tell.

∙ Listing: 1430 Diamond (4/4) 2,900 sqft – $1,795,000 [1430diamond.com]

∙ Have You Heard The One About The House With Over 50 Offers? [SocketSite]

Sue Bowie seems to be successful, why does she use such a crappy website for this? Is that kind of thing just a low priority in the agent world?

This is a very different part of Noe Valley. Though prices are inching up there as well, I doubt they’re at $900 psf yet. I agree with the point that $619 psf is low for this mini-hood; I would put it generally at $700-800 psf (though on the lower end for a larger place such as this).

Yes, I would essentially agree. It’s certainly pushing the “boundaries” of NV..more like Diamond Hts. perhaps to some.

Pretty ordinary remodel.

2.35m-26 offers

^^^

Noe is only hot, hot, hot. It is not hot,hot,hot,hot,hot,hot,hot.

$1.925M

not the nicest weather in noe and not a quick walk to dolores, the google bus, or the j church; remodelled but not luxe, i’ll guess 2010 price was right but financing was tougher then…$1.895MM

Average staging by a student in design school, no curb appeal, average rooms, surrounded by average homes. No accounting for taste.

into contract on may 25…just 2 weeks on market

no inside info on the deal, but i’ll guess $2.175mm (roughly $750psf), 15 offers

Closed at $1,775,000 6/25. I guess the poor location, essentially Diamond Heights not Noe Valley, did it in.

Uh oh. We saw this at the end of the last bubble.

Sold for under *every* estimate.

Re: number of bids as a general topic.

I caught up with a friend who put in a bid on a SFH three months ago and it kind of confirmed what I had suspected about the number of bids on a place– it doesn’t mean that much. They bid on a place in Noe at a price where they thought it really limited downside to them if they had to sell in the next five years. They didn’t “win”– weren’t even close actually. But despite this, they don’t have active plans to move from their rental unless a place represents really dramatic compelling value vs the rest of the current market. They have a nice 2BR which is small for them but have an amazing deal with rent control. They may live there for years without buying a place.

If a house is intentionally “underlisted” and it gets 40 bids, then you are told that there are 39 unsatisfied buyers who are dying to buy a house as proof of the hot market. Some people will bid if they feel it represents a very good value vs the current market, but otherwise don’t intend to buy.

I see the rationale for listing a place at a very “under-listed” price. It generates hype and the buyer is at the mercy of hearsay through their broker. If a buyer thinks there are a lot of other people bidding, it not only gets one or two people to bid higher than might make sense, but it reinforces their psychology that they are buying something of value because so many other people want it too. I read a study about the psychology of auctions. It was different because it was examining the open auction process. An example was used of placing a relatively illiquid item with few “comps” on ebay at a “Buy it now” price and getting zero bids, but once they relist the item with an open auction and other people bid up the price, it trades for a higher price than the original “buy it now” price. People feel better if there are many other bidders– or even if they are just told there are many other bidders.

(I also never completely trust the numbers coming out about number of bids on a house, but that is because of personal bad experience several years ago.)

I think the large number of bid, apart from the occasional grossly underpriced trap, has to do with a new reality in the market.

2 years ago, some places were sitting on the market while still being under fair market value (or whatever we could call “fair” at the time, which is very subjective). This had to do with too few buyers chasing too many goods. They had very decent options and what would sell most was either quality or really low price.

Today this reserve of good deals is all but gone. We’re more in a seller’s market I think, and people who market their place at 2010’s price can sometimes attract more buyers than they expect.

“people who market their place at 2010’s price can sometimes attract more buyers than they expect.”

“Listed for $2,195,000 in 2008 and $1,895,000 in 2010”

“Closed at $1,775,000 6/25.”

More Bidders Sure

At a Lower Price

ReadingforReadingForRealtors,

You should practice what you preach 😉

I had my disclaimer in the “can sometimes”.

The lows of gravity still apply, no doubt. Still 1.775 freaking millions in Diamond Heights.

Problem is that busy street

and the rent-controlled tenant

and the bedrooms are not all on one level

and, you know, noe valley, which is a dangerous and crappy area where nobody wants to live

Get rid of these horrible flaws and you get WAY more than 619 a sq. ft. And these problems were all obvious, which is why everyone on this thread correctly predicted nobody would pay asking.

I did not risk an estimate

Crazy result. Who knew this would take such a beating?

“I think the large number of bid (sic), apart from the occasional grossly underpriced trap, has to do with a new reality in the market.”

That’s not my point at all. In any market, if you “underlist” significantly enough, you can get a large number of bids. My point is that realtors tout this “new reality” as proof that 40 bids = 39 desperate other buyers out there. That’s just not the case. A fraction of those 39 will go on to buy in the next year, but I bet it’s a much smaller fraction than people think. It is in the realtors’ best interest to overstate the meaning of the number of bids.

“New reality” to me implies a paradigm shift. While the market is better in recent months, the truth will be told in the long run. Btw, I’m not at all a housing bear for SF proper. I’ve been in the gray area for a long time now– I don’t believe the big bulls nor the big bears on here. I think we’ll have some ups and downs and some springs and summers where sales pick up a bit giving hope, but I also look at the incredible level of rates, a rental market that I think is incredibly artificially constrained right now “forcing” short-sighted people to buy vs rent, and I think– this is the best the market can do? It’s a better market than the last few years, but there are still SFH’s on and off the market without selling. I know realtors will say that anything that doesn’t sell is just a problem property and everything else gets multiple bids (sorry, “offers” in r/e parlance).

It’s funny how the predictions for this property were all above what ended up happening and now after the fact– it’s all excuses/rationalizations about how problematic this property/neighborhood is.

thegray,

still 1.775 freaking millions for what is basically a row house in Diamond Heights…

I was on the market between 2009 and 2010 and have seen tons of places. At the time I would laugh at the outlandish asking prices, and focus only on the places priced right and there were plenty.

I did my purchase in 2010 on a place that was starting to get stale and where cash mattered a lot. I cannot find today anything close price-wise in my neighborhood for a similar property (I am looking for another investment). The last good deals disappeared around December 2011. Maybe it’s temporary and maybe I am deluding myself that the market has turned. But my search for a second place to purchase is going nowhere and I am now shopping outside of SF.

lol,

a second place for what reason? You’re looking for a second place that is a single family home to rent out?

Rent out, or move in then rent out my current place. I am lucky enough to live in a place that can be cash-flow positive today.

This is what I did in another life. The fun never stops.

I haven’t seen any single family homes that I could buy and make money on the rent right away, are you seeing that? However, the rent of your current place and move into another scenario is something I am looking at as well. I haven’t found the right place at the right place yet for that move.

I think this place would cash flow right off the bat:

http://www.persicaproperties.com/San_Francisco/California/Homes/Inner_Mission/Agent/Listing_55567835.html

But it already has an offer. It might require a bit of work, too.

sparky,

That wouldn’t be a SFH at this point. I am not afraid of exotic financing like TICs. I only care about long term and cash flow. 15 years from now a TIC will be a condo and that’s a timeline I like.

Plus if you remember my first posts 4-5 years ago as SFS, my model was an aggressive 40 to 60% down with short term financing, like 5 to 8 years, shooting for 5. I am still doing that. I pick a no penalty prepayment option on an adjustable with 5 years fixed so that I can adjust the prepays to my abilities of the time and still get a low enough rate.

So far I am 40% paid off on my 50% financing from 2 years ago. I am on track for the 5 year target and the quickly shrinking principal makes it easier as the interest part is now less and less.

Another nice thing about this is that every penny I put into prepay is similar to an investment at 4%+. I find it a great way to put your savings in these uncertain times. Investment subject to termites and earthquakes that is…

As always, my plans never include appreciation. If you have to have it to make this work, this is not a good plan. There are too many unknowns to make you trip.

Your mileage may vary.

Great thanks.

‘still 1.775 freaking millions for what is basically a row house in Diamond Heights…’

We’re actually not that far apart in our views. I know the market is doing better these last few months. I don’t know what the future holds at all.

My point was just about the whole “number of bids on a house” issue and how it is mis-interpreted and misrepresented.

My second point is that– before a house sells, people may or may not submit their guesses. But if it sells for over expectations, then it is proof that the market is crazy hot. If it is a “disappointment,” inevitably after the effect people call it things like “a row house in Diamond Heights.”

I think the market doing better is a good thing from both sides as it should bring out latent sellers as well.

Yeah well flesh it all out. A few people who didn’t bother to guess turned up to gloat and draw conclusions as if it was a ruinous indicator, or something. Blah blah busy street blah — ignoring the factors they surely realize about the property. When bullish posters pull that sort of move in reverse the Ed tells ’em off with his bracketed comments. Typical.

Yes, how dare anyone comment who did not make a guess!! Ken, what was your guess again? I can’t find where you noted the obvious “factors” and predicted a below-asking sale.

Bottom line is that this, yesterday’s CSI numbers, and loads of other examples show there is no re-blown bubble. SF picking up off the bottom a bit? Yeah, maybe, along with the rest of the country due to insanely low mortgage rates. But no frenzy.

Agreed, no re-blown bubble. Just the market picking up after a strong dip.

Bottom line is since you’re so incredibly childish and rude to start with, you’re not good enough or knowledgeable enough for anybody to pay attention to, anon. That’s the bottom line when it comes to your hobbytalk on here. Guess I missed this one. I often guess, though. You, you say like five things over and over again because you’re a troll who can’t.

OK, I’m a troll who can’t. Uh huh.

@sparky-b You are planning on renting out your current house and buying a new one to live in? This makes sense for a lot of reasons, mostly because of the lower cost of financing.

My original plan back in 2000 was to buy a two unit house, live in it for a while, and then buy a larger SFH when the time is right and keep the first place for rental income. Home prices have gone up more than I expected since then, so it would be a stretch to buy the second place, at least in the same area as I live in now.

Since then I have started thinking more about investment risk and have decided that for me at least, owning two $1M+ properties in the same city is not really a good idea. One good earthquake could make a mighty whack in my net worth. And I don’t really work in an industry where “just work a few more years until retirement” is a choice for most people. I might be an exception but I am not counting on that. My wife can always keep working but she might not be too happy about that.

Have you considered the risks of portfolio over-concentration in your decisions? I know you are an expert on the industry so the risk is lessened for you but it is still there.

^^^ sparky set the bar pretty high when it came to financing. What’s your current rate, by the way?

“[investment risk: owning two $1M+ properties in the same city] is not really a good idea.” Very much in agreement.

NVJim,

Yes we are looking to buy a house to live in and rent out our current house, or at least that is one scenario we are looking at. That has been in play for us a long time now, but we haven’t found the right house to make us move.

I am also looking at buying units to hold and rent out. I like that play, make it cash flow positive, pay it off before retirement and it is a nice monthly check that keeps up with inflation.

I have 3 houses in the city right now (or really part of 3 houses), I don’t really worry about what will happen if there is a big quake. If I had that worry on-going I wouldn’t be in a position to buy a new family home.

My mortgage rate is 2.6% on my house, so I wouldn’t be getting a better rate at the new house but I would be getting another good one.

sparky-b, And to think I was concerned about your Zillow value being flat from purchase price. I still worry about you, though; for heavens sake, refi into a fixed rate product (do you still cash flow at 7%?)

For an industrious person like you, I would think an RH-2 rehab or build out with condo conversion would be a good bet. Recent tax code changes have knocked a bit off on the profit side of things on the second unit, but you’re looking at $250k tax free on the first unit ($500k if married) if you inhabit for two years. The de Vitos seem to have played that game well the past decade.

EBGuy,

#1) I guess it is nice for people to be concerned for me, but looking at my house value is a bit creepy.

#2) Zillow estimate, really. Those values have no value.

#3) I don’t see the value in refi for a fixed rate. If rates started moving up right now (which they won’t) it would be about 8 years to equal out on the refi cost if rates go to 7% or so. The refi would be a new 30yr. so I would have years of extra payments. I don’t know if I will live here in 5 years so it is not worth it to me.

#4) Yes it would cash flow at 7%.

#5) I am not moving into a condo/rehab situation again. The de Vitos did it with houses, which I have done as well and I might sell this house if we move for the tax free money. That is an option it depends on many factors, a big one being if we have a rental property or not at the time.

Interest rates aren’t going anywhere anytime soon.

Certainly not anywhere close to 7%. At least, not for the foreseeable future.

Who knows, though. Maybe Mitt Romney will nominate Peter Schiff to be Chairman of the Fed. We’d get to seven percent pretty quickly if that happened.

LOL!

456 27th Street, a probable teardown, just went for $1.12M, 41% over asking. Does anyone know how many offers it got?

http://www.redfin.com/CA/San-Francisco/456-27th-St-94131/home/1249017

This isn’t even a very nice block, imo. The market is getting kind of crazy again.

And 1612 Church, went for $930k, 33% over list.

I believe that the hysterical preservationists have caused the peculiar situation that the less interesting a small house is the more it is worth as a tear-down.

Curiouser and curiouser!

^^^ NVJim–one stat the perennial bulls may have missed: if you look at the details for 456 27th street and note it was only 693 sq ft, a sale at $1.12mm implies $1600+psf. Looks like NV has surpassed PacHts as the priciest SF hood!?

On a more serious note…I’ve been somewhat amazed at the lack of “real SFH” listings/sales (say houses with at least 3BR’s) in the NV core in recent months. If you arbitrarily take the ‘core’ as any place below Douglass from which you could roll a ball down hill and have it end up at 24th street (so the collection of ~8 listings just over the hill to the south and perhaps more DH than NV don’t count), you really haven’t had more than a sale or two in the last quarter. Makes you wonder if/when more inventory in the core will come online…and where something within walking distance to the shuttle stops will price out. Maybe people are waiting until after the FB lockup expires later this year?

The lack of inventory is citywide and very puzzling. I can’t figure it out.

The lack of inventory can easily be explained by Prop 13. How long is the former site of @home going to be vacant? The current owners can afford to live in denial because no one will force them to rent at the market rate. Given that no one is paying market rate property taxes, the city will continue to be subject to unused buildings and low transaction volumes because property owners can afford to do nothing with their lots while they wait for prices to rise.

Why now though? We have less than one month’s inventory of SFH, the lowest I have ever seen. Maybe everyone really is holding inventory off market, expecting prices to rise.

Yes, from my anecdotal discussions with owners, they are not going to budge until prices are where they want them to be. There is a reason why housing downturns are periods of low transaction volume while stock market falls are periods of high volume. One asset is marked to market whereas the other is marked to desire.