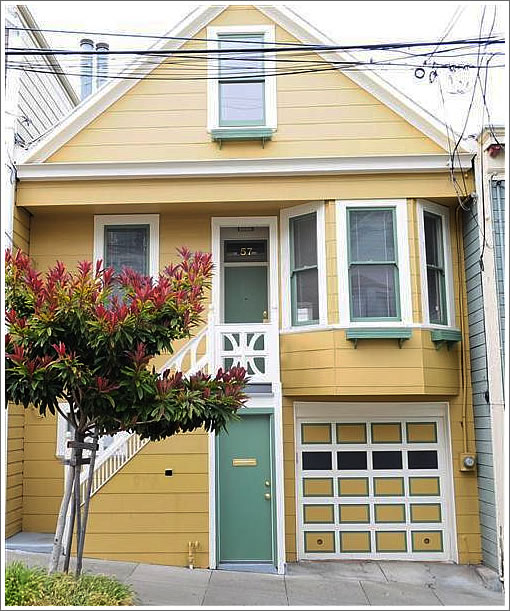

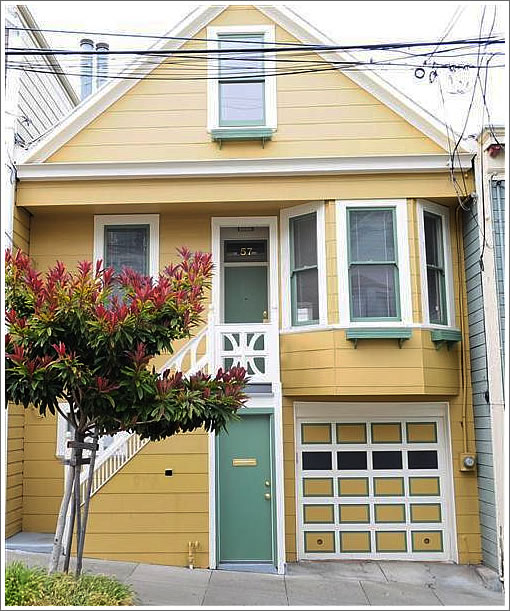

Purchased for $725,000 in June 2004, the 1,165 square foot 57 Bessie was listed in 2007 asking $849,000 before being reduced to $749,000 and then withdrawn from the market.

The single-family home on the northern (relatively) flats of Bernal Heights is back on the market today seeking a short sale at $695,000.

∙ Listing: 57 Bessie (3/2) 1,165 sqft – “$695,000” (Short Sale) [MLS]

I’ll lump bernal in with Noe as two neighborhoods that are not done sliding. I’m guessing that 2012 will be a good year to buy in both neighborhoods. Anyone agree?

I don’t think anything in Noe is selling below 2004 prices like in Bernal. Noe has become quite a nice area. The problem with Bernal is that it is bordered on three sides by some nasty neighborhoods, and it just hasn’t improved like Noe has. But I agree that Noe, Bernal, and just about everywhere else in the city still has farther to go, and deals will be better two years from now. Rent a very nice place until then and let your landlord effectively subsidize your living expenses.

If this place sells for asking, that’s about a 20% real decline since 2004, not including transaction costs, etc. Pretty ugly.

But still $600 a square foot now for a little cottage with barely usable rooms upstairs? That 2004 price seems awfully high in retrospect.

Some things in Bernal are selling for more than 2006-7 prices. Some things are selling for less than 2005 prices. I’d be surprised if this zero lot line short sale goes for less than its 2004 purchase, but it might. This area is potentially poised to get better, actually. We’ll see. But the Cesar Chavez greening will not hurt it.

I lived a couple of blocks from there…

just close enough to C.Chavez for trouble.

Excellent curb appeal, and they did well with the kitchen. Agree with the previous comment about the room upstairs. This one is an interesting case study.

This house seems problematic with two attic bedrooms, no yard and a strange living room layout. On the other hand this is a pretty nice location, one block from the park. The area continues to improve IMO.

Agree with anon. This one is going to go over asking and should find a buyer pretty close to the 2004 sales price.

The listing indicates rent is $3100. Surely that isn’t for the inlaw. Does this mean that the main house has a current tenant ?

with Noe as two neighborhoods that are not done sliding

115 Valley is a Noe apple that just sold for 22K more than its 11/2006 price of 1.56M.

I don’t know SF well but I do follow this site…there is a flight to quality going on in this leg of the housing bust. I see houses in my ‘hood (North Berkeley) go no sale month after month that sold at no discount to better properties 3-4 years ago. Some of these places are unsellable. One that I looked at as a fixer in 2007 has been up for sale 4 times in the last 2 years and probably won’t even fetch the price paid pre-fixed. Lots of steps, no parking, bad layout, busy corner – things that can’t be fixed cause people to move to the next property. So quality properties in Bernal, Noe or anywhere remotely desirable could sell for equal to their sale price from 3 years ago.

Yes, Noe has held up better than other areas, no doubt.

A few other recent Bernal apples in addition to the subject of this thread:

Down 13% from ’07:

http://www.redfin.com/CA/San-Francisco/330-Gates-St-94110/home/1534413

Down 15.5% from ’06:

http://www.redfin.com/CA/San-Francisco/3301-Mission-St-94110/unit-301/home/1318175

Down 7% from ’08:

http://www.redfin.com/CA/San-Francisco/160-Manchester-St-94110/home/1158439

It’s easy to find positive Bernal apples too. 70 Winfield is positive, 244 Elsie is positive, there are more.

lol at anon: when dougie said Noe was not done sliding, his (typical) response was to provide one datapoint to bury the subject once and for all! The One-Man Bear River Dam has to respond to everything and anything.

Also, BH went up from 2004 to its top in 2007/2008. A sale at or under 2004 would be an interesting development.

lol at anon: when dougie said Noe was not done sliding, his (typical) response was to provide one datapoint to bury the subject once and for all

Not really, just showing that it’s not all sliding is all. That 115 Valley got a mention because it’s from today. Everybody knows there are plenty of positive Noe apples recently. And I do like the “flight to quality” theory that djt submitted.

Not to mention the 3.35mm 23rd st sale from last week, which was probably a record for a non downtown view property.

Another recent Noe apple — down a tad from ’06:

http://www.redfin.com/CA/San-Francisco/1461-Sanchez-St-94131/home/1869305

And another right at its ’06 price:

http://www.redfin.com/CA/San-Francisco/4037-23rd-St-94114/unit-4037/home/1939165

Probably safe to say as a general proposition that Noe has retreated back to about 2006 pricing while most of the city is back to about 2004 or a little further for some of the weakest neighborhoods. And we can all argue about whether the slide will continue, level off, or reverse.

Original loan was a reasonable 80% LTV (courtesy of World Savings, variable, of course). Obviously, it went downhill from there with the subsequent Wells Fargo refies and/or HELOCs (2005 & 2006).

We toured this place when it was for sale in 2007. It is tiny, the rooms are tiny and the rear has no yard. The building behind it comes right up to it, there was some weird lattice work. And the in-law had a strange lay out too and was tiny. I remember being very dissappointed after we looked at it. Glad we didn’t buy it!

I hate to say it but I agree with anon. If people on this board were right, I would be living in Bernal today.

I havent been desperately trying to get Bernal for a long time. This site is out of touch by finding clearly over priced homes (even by bubble standards) and comparing them to not even sold homes.

Prices in bernal are near 2007 levels. Its nuts!! 2/1s in good condition are going for 700k. I know because I bid on many before ultimately giving up.

Pieces of crap sit, but nicely remodeled 1000 sq ft homes are going for 675/sqft+.

Maybe 1/20 homes goes produces an “apple”, but the other 19/20 show strength, much to my dismay.

Agree with Jeremy. Small, decent houses in the nicer parts of Bernal go very fast– e.g., that recent 699 listing on Virginia that sold for 825. There are very few listing, especially of nice places with a garage. And there is upside potential with the changes to Chavez, etc.

224 Elsie sold for .6% over 2007 price.

70 Winfield sold for 1% over 2006 price.

115 Valley sold for 1% over 2006 price.

These are the positive apples? Did Bernal top out in 2006? Noe in 2007?

@Jeremy: Did you bid on 330 Gates or 160 Manchester? Both were nice.

These are the positive apples? Did Bernal top out in 2006? Noe in 2007?

A case can be made for yes, yes, and yes. Nobody’s boasting about great appreciation. The point is that not everything is sliding.

94110 median $ per square foot from PS:

2010 – $607

2009 – $604

2008 – $667

2007 – $702

2006 – $656

2005 – $677

2004 – $560

Flat 2009 to 2010 but 14% slide from 2007. Back to 2004/2005.

I don’t disagree. Saying 2004-2005, considering late 2004 is when the market broke north, is probably accurate. Those are still bull years.

And yes, in most parts of town north of 280, it is 2006 for volume + price, and 2007 for price, (2008 was declining, not rising, although it should be said spring/summer 2008 will often contain the priciest individual sales). So 2006-2007 can be called the peak years of the last market. Again though, numerous exemptions exist with 2010 sales. Some show no slide at all, even minute gains, and many show much smaller declines. By and large the buyer who goes around looking at decent properties expecting 14% off in Bernal Heights is going to be disappointed.

Also, 94110 includes a big swatch of the Mission. It’s everyone whose mail goes through the 23rd and South Van Ness post office. I’d posit also that there are condos and houses in the southern Mission getting high prices that were not yet seen back in 2006 or 2007. And Bernal, broken down by ZIP, is always going to be problematic.

244 Elsie?!??! Paying 1000 sq/foot in a less than prime area of SF is a positive!?!?!?

Financial suicide if you ask me.

FYI Yurt Dweller “positive apple” is mathematically positive, meaning more than the last sale (+), not less than the last sale (-). It is not a subjective positive. It is not the type you experience out in the yurt chillin with in a communal setting with your buddies, such as in the “Positive I a man iration yeah! Irie ites. Positive vibration yeah”

I am getting ready to put my house in Glen Park on the market. I was going to buy a condo, but now I’m wondering if I should rent for a while (up to 2 years for me to retain my property tax base) and wait for a better time to buy. I have no mortgage. It seems wise, but on the other hand I don’t want to find myself unable to get back in. Anyone’s thoughts on this appreciated. I am about to retire and money will be tight.

I just finished working with retired people who want to downsize from their large Twin Peaks place and move to a SFR somewhere smaller in a warmer area near light rail. Parts of Glen Park were on the list. Every time we found someplace suitable it was at least 820K or so. That’s right now. As for the future, we’ve seen reports of 92 independent economists commissioned by a bearish survey who all thought that next year would actually show improvement. For buyers, that means more expensive. A lot of people on here with well reasoned arguments think that the market will slowly regress for the next few years, but that for a buyer, practically, it might be masked by inflation. A lot of people on here still think that a huge decline is right around the corner. Few, if any, think that a huge gain is right around the corner. In terms of the local market, condos have taken a bigger hit than SFRs. So if you are willing to downsize, in terms of right now, perhaps buying a condo would be the most cost effective move. Glen Park SFRs have maintained their values quite well by and large.

thanks for the clarification…one love!

Effective interest rates of 2-3% gave us the bubble of 2005-2007, and FHA financing @ 5% is keeping prices what they are.

I think we’ll see 2000 prices when we see 2000 interest rates (8%+).

btw, i am pretty sure they put well more than $22K worth of work into 115 valley. Not quite an apple.

anon is a salesman/speculator with personal interest in off-Noe neighborhoods. Listen to him at your own risk.

This shack is worth less than 300K. Nice job on “unlocking” some attic square footage to fool footage-hungry masses. Sure an idiot young couple will put their life savings “at work” there and pay 2.5 times rent total for the privilege of living with no garden and a bit too close to the gangs. But I am sure that will be all worth it in the end. I know 2 2007 and 2008 buyers stuck in their overpriced houses and they’re bleeding cash with no way out. Thanks for playing. The salesmen thank you.

I’m totally at a loss for where you perceived any of the above language as meaning the Bessie house was a good deal in this market. Because it is not, an nobody said it. Your ceaseless courting of arguments is unique, even among this crowd.

btw, i am pretty sure they put well more than $22K worth of work into 115 valley. Not quite an apple.

I doubt it. The pictures don’t back that up. I saw it last time around, and it was a spec home with nicer finishes at that time. But you might be right.

I would also add that 115 valley seller has to pay 5%-6% for the transaction costs. That is $80K – $90K in fees and nothing to sneeze at.

I was trying to track down a NOTS on Bessie and happened upon a NOD around the corner at 3232 Folsom St. It started out with a $500k loan from World Savings Bank in 2003, with a subsequent refi in 2006, and then a final one with Wachovia in 2008 (how’s that for timing). A NOD was filed on April 26 for 3232 Folsom. Will the North Slope hold?

Ahh… the NOTS (Dec. 28, 2009) is at the end of the block. There was a WaMu refi in 2008 for a $417k first and a $90k second. Looks like a spouse passed in 2005 and… well, you know the rest…

57 bessie is already pending

If you’re simply going to point out when a property goes pending versus when we report its actual closing (which we do for all properties we feature), please do so when it falls out of contract as well (as has 57 Bessie which is once again active and available at $695,000).

Sure but the status only changed last night, and I actually checked for that one yesterday afternoon.

[Editor’s Note: Cheers.]