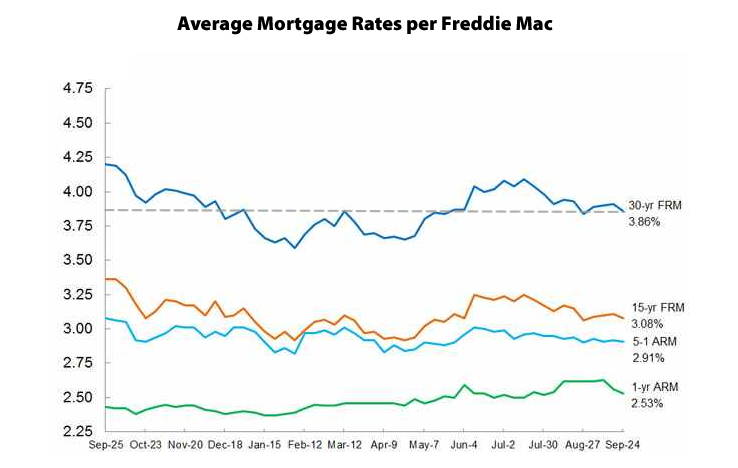

With the Fed having balked at raising the Federal funds rate last week, the average rate for a 30-year mortgage dropped to 3.86 percent, down from 3.91 percent the week before and versus a 4.20 percent rate at the same time last year, according to Freddie Mac’s latest Primary Mortgage Market Survey.

And according to the futures market, the probability that the Fed will hike rates by the end of the year has dropped to 35 percent.

The benchmark 30-year rate, which hit an all-time low of 3.31 percent in November 2012, and a three-year high of 4.58 percent in August 2013, has averaged roughly 6.7 percent over the past twenty years.

With the shaky world economy this makes sense. Will there be a hike in early 2016? Maybe, maybe not. If you own GNMA funds, as opposed to direct bonds, look at the share price this year. Investors are skittish and anticipating a rate increase but it has not happened.

Either way, SF is one of 20 or so markets whose home affordability is right now below its historic average. So indications prices have peaked here, which are out there, make sense. Folks can’t afford to buy here.

At the same time, double those 20 or so markets are below their historic affordability.

So, my sense, is that prices have peaked in SF and will retreat some even if rates stay low. But other markets, like KC and Pittsburg, will see price appreciation next year.

UPDATE: Futures Market Says No, But Yellen Says Yes.