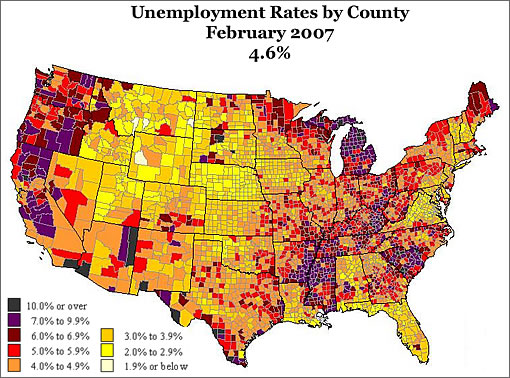

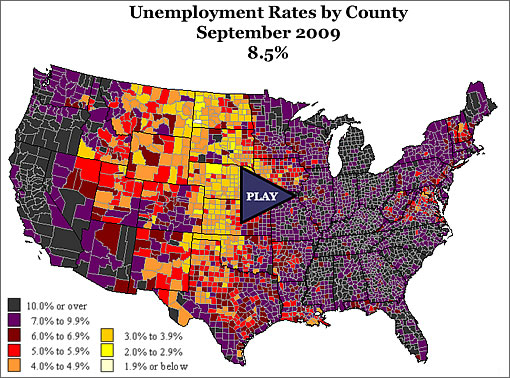

As the pace of existing home purchases in U.S. picks up and the latest Case-Shiller Index twenty-city composite ticks up, a plugged-in tipster points us in the direction of a rather sobering animation of the rising unemployment wave spreading across our country.

The questions: what’s really driving any real estate “rebound,” is it sustainable, and what happens if it’s not? Are we currently scooping up fish left floundering on the ocean floor by receding seas unaware of a wave that’s soon to return?

∙ Pace Of U.S. Existing Home Purchases Up 23.5 Percent YOY [SocketSite]

∙ September Case-Shiller: Bottom Tiers Up But Flat At Top For SF MSA [SocketSite]

∙ The Decline: The Geography of a Recession [americanobserver.net]

∙ U.S. Unemployment At 10.2 Percent, Five Tenths Above San Francisco [SocketSite]

∙ San Francisco County Unemployment Up To 9.9 Percent In October [SocketSite]

I will share my story.

My colleague lives in One Rincon Hill. As a condo owner and a resident, he was invited to the grand opening cocktail party. He was so shocked to see most of the guests are Chinese. I asked him if they are Chinese living in US(Chinese American). He said that they are all from Taiwan, Hongkong, and China and spoke no English at all. (My colleague is Chinese American and speaks Chinese as well). According to my colleague, these Chinese people are renting out their units.

The condo I bought is a brand new and people have just started moving in. I already see rental ads of several units on Craiglist and, so far, 3 of my neighbors bought condos of this building as a weekend or vacation homes.

Sobering indeed. Thanks to your tipster for this graphic illustration of the real needs of this country … employment. All the posturing from Washington and Wall Street about the recession being over pales in comparison to the rising unemployment rate.

JBAC- What’s your point?

I think the point is that its quite possible that whatever market currently exists for luxury condos in downtown SF, that its primarily a speculative one driven by foreign buyers with cash on hand, and not by any fundamental homeownership demand. Which begs the question as to why our Planning Department should be approving any more high-rise condos for a while if the only “demand” is from foreign nationals looking for an investment to park their home currency.

clone mom’s thursday meal

fish flip metaphor copied

milkshake is flattered

that’s *awesome*. we need some sort of ‘export’, why not condos?

after they all sell out, we can create some sort of brutal tax assessment for anything over 5 stories, as well as some sort of law that allows the homeless to move in rent-free.

it will be like Alaska, we will all get checks from the gov’t.

(just me, goin’ Rogue again…)

“The questions: What’s really driving any real estate ‘rebound,’ is it sustainable, and what happens if it’s not? Are we currently scooping up fish left floundering on the ocean floor by receding seas unaware of a wave that’s soon to return?”

I fully realize some of the real estate chest beaters around here may feel differently, but my answers are: government intervention, no and perhaps another collapse in “demand” and prices.

And, hmmm… I would suppose it’s possible the biggest wave (for San Francisco real estate, anyway) is yet to arrive.

He said that they are all from Taiwan, Hongkong, and China

I think I might actually know one of these buyers.

Which begs the question as to why our Planning Department should be approving any more high-rise condos for a while if the only “demand” is from foreign nationals looking for an investment to park their home currency.

Are you kidding? That’s a great deal for SF residents! Build luxury condos at, say, $700/sf. Get foreigners to buy them at that price. Then foreigners either rent them out at ridiculously low cap rates (i.e., SF renters get subsidized rent) or sell them in the future for below purchase price (i.e., SF buyers get subsidized housing). And taxpayers win because of additional development fees and property tax base.

Winners: builders, construction workers, SF renters, SF buyers, SF taxpayers

Losers: overseas Taiwanese/Chinese

@chinanob wrote: “Which begs the question as to why our Planning Department should be approving any more high-rise condos for a while if the only “demand” is from foreign nationals looking for an investment to park their home currency.”

this is totally misplaced angst and a fundamental naivite about the role of government as a whole, and a planning function specifically. It’s not the government’s job to regulate the supply and demand of different competitors in the market to ensure that the market stays at equilibrium. If you play out the logisitics of that scenario it leads to a farcical and unrealistic command and control regulation of the minutiae of the economy, even beyond what communism brought us. It’s the job of the planning department to regulate land use and buldings — that is, what can go where, not to decide that the market is ready for developer X to build his building. If the land use and height/bulk and so forth is appropriate at that location, it’s not for the City to give a green light to one developer and not another for pure reasons of some arbitrary sense of market equilibrium, which is a completely intangible notion. That wouldn’t even be constitutional, for starters. If housing or office is appropriate at that location, then housing or office is appropriate at that location. It’s the developer’s risk whether they will lose their shirt or not. If a developer wants to take a chance that demand will be strong enough to support their project, that’s not the public’s interest. At some point there will be demand, unless the entire region will shrink in population from here to eternity and not a single more person wants to move to the Bay Area. The planning commission disapproves additional certain uses (say video stores, or coffee shops) from being built in certain neighborhoods in order to prevent crowding out of other key neighborhood services, not because they’re trying to prevent competition or are concerned that the market for DVDs or lattes is saturated and the business owner is going to lose money.

Don’t worry guys, jobs will be created in the US just as soon as Chinese wages equalize with those in the USA. Until then, layoffs, a shrinking manufacturing sector and declining incomes are a given. These is an upside however, the price of LCD TVs is dropping and you can still buy pretty much everything else cheaply, at is is manufactured in China. The downside is that nothing is cheap enough when you have no income.

Great graphic! It paints a bleak picture. 🙁

I just got back from a recent business trip that included stops in Frankfurt, Melbourne and Toronto. Anecdotally I spoke to a few knowledgeable people in those local housing markets and they noted that prices have rebound in a big way, benefiting from both government subsidies and low interest rates, so it’s not entirely surprising that it’s happening here too. The big difference of course is that the employment outlook is not as dire as it is here and those countries overall fiscal position is significantly better than ours, so arguably they can actually afford the giveaways; Unlike us! It really is difficult to pinpoint exactly how this is going to play out but it is starting to look awfully like 2001 all over again.

So what, we should all move to the mid-west?

Or Washington D.C. – it’s that relatively bright spot around north Virginia, near Krugman’s house.

Actually, the midwest relative strength is probably due to agri/energy activity working on a smaller population (fewer jobs impact the percentages more). I don’t know if that is coming from the government or not.

Does anyone know?

Dub Dub, it’s the Great Plains states that have very low unemployment. It’s largely because they have very low population (and has been DE populating for years), and the population that is there is involved in grain farming or energy or supporting those sectors. In fact, the population density is so low on the remaining yellow areas of the map, that if you sized the map to population rather than geography you’d barely notice this “bright spot” existed.

^^^ Yes, I confused midwest and Great Plains, sorry about that. I should have just said “the middle part” 🙂

“Actually, the midwest relative strength is probably due to agri/energy activity…”

Yes, those low unemployment counties in the middle are mostly agricultural based.

There really isn’t such a thing as an unemployed farmer. The economy hits farmers in a different way by hitting their bottom line. If the market pays a farmer less for their goods than it cost to produce them, the farmer takes a loss. If that happens enough times in a row (weather, economy, misfortune) then the farmer goes bankrupt.

An interesting chart to see would be the growth in agricultural debt by county. My guess is that it is been growing over the last two years.

Dub asks does anyone know?

All Ag and alternative energy involves government spending in some form. Soon the government will be everywhere, screwing up what the free market couldn’t and saving everyone from themselves.

Wrt Chinese buyers at rincon hill: another anecdote that foreign buyers do indeed invest in SF. I remember folks here questioning if there are substancial foreign buyers. Answer: there are.

And I think it’s friggin’ awesome!

Helps developers sell units, the city with high property taxes, local renters (rent are lower than mortgages) and helps keep property values high in our world class city. No doubt these buyers are in it for the long term and will profit handsomely 5-10 years from now.

We all know that unemployment figures are a lagging indicator, so I’ve been doing a little research to figure out if the lag we are currently experiencing is abnormal.

If we look at the last few times that unemployment peaked at over 6% we see that these peaks occurred shortly after the end of a recession and on average 10 months after the bottom of the stock market (S&P500).

The longest lag between market bottom and peak unemployment was 21 months in the early ‘90s.

The shortest lag was 5 months in the early ‘80s.

If we have an average lag this time around we should be looking for an unemployment peak in January 2010 (reported in February). If it takes longer than this that doesn’t mean that the economy will be terrible, unless you consider the ’90s to have been a terrible economy.

Also, the BLS reports tend to focus on non-farm payrolls, so that might be skewing the data in the Great Plains.

Sorry, I forgot to mention that the data I used above is only for the post WWII period.

Fortunately, development/construction cannot be outsourced. The land is here, and you cannot send a high-rise to India to have it wired. This really is the only US industry keeping a high percentage of jobs/dollars in the country.

“Fortunately, development/construction cannot be outsourced. The land is here, and you cannot send a high-rise to India to have it wired. This really is the only US industry keeping a high percentage of jobs/dollars in the country.”

This comment seems neither here nor there, and I’m not sure what you’re trying to say. Maybe you’re commenting on jobs increasingly being moved overseas and suggesting that construction is somehow immune to this factor.

But note that you need people here who can afford to buy those developed and constructed houses, and those people need jobs. It doesn’t matter if an industry keeps a high percentage of jobs/dollars in the country if there are no dollars to keep here.

I still question whether a meaningful percentage of foreign buyers buy into these sorts of buildings in any case. What’s their motivation for doing so? And do you really think this is a good way to run a sustainable economy in this area, even if it’s true?

Looks like “fly-over” country is where the smart people are.

I cannot believe the full might of the US was used to bailout New York City and their greedy shenanigans, as they do not seem to be hit as hard as the other cites and metros that bailed them out. By all rights, New York City should be whacked the hardest by this great recession with 20% + unemployment.

Totally unfair to the rest of the country.

As NYC is a pretty expensive place to live and has a high proportion of renters it wouln’t surprise me that they have a lower unemployment rate than the surrounding area, when the jobs go so do the people. This makes NYC a net exporter of the unemployed.

It has been mentioned on this site that the same effect is hapening in SF, keeping the rate of unemployment lower than would be expected as tese people move across the bay or back East to mom & dad after losing their jobs.

The Plains states benefit from massive government grain subsidies and price supports (bringing you high fructose corn syrup and ethanol). Some of this money filters into the local economy, helping to support home prices and employment.

Looks like this is the one time it appears you’d be blessed if you lived in a “red state”.

No doubt these buyers are in it for the long term and will profit handsomely 5-10 years from now.

Um, not at a generously calculated 2.2% cap rate.

The only way that they are likely to “profit” is if (a) you assume that they would have earned 0% on that money otherwise and/or (b) through sheer luck.

Note that even the prospect of high inflation will not make their investment profitable because it will simply weaken the US dollar vis a vis their home currency (and thus their nominal “gain” will be wiped out by currency exchange losses).

^ um, betcha they will see their asset appreciate north of +50% 10 years from now. given the 10-20% cash down payment, their ROI will be quite healthy, probably beating out DIJA average returns. and to boot, they have a pied-a-terre in world class, superstar frisco, if they choose to forego rental income. sweet.

^Alex, only partly true. The conservative states of the South are doing just as badly as the rest of the country. As people have previously pointed out, it’s only the lightly populated Great Plains states that are holding it together in the Great Recession….

“No doubt these buyers are in it for the long term and will profit handsomely 5-10 years from now.”

In 5 years? Not a chance. We’re several years away from even hitting bottom. In 10 years? we’re only guessing that far out. But given the hole they are in now, which will grow deeper, I would give just breaking even in 10 years extremely long odds.

One thing this country has proven to be really, really good at in the last few decades is getting foreigners, particularly Asians, to dramatically overpay for real estate only to suffer big losses down the line. One fun way to get them to repatriate some of the dollars we send their way buying plastic crap made by Chinese prison laborers. That said, I don’t believe this “mostly Chinese buyers” story a bit.

Asians do love them some real estate.

That said, I don’t believe this “mostly Chinese buyers” story a bit.

I don’t either. It would be great if someone had proof of this that doesn’t come from sales people. I heard this story all the time about Santa Monica (only it included Iranians too!), and it certainly wasn’t true there.

JUST BOUGHT A CONDO: Your “colleague is full of it. A party — where so many crash — is surely not the most ideal judge of anything. But, most important, One Rincon has practically NO foreign owners. The “trend” of foreign buyers has not hit SF in a big way regardless of attempts from reporters and others to try and say so. These are all Americans. Perhaps first generation, but Americans just the same. Most likely your colleague is either exaggerating or simply is a snob so he’s decided to label them fresh off the boat, even if they aren;t. And guess, what? some of those chinese are actually japanese-americans, korean-americans, filipino-americans, etc.

^ umm, pardon me Armando. Any hard data besides your ‘gut feel’ on this one? At least the other dude went to a party, observed the mix of people and spoke to many of them.

And don’t forget folks, many Asian families are extended, and they certainly have members from abroad looking at investments stateside. My Vietnamese contractor has family abroad doing just that, and I hear stories from him of other families doing the same. Obviously, it’s not that every Asian family is doing this. But for peets sake there are a couple billion of ’em! You’d think more than a handful would buy here, what they see SF as the premier American gateway to the pacific rim. This is not such a tough concept to understand.

um, betcha they will see their asset appreciate north of +50% 10 years from now. given the 10-20% cash down payment, their ROI will be quite healthy, probably beating out DIJA average returns

If by “quite healthy” you mean “likely losing a bunch of money,” then yes, I agree with you.

Previous posters implied that these buyers were all-cash, but now we’re assuming they’re leveraged. No problem, let’s run the numbers.

Generously assume nominal incomes (and thus rents) increase by 4%/yr on average over the next decade (i.e. rule out any possibility of a Japanese style “lost decade”). Prices can thus rise 48% while maintaining the fantastic cap rate of 2.2%.

Assumed costs: $550k 1BR property, 10% down, $500k loan at 6% (investment property means higher rate…6% is probably too low) = $30k/yr interest, $2.5k/yr opportunity cost of downpayment, $7k/yr taxes, $6.5k/yr HOA dues.

Assumed income (net of management/maintenance fees): $2400/mo * 10.5 months/yr = $25k/yr.

Net income (loss) in 2010: ($22k/yr)

Net income (loss) in 2020: ($13.5k/yr)

Total net income (loss) while holding: ($255k) (NPV 2020 dollars)

Sale price in 2020: $814k (2020 dollars)

Transfer costs: 1.5% at purchase ($13k NPV 2020 dollars), 7.5% at sale ($61k in 2020).

Gross profit (loss) in 2020: ($65k)

Of course, this all assumes that buyers are willing to accept the same lousy 2.2% cap rate in 2020 that they are accepting today, even though mortgage rates will likely be 50% higher than.

In reality, the cap rate is likely to be substantially higher in 2020 than it is today, i.e. prices will not appreciate a full 48%. Obviously that just makes the whole thing look even worse. They could easily lose six-digit figures of dollars on this property, even with a 10 year hold.

and to boot, they have a pied-a-terre in world class, superstar frisco, if they choose to forego rental income. sweet.

Oh, and I can only hope this is meant as a joke. The loss would look horrific if the property were producing no rental income.

This one was too hard to pass up.

Price wars have broken out among large law firms. Deflation nation.

^^^ from that ABA Journal article:

Hassett was astounded by the unanimous response. “I have never heard 15 lawyers agree on anything else before this,” he wrote.