∙ Owners Stop Paying Mortgages, and Stop Fretting [NYT]

∙ Foreclosures shifting to affluent ZIP codes [SFGate]

∙ Interest-only loans meteoric rise in the Bay Area [SocketSite 2005]

San Francisco real estate tips, trends and the local scoop: "Plug In" to SocketSite™

∙ Owners Stop Paying Mortgages, and Stop Fretting [NYT]

∙ Foreclosures shifting to affluent ZIP codes [SFGate]

∙ Interest-only loans meteoric rise in the Bay Area [SocketSite 2005]

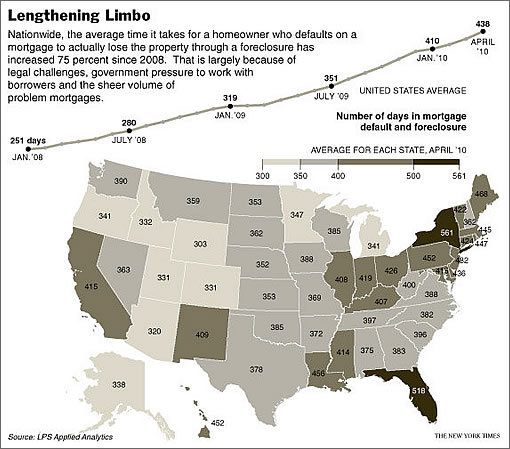

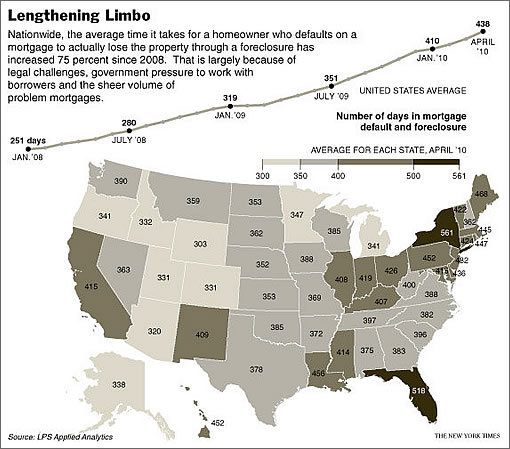

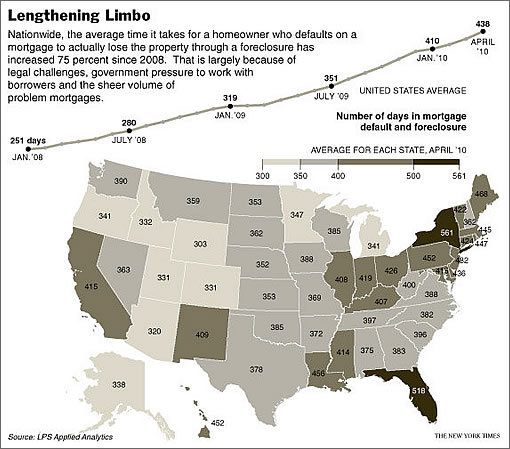

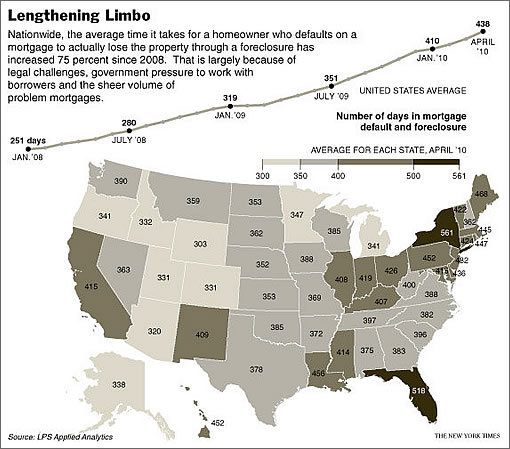

Yeah saw that article this morning and was all excited to learn people were going over a year without paying on their mortgage before being evicted. Then was disappointed to learn that those numbers were being skewed by Florida and New York and that in California its easier for them to give the freeloaders the boot.

[Editor’s Note: While Florida and New York require judicial foreclosures which are more cumbersome, according to The Times the average number of days it takes a California home in default to be lost to foreclosure is up to 415 (versus 518 in Florida and 561 in New York).]

For those who have cash, I don’t think ARM resets are going to cause problems with rates being so low. Having just gone through a reset my rate is now just over 3% for the next 12 months. With a small additional downpayment of the principal before the reset, I was able to keep my monthly payment the same despite now having to pay principal. If rates go up I will refinance into a 30 year product but for the moment it makes no sense and the reset has helped me pocket about $500-600 extra per month. Obviously if rates go up to 7-8% then the potential for collateral damage is significant but I don’t see that happening any time soon with the current economic outlook.

Let’s not put too happy a face on this. The loss of a house is the loss of a dream of homeownership and ensuing financial stability, now and at retirement.

Something that doesn’t seem to be mentioned in these types of articles is that the same people that stop paying their mortgages often also stop paying their HOA dues, if they have them, as well as their property taxes.

I don’t know if the local government will get the taxes back somehow, or whether local schools and other government facilities will get reduced income.

However, I do know that they they do stiff their neighbors in the HOA, since the HOA usually doesn’t get any recovery of lost dues if the primary loan is more than the eventual sale price. Leaving the remaining homeowners to make up the difference in lost HOA dues, which can be substantial for the other homeowners in small HOAs.

So, it not necessarily just the “big bad banks” that these people are stiffing, it is also their neighbors, definitely those in the same HOA and possibly also those who pay taxes to the same local government.

I’m curious to know what the reset (or is it “recast”?) wave actually entails at this point. Is it simply the expiration of the initially fixed (and possibly artificially low) interest rate period? If so, then the fact that rates are unusually low right now only postpones the pain – the “wave” will hit when rates return to historical levels. Indeed, it may be more concentrated in time, since although the originations were spread out, all the now-floating rates will rise simultaneously.

I’d also like to know whether others will be able to refinance as Willow plans to do. Many of them will have to put some cash in, and accept a higher payment (fixed vs. floating) as well. They’ll also have to have kept their credit rating up during this period.

Po Hill Jeff, you’re right that the interest rate re-set is pretty much a non-event in this low-interest world. The issue will be the I/O and neg-am loans where the borrower has paid no principal at all for some number of years. With the re-cast, principal payments will now be added to the monthly loan payments and they will be spread over a shorter period than normal (e.g. over the last 25 years of a 30-yr loan with a 5-yr I/O period). The bump in monthly payment can be quite large even with no interest rate issuet. And it is nearly impossible to refi because a very large “down payment” would then be needed.

Po Hill Jeff,

It is the experation of the initial rate. That rate was fixed annually and went up slightly over the say 5 year period if you weren’t paying the whole thing.

The payment is then fixed for a year based on the average of the 12 months previous. That is changed every year on the inseption date.

I have been saying for a while that because rates have been so low for a while now the wave would be very small. My minimum was covering the full thing for the last few years before it converted.

I don’t plan on converting mine anytime soon. I think the extra cost would take much too long to recoup vs. when interest rates get “high” again.

flaneur, I don’t feel sympathy for most of the people profiled in the nytimes article. The guy at the end of the piece, Jim Tsiogas, was particularly galling because he’s a landlord and presumably has two commercial mortgages he’s defaulted on:

Emphasis added. If you’re renting properties that you don’t even own out to other people, why should I feel sorry for you? I should feel angry that the system isn’t working the way it’s supposed to and you’re not out on the street to wail and grind your teeth.

That’s what “entrepreneurial capitalism” has come to in this country; when you use leverage to make a lot of money, you just talk about how smart you are and when you make a mistake and overleverage, you just default and blame the bank for “being unwilling to help”. He’s a deadbeat, nothing more.

Reset = changing of rate, and as people mentioned, LIBOR is very low right now, so ARMs have low rates

Recast = changing of structure of the payment, e.g. from IO or negative amortization to amortizing interest + principal, and some people will have trouble paying principal, especially if they have lower household incomes now.

Lots of news articles mix and match these two terms.

It makes sense to stop paying your mortgage from a purely business point of view. In fact, the more people begin to look at the purchase of a home as a business transaction the better off we will all be. Why not engage:

– A financial professional to help you understand how much house you can afford to buy.

– A lawyer to review your mortgage documents.

– A lawyer to draw up the contracts.

– A business professional to develop an exit strategy ahead of time (stop paying mortage, strategic bankruptcy, asset protection strategys etc.)

– Someone to help you buy housing futures to help you manage risk (oops; I’ve gone to far here, since investing in housing futures diverts scare resources from the productice economy).

peon posted:

I’m not a lawyer, but I recall reading somewhere that in California, although mortgages are not recourse, HOA dues are a personal liability and the association can sue former owners after a foreclosure for unpaid dues. So if someone is strategically defaulting on their mortgage, the association can go after their personal assets post foreclosure, whereas a bank holding a mortgage can’t.

i’m not sure about HOA’s either – i think a fair number of owners pay their HOA’s because it’s a smaller payment and because they live with the people they are stiffing. Maybe if you’re in a 300 unit building you can be anonymous, but in something like a 12 unit building or less – which are common in SF – everyone in the building will know you’re stiffing them and that can’t be too comfortable.

“Let’s not put too happy a face on this. The loss of a house is the loss of a dream of homeownership . . . .”

Uh, that is one of the positives. The “dream” of homeownership is a pernicious lie–one has to be asleep to fall for it.

We have a new, as of 2005, 8 unit building in Oakland where 2 units have foreclosed and resold. A 3rd has been in default for about a year. They have not paid HOA for well over that. We tried suing the other two units. One declared bankruptcy. On the second, by the time collection agencies and attorney fees were accrued, we had to call it quits and take a loss. We were actually relieved once the units did foreclose, because then the banks/future purchasers were on the hook for HOA fees after bank takeover.

-Poor Owner Living In Oakland Self Employed

I have personal experience as a member of a small HOA (4 units) where a unit stopped paying their HOA dues. The first mortgage was worth more than the unit, so our lien was worthless. He also owed money to the IRS, which also came before us in the pecking order. The owner abruptly moved across country, leaving no contact information, and eventually declared bankruptcy, so it was not really realistic that we were ever going to be able to collect anything from him, even if we did go to small claims court and get a judgement (we were too small to hire a lawyer and none would take such a case on contingency).

We were in the same situation as POLOSE — the only good thing that happened was that once the bank assumed ownership they did start paying the dues. But the laws (encouraged, no doubt by morgage lenders’ lobbyists) specifically exempt them from any responsibility for the lost dues from before they officially take ownership.

By the way, I should add that the fact that this person knew that all of his neighbors knew that he was deliberately not paying his share of the HOA dues was clearly not a deterrent at all.

If you start looking at paying your bills as purely a “business” decision, and care only about how it affects you personally, with no “moral” or other considerations attached, then you don’t care what effect it may have on your neighbors or anyone else. I’m not saying whether that’s a good or a bad thing, it is just a fact of life.

It will be interesting to see how the reset versus recast waves play out. Personally on my loan the reset and recast dates are different, it resets in 2012 and recasts in 2017 (basically becomes a 20-year amortized loan). As noted above with LIBOR so low, resets will not be an issue but recasts could. I know that I am perfectly willing to continue making my interest payment (as long as the rate doesn’t jump) but I will consider all my options before making more principal payments on an underwater place.

Duhhhhhhhhhhhhhhhh, you just pay the HOA when you strategically default on your non-recourse loan… Critical analysis people! Try it.

Gee, J, it would be nice if that actually happened. Unfortunately, it doesn’t seem to happen in the real world. Once people get into the mindset that “I don’t have to honor my legal obligations”, they tend to stop honoring more and more of them.

I guess some people can’t or won’t make that fine distinction that you find so easy to make between which bills or contracts you are morally obligated to pay or honor (such as the HOA) vs. which ones you are not morally obligated to pay and it is therefore morally acceptable to deliberately stiff someone on (such the lender).

Somebody who can’t afford to pay either his mortgage or his HOA dues isn’t a strategic defaulter, they’re probably defaulting because they lost their jobs, had a major expensive health care event, etc. There’s no reason to bring “moral obligations” into it.

By definition, a strategic defaulter is someone who is current on all their other financial obligations but who is choosing to not make their mortgage payments because they owe more on the property than it’s currently worth. The member of the HOA that peon described above was not a strategic defaulter, he defaulted because he didn’t have enough money to pay his bills, whether mortgage, HOA, or federal taxes.

It will be nice if all the strategic defaulters are nice enough to keep paying their HOA dues, while they are milking their properties for as much as they can before getting kicked out. Maybe that will happen, but I somehow think that will be the exception rather than the rule. I guess we’ll see.

Speaking strictly from the HOA point of view, the real problem is that it takes so long for the foreclosure process to complete. If they were kicked out promptly, then the loss to the HOA would be minimal and the loss would be only to the lender, and the HOA wouldn’t be caught in the middle.

^Could that be part of the reason the banks are taking so long?

As the homeowner stiffs the bank, the bank stiffs the HOA. It’s the new morality – None!

“The loss of a house is the loss of a dream of homeownership and ensuing financial stability”

Oy vey!

Homeownership does not create financial stability.

Financial stability creates home ownership.

The only people who are “losing” their homes are the ones who never could have afforded it in the first place without dodgy financial “affordability” products.

Of course, without a spiraling-out-of-control home price bubble of the better part of the last ten years during which home prices raced far, far ahead of household incomes due to mortgage-backed securities cooked up on Wall Street, the dodgy “affordability” products themselves never would have become necessary.