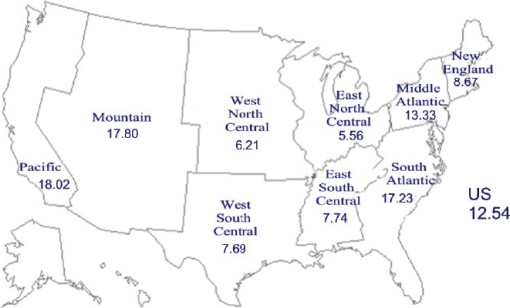

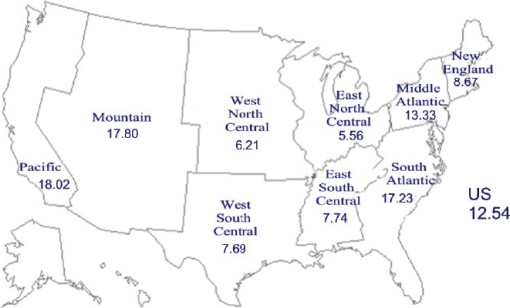

The Office of Federal Housing Enterprise Oversight (OFHEO) released its first quarter House Price Index (HPI) and appreciation tables this morning. According to the OFHEO, “U.S. home prices were 12.54 percent higher in the first quarter of 2006 than they were one year earlier. Appreciation for the most recent quarter was 2.03 percent, or an annualized rate of 8.12 percent.”

For the San Francisco MSA (which includes San Mateo and Redwood City), home prices were 14.60 percent higher than a year earlier, but appreciation for the first quarter of 2006 fell to 1.15 percent, or an annualized rate of 4.6 percent (about half the national average).

“These data show average housing prices still growing stronger than some might have expected,” said [OFHEO Acting Director James Lockhart]. “They do indicate, however, that price growth is moderating in some parts of the country, particularly in areas where prices have been rising the most.”

∙ OFHEO First Quarter 2006 House Price Index Report [OFHEO – pdf]

Well worth reading the pdf to at least page 5 and 6 – “Cash-Out Refinances and Estimated Appreciation Rates”. Seems like what they are saying is that in areas where there have been a lot of “cash out refinances”, their home price index has been inflated more than their purchase-only index:

“Thus the HPI dataset, which includes appraisals used for cash-out refinances, may have relatively more rapidly appreciating houses than the purchase-only index.”