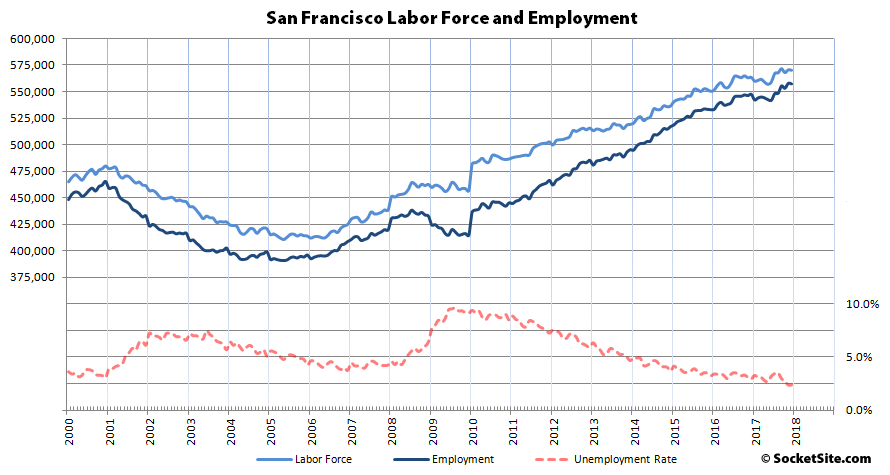

While seasonal hiring typically ticks employment up at the end of the year, the number of people living in San Francisco with a job slipped by 500 in December to 556,900 while the unemployment rate held at a record low of 2.3 percent as the size of the labor force atypically slipped as well.

That being said, there are still 91,400 more people living in San Francisco with paychecks than there were at the end of 2000, an increase of 120,200 since January of 2010 and 9,700 more than at the same time last year.

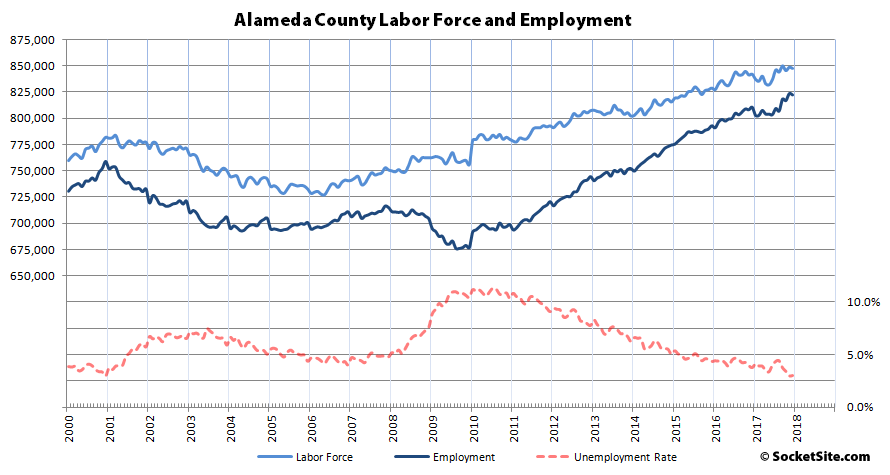

In Alameda County, which includes Oakland, employment slipped at the end of the year as well, from a record 823,900 in November to 822,600 in December but remains 11,700 higher versus the same time last year. And as such, while the unemployment rate inched up from a record low 2.9 to 3.0 percent there are still 130,600 more people living in the Alameda County with paychecks since the beginning of 2010.

Across the greater East Bay, employment slipped by 2,400 to 1,367,500 while the unemployment rate held at 3.0 percent and within 0.1 percentage points of the 2.9 percent record low set in December 2000.

Up north in Marin County, the number of employed slipped by 900 to 139,500 and the unemployment rate inched up from a record low 2.2 to 2.3 percent.

And down in the valley, while the unemployment rate in San Mateo County held at a record low 2.1 percent the number of employed residents slipped by 600 to 447,300. But employment in Santa Clara County actually increased by 2,800 to a record 1,017,700 while the unemployment rate held at 2.6 percent which is within 0.2 percentage points of the county’s 2.4 percent record low set at the end of 2000.

There is a demographic shift right now with the millennial generation cohort, they recently passed the peak renting years, and are moving into the peak homebuying years. The generation behind them is much smaller.

Meanwhile, SF has built a ton of new rental units, and is among the worst cities for homebuyers for a multitude of reasons, not just affordability but also the hassles. Since demographics is destiny, I think we might be looking at peak SF for now.

Airbnb, Uber, Lyft, Dropbox, Stripe, Coinbase, Square, not to mention Google, Apple, Facebook.

SF’s economy is going to go up. We’d best plan for it.

Although those companies may be poised for additional near term growth, that doesn’t necessarily translate to upward pressure on SF residential real estate. I know lots of people who lived in SF until their 30s then moved to the burbs when they got married/had kids, now they commute. That’s where the millennial bulge are right about now.

In addition, not all of these companies are located in the city, many are in south or east bay, where they have more affordable houses with actual yards and no daily poop on your doorstep. Also the companies are increasingly opening satellite offices in more affordable metros, because their non-executive employees are struggling too hard.

Airbnb, Uber, Lyft, Dropbox, Stripe, Coinbase, and Square are all HQ’d in SF.

Definitely as companies grow they open offices elsewhere. That’s because they are growing.

Millennials have spearheaded the trend to stay in urban areas if they have kids (many don’t, at least less than other generations.) plus retiring boomers are moving back to urban areas to play in their retirement years. Plus the huge tech juggernaut keeps inventing new phenomena (AI, robotics, driverless, bio, etc., etc.) which of course is ground zero here.

Overall, I expect a very robust 10-20 year future for Bay Area RE, and it’s crowning jewel, SF. Long term RE assets in SF will blow the doors off RE assets in Seattle, just like they have for the last 30-40 years. Get into a good property here as soon as you reasonably can, keep it long term, and you’ll be able to coast through your retirement years folks!

What do you think the actual returns were for RE assets in SF versus Seattle over the past 30-40 years?

Past performance as they say. For the past few years Seattle appreciation has been significantly stronger than that of SF. That will continue for a decade and more. Especially if, as some projections show, Seattle will add more residents to its metro than not just the SF/Oakland metro area, but SF/Oakland and the San Jose metro areas combined. Population growth is more than double that of the BA and jobs growth likewise. If Apple chooses to build its second HQ in Seattle then all bets are off (heard on the radio today that Apple has ruled out California and Texas -the latter I assume for political/cultural reasons) which puts Washington State near the top of the list of likely choices.

To add, the ROI on rentals is 5% plus in Seattle. Much better than SF which is pretty much flat. That will continue. Of course the real bet is Vancouver for appreciation and ROI – its home prices are 50% less than Seattle’s. There is a macro shift going on here on the West Coast. LA will remain the number one city here for business/culture/desirability but the BA will be more and more challenged by Seattle for the title of number 2 West Coast metro.

Home appreciation for the last 20 years (almost – since 2000) has been 145% in Seattle and 136% in SF.

If LA is the #1 city for business in California, why are Google, Apple, Facebook, Oracle, Salesforce, all HQ’d in the Bay Area?

What are the comparable growth companies in LA?

Being a business center means more than having a number of top tech companies headquartered in once locality. It is much more than that and, indeed, the variety of different major business categories found in LA (and not in the Bay Area) is in itself a testament and measure of LA as a business center.

Los Angeles is the third largest metropolitan economy in the world with a GDP of over $700 billion.

$236 billion worth of goods pass through L.A, the largest seaport in the Western Hemisphere. The LA/Long Beach port complex is the largest in the US. L.A. is the world leader in aerospace, clean technology, entertainment, fashion, healthcare, and tourism. L.A. County is one of the largest manufacturing centers in the U.S. The Los Angeles International Airport is the world’s sixth busiest airport. Los Angeles is home to some of the top research institutions/ facilities and teaching hospitals in the nation. LA has the third largest collection of cultural institutions in the US. LA is building a vast public transportation network which will rival those found in prominent eastern cities. There is more but that list is a good start.

LA is much, much larger than the Bay Area.

But the strongest fastest growing companies are all here.

Which brings us back to the actual trends (see above) at hand…

Millennials being city slickers is largely a myth. In 2014, 529,000 individuals between the ages of 25 and 29 moved to suburbia from downtown, while 426,000 did the opposite, according to US Census. Among 30- to 44-year-olds, they are actually heading for the suburbs at a significantly faster rate than in the 1990s. A survey published by the NAHB last year found that most Millennials want to live in suburban SFH, even if they currently live in the city. And of those who DO prefer to live in the city, many are priced out at these levels and end up in the burbs anyways. Census also shows 30% percent of Millennials live within urban areas, 70% outside. Census says that overall, the nation is less urban in 2014 than it was in 2000.

This may be close to a peak in terms of population and jobs – though the figure stated above is not a direct measure of jobs in SF. Just people who live in SF and have jobs – be they in SF, the East Bay or on the Peninsula.

The demographic trends are unmistakable. The Bay Area is growing much more slowly than more dynamic metros like Seattle, Austin and Atlanta. Seattle and Portland’s growth rate is nearly 3 times that of the Bay Area. Job growth is stronger in those cities also. The projection that SF would eventually reach a million residents is being backed off a bit now. It never was in the cards – safer bet that Seattle, which has close to SF’s population, will hit one million residents first and the same for Portland. The macro shift going on is seen in demographic measures across the board. In soft measures too – almost 40% of millennials want to move out of the Bay Area (Bay Area Council poll) in the next 5 – 10 years. Of course they won’t all do so, but that the Bay Area is at or near the top in this “dissatisfaction” measure is telling.

As to millennials not continuing to rent in large numbers as they “age”, I’ve seen stats that indicate home ownership is not as much of a priority for them and that a large percentage will remain renters. The residential rental market is strong and should remain so for the next decade.

Those priorities will naturally change as they age.

Who cares if the Bay Area’s population will grow less than Seattle or Atlanta or Austin. They can absorb all the mid level jobs. The key is that most new jobs and opportunities here will be for those who are highly talented, educated and/or trained. It’s more a demographic shift to higher incomes that will continue to come here, and fuel RE values.

Exactly. Population growth in Atlanta (?) has zero relation to SF housing prices.

What does have an effect is whether the Bay Area economy continues to spit out high paying jobs at growth companies.

Yet you said LA is much larger than the Bay Area and so that is why it is a more robust business center. Population growth is correlated with job growth. BTW, the state government is talking about taxing large companies here and taking a portion of their tax savings under the new tax law. And one wonders why businesses are leaving.

Again, which companies in LA are as fast growing and high paying as Apple, Google, and Facebook? Those companies pay high salaries to lots of people, which drives our real estate market. LA is larger, but the Bay Area unambiguously has stronger companies.

Yes, Bay Area has the tech giants. But reality is also coming to those companies. Apple, just as Amazon did, is announcing its next big location for jobs will be outside of the Bay area (Austin a strong contender). Give Google credit to sticking with bay area as it scooped up probably the last remaining large urban parcels in downtown San Jose. Facebook will be the question mark, right now they are expanding in Silicon Valley but also lobbying hard for big time tax payer infrastructure investments for which Bay Area doesn’t even come close to Seattle’s $60 billion dollar commitment and not even in the same state as LA’s massive $120 billion dollar decades long commitment to build out its transportation/transit infrastructure. I could easily see Facebook making the same move as Amazon and Apple without some major Bay Area transportation/transit investments.

This is so obvious yet BA/SF boosters refuse to see it. The BA’s status as the tech capital of the US is not guaranteed to endure. It is shifting already in terms of relative importance as Austin, Seattle and other more business amenable and millennial friendly cities challenge the dominance of the Silicon Valley.

Infrastructure is a key. The BA is doing almost nothing on this front. LA is creating a massive public transportation system as we speak (or write) and Seattle’s rail transit system launches its first major new line in 2020 or so with additional lines coming on every 3 or so years after that through the 2030s.

BTW, Facebook is among companies that are strongly pushing back on Baylands as envisioned and calling for a much larger housing component. The affordability crisis and the lack of a cohesive region-wide transportation system could indeed kill the golden goose in coming years. As to Apple, I’ve heard Texas has been eliminated (as of course has California) from locations for its massive new campus. If Apple chooses the Seattle area a critical mass could be attained there that might get Facebook and others to shift significant jobs out of the Bat Area. Meanwhile DTX is pushed back to 2022 or such and there is no plan to bring it to the TTC in the coming 20 or so years.

Dave – no area’s status endures – Seattle was a low cost area, but the success of a few large corporations made it crowded and a lot less affordable, which made Amazon look for new HQ city. NYC is the finance capital of the world even though it has been challenged by other metropolitan areas at times and will continue to be challenged by growth in Asian countries with much larger populations.

Nonetheless, you can argue that the Bay area need better transportation options. So does LA – despite their large investments in recent years; each time I go there I spend hours ‘parked’ on congested freeways.

You’ll also spend hours parked on freeways in Seattle.

The tech companies will grow, but their HQ’s are here, which means the highest concentration of wealth, which means our housing prices stay high. Google has plenty of offices globally, but the center of it is here.

It’s not really a matter of Seattle vs. BA/SF in the sense of if one does well the other necessarily suffers. They are both well poised to remain strong tech magnets. In tech, Seattle is dominated by Amazon and Microsoft (both huge) while the BA/SF hosts dozens of very large tech companies. So they aren’t really two peas in a pod. SFRealist is correct that this area will remain the locus of the top tech talent and executives for quite a while, even though local companies will spread the more commoditized workers around to cheaper places, which probably means places like Omaha more than Seattle, as Amazon has already demonstrated by setting up HQ2 elsewhere.

Amazon’s HQ2 was a logistics move triggered by several factors. Prices were not the driving factor. In fact the cost of living is 35% lees in Seattle than the BA. The median home price is 750K or so in Seattle. Much less than SF. The median salary is about the same as the BA and perhaps more given no state income tax. Several friends who have transferred there from here got a nice 8% or so raise even though their BA salary was frozen for their first year in the new office. The BA will remain the focus of the headquarters for a while but more and more of the engineering staff will be housed in places like Seattle ands Omaha. LinkedIn friends here in the BA are expecting a job shift north and they can’t wait. So much so there is a new rumor every month or so about such. There is a soft competition between the two regions for future number two status as most important region on the West Coast. It is what it is and it has significance for rental RE investors going forward.

Dave, we’re not saying anything different except on one point. Seattle is doing great. Its tech world is almost entirely two very, very big companies. SF/BA is also doing great but with many more tech companies. They aren’t really competing with each other for companies, but of course all tech companies everywhere compete for talent. When tech companies want to set up offshoots for their commodity employees (admin people, DBAs, tech support, entry level people) it ain’t going to be in Seattle because that is too expensive (not SF expensive but still costly). It will be Omaha or Birmingham or Lexington or other far cheaper places. SF and Seattle will continue to attract the cream of the crop. Seattle isn’t thriving as a down-market alternative to SF.

Which is exactly the dichotomy that was drawn between the tech companies and talent in Silicon Valley versus San Francisco up until around 2010. And then something funny happened, driven by a critical mass of talent and new opportunities.

The reason the city started getting a lot of tech after the Great Recession is because social media start ups were prevalent here, and that industry blew up. Can’t really compare that to Seattle, which mostly has amazon and Microsoft, plus some start ups…but not game changer industries that are predominately Seattle based. Most future tech industries are based here, either in SF or the valley: AI, driverless, robotics, bio, etc. To think that key future technologies are going to osmosis out of the area is laughable. Of course the influence of tech has permeated all industries so it’s effects are spread around, but core technologies are still coming out of this area.

@SFrentier (or is it renter) as an FYI Boston has replaced the BA (SSF) as the biotech capital of the country. AI? It is tied to VR and Google is doing stuff with that in SoCAL (makes sense given its the capital of the entertainment industry) so don’t bet on AI or even driverless cars technology ultimately being centered here.

The tax situation for businesses is prohibitive in Cali. Whatever you think of Trump’s business tax cut there is talk in Sacto about the state taking (taxing) half the tax break companies will get. California has the highest business taxes now and that will just make it worse. Plus, the state PTB have their eyes on not just Prop 13 but Costa and rent control. They would like to eliminate both 13 and Costa. It would take a vote of the people and now, with talk of registering undocumented resident to vote at the DMV – well, why is the state contemplating that? To end Costa, 13, maybe impose commercial rent control. It will take a vote of the people and presumably these folks, generally being renters an having small incomes, will support such measures. Plus vote for giveaways/bailouts for state and municipal pension plans that may get into trouble. The Golden State will be more and more tarnished in terms of a place to do business given the current trajectory of things.

Dave, it isn’t news that California has a challenging environment for businesses especially when you compare to inland states. If your speculations come to pass it will surely make it even more dicey to do business in the state. However, I don’t think you will find it to be any more business friendly in Boston or New York city (or Paris, Berlin…) and even Washington State has challenges. In addition the California legislation will affect all of the state, not just the BA.

Texas is one of the states that benefit as they are more business minded and they have lots of room.

So, California might (1) allow undocumented aliens to vote, (b) broaden residential rent control, (c) impose commercial rent control, (4) do away with Prop 13, (5) giveaway/bailout municipal pension plans, and (6) take the federal tax break businesses just got (well, half of it). And all that will further tarnish California in terms of a place to do business. Right . . . lots of businesses making decisions based on such nonsense hypothetical worlds.

Meanwhile, in the real world, the BLS just reported the lowest ever unemployment rate recorded in California (since they began tracking in 1976). Even better in the Bay Area. Businesses here are humming along. And corporate taxes were $10.1 billion in 2016-17 (the last full fiscal year) compared to $108 billion in personal income and sales/use taxes. Talk about businesses just about to start fleeing California has been around for decades, mostly on Fox News and the WSJ. But maybe all those undocumented aliens voting will make it happen this time around.

Dave, if California’s tax regime is so bad for business, why did two brothers from rural Ireland, who could have moved to any city on earth, choose SF for Stripe?

And Dave piqued my interest about registering undocumented aliens at the DMV to vote. Turns out that is alt-right B.S. repeated on the usual racist, gay-bashing, nazi websites. Complete fabrication. And that was the first domino in Dave’s projected legislative nightmare. Far, far beneath the generally reasonable discourse you typically see here.

And so unnecessary: the Pension Albatross – tho probably an even bigger problem @ the local level – coupled with the general irresponsibility of the Legislature are more than enough to cause worry…without resorting to “creative” writing.

SS asked what info I had on Seattle vs SF home appreciation over last 20-30 years. In 1994 Seattle (king county) median was $215k. San Francisco was about $265k. Today Seattle is about $720k, SF $1.4mil. Double! So yeah, SF blew Seattle out of the water wrt appreciation. And yes, I expect SF appreciation to be stronger than Seattle over the next 10-20 years. Year to year will vary of course. It’s obvs that SF is the stronger market…in so many ways I’ve pointed out before: it’s CA, better weather, more global/gateway city, stronger tech base, more international buyers, more tourists, less space to build, etc., etc., etc.

The question was actually with respect to your statement about the long-term performance of “RE assets” in SF versus Seattle over “the last 30-40 years.” And based on your response, it’s pretty clear it wasn’t based on actual data or analysis.

Ignoring the issue of simply comparing “medians,” King County is a lousy proxy for Seattle proper.

But if you’re simply talking about the change in home values in the greater Seattle area, the Case-Shiller index for “Seattle” has increased 296 percent since 1990 (the first year for which it is indexed). The index for “San Francisco” is up 240 percent over the same period of time.

So is today’s Seattle prices higher than the $720K mentioned or were the 1990 prices lower than $215K? How is King County a poor representation? Is it including too much or do you want to include adjacent counties? Just trying to follow your logic.

The median home price in Seattle is 722K. In King County 630K. Those numbers come after several years of double digit appreciation, There is concern about affordability declining in Seattle and it’s good that the city is seriously addressing this when it is still much more affordable than SF. SF where the median price is 1.4 million or so and the median income about the same as in Seattle. Truth to tell, SF waited way too long to address this issue and, at this point, it probably can’t be resolved.

No, my data is accurate. As early as 1994 Seattle and SF medians were about $50k apart. And now SF is about double in value. You can quibble with the deets, but the value differential today is substantial. Not sure about those CS #’s, as they are far from reality. But perhaps you can explain how SF is 2x value now, when 24 years ago they were within 20% of each other. The math is pretty indisputable.

To be clear, the “accurate” data and subsequent analysis to which you’re referring is a comparison of medians pulled from different sources, including a comparison of the median sale price for properties in San Francisco proper versus the median for King County (which measures a disparate 2,300 square miles) as a proxy for “Seattle.”

At the same time, a comparison of the indexes for home values in “Seattle” and “San Francisco,” indexes based on apples-to-apples changes in actual property values, isn’t reality. You know, well, because.

So is the higher increase quoted by SS because Seattle started at a lower level than stated by SFrentier, or is current price in the ‘real’ Seattle significantly higher?

720k/215k = 335%

1,400k/265k = 528%

If the difference is the starting prices it is pretty irrelevant for today’s investor, but if the current prices are wrong it matters.

It is not irrelevant for today’s investor but it is not near as significant for today’s investor as are the population and job growth projections for both cities in the coming decade plus. Seattle is far ahead on that and on current affordability. Getting less affordable, but still affordable to someone making the medium income there which is not the case here.

As to appreciation – Seattle is ahead for the last 20 years but SF for the last 10. It’s a snapshot in time but investors shouldn’t rely on past performance as a guarantee. Look at the trends and numbers – even soft numbers like quality of life measures by current residents. SFrentier sounds as if he invested a long time ago and if he did he has seen very good appreciation. Investor’s today, however, can’t count on replicating his experience.

My view is that when you are at 1.4 million for a residence it gets very hard to find buyers at ever increasing prices, even if you have a strong job market with low unemployment and limited new supply. When you are at 720K there is more room for growth in a good labor market; even if there are lots of new supply coming into the market, location and distance to job centers always matter. I don’t believe that Seattle is overtaking the BA in the fields of tech and innovation (not even close), but it can still be a strong market for RE investment.

Room for good appreciation in a solid labor market is what the SFH rental investor looks for or should be looking for. It is a win for corporations too. I was talking with a builder in a very hot housing market (not the NW) and he mentioned that, in talking to prospective purchasers who are being relocated there from the SV, many are getting “housing” bonuses in the SV. That is there getting 20K or 30K more in pay per year to help defray the exorbitant cost of housing in the BA. They will lose that when they relocate thus saving the employer money. Even so, the housing is so much cheaper in this market (median 360K for an existing home, 500K for a brand new home) that the employee will come out way ahead of the game too despite the loss of the housing subsidy.