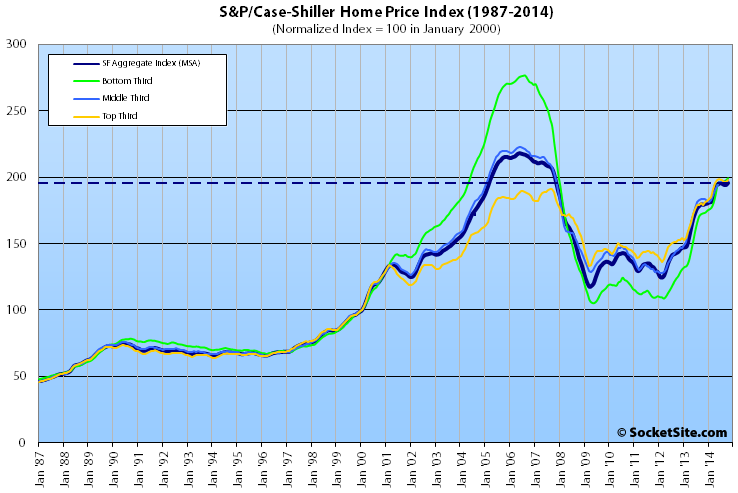

Single-family home values within the San Francisco MSA have ticked up for the first time in three months, gaining 0.8 percent from September to October and running 9.1 percent higher than at the same time last year, according to the latest S&P Case-Shiller Home Price Index.

While the aggregate index for San Francisco home values has gained 66 percent since early 2009, it remains 10.3 percent below its 2006 peak.

The index for the bottom third of the market gained 0.8 percent in October and is running 15.3 percent than at the same time last year; the index for middle third of the market gained 1.3 percent in October (up 7.9 percent year-over-year); and the index for the top third of the market gained 0.8 percent and is 10.3 percent higher than at the same time last year.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA are back to May 2004 levels (28 percent below an August 2006 peak); the middle third is back to just above February 2005 levels (11 percent below a May 2006 peak); and values for the top third of the market are 3.4 percent above their August 2007 peak, just below the all-time high reached this past June.

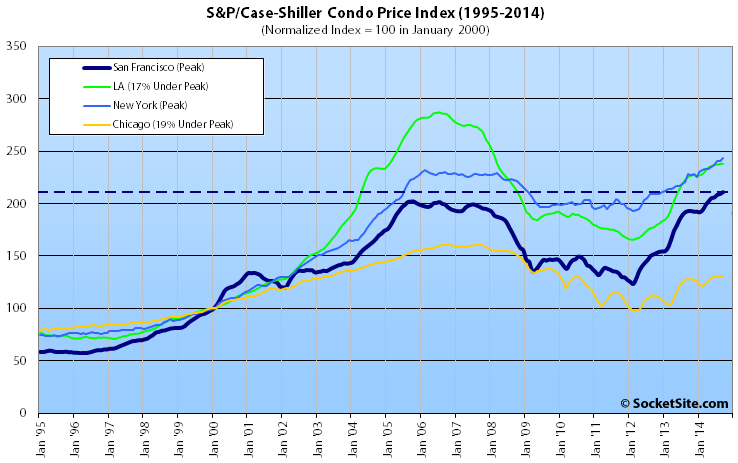

Condo values in San Francisco ticked up 0.6 percent in October to a new all-time high, up 10.1 percent over the past year and 5.0 percent higher than at the previous cycle peak reached in October of 2005.

For the broader 10-City U.S. composite index, home values were relatively unchanged in October, slipping a nominal 0.1 percent from September. While the composite index remains 4.4 percent higher on a year-over-year basis, it’s the lowest year-over-year gain since 2012 and the index remains 16.8 percent below its June 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

It’s the dreaded triple cross! Bubble 2.0 has arrived.

I agree. Robert Schiller (from the Case-Schilller Home Price Index quoted above) just gave an interview where he noted that SF was in fact in his estimation “a bit bubbly”. See link to article here: http://www.valuewalk.com/2014/12/robert-shiller-housing-bubble/. I agree Jim, Bubble 2.0 has arrived indeed!

How can something be “in fact” and “in estimation” at the same time?

I think NoeValleyJim was just goofing around with that comment. The SF numbers really don’t look bubbly to me right now. Basically flat for the last 6 months. They shot up a ton in the two years prior, but this is looking more like a anti-climactic plateau then a bubble about to pop. A high plateau to be sure, but there is a lot of money in SF these days.

I agree that SF was a bit bubbly in the past 2 years per Schiller’s comment, and has also been flat-ish for the past 6 months. I don’t think they’ll go up further outside of a few hoods that have been in major appreciation mode. I think some developers are getting a bit ambitious with initial asking prices, because I’ve noticed a number of high-price sfhs in my hood stay on the market for several months (unheard of a year back) before being sold, and having to reduce prices a bit in order to sell. These were all flips as they were completely renovated.

There is a money in SF always to be sure, but some of it has been spent/spoken for in the past 1.5 years, and also many affluent families are purchasing second homes outside of SF so money is going there too.

For a bubble to burst, the only way to prove it was a bubble, there has to be some factor that modifies demand, since supply will only increase slowly in the next few years.

In Paris, the latest figures show that resale of existing apartments is effectively flat, with only single figure declines in some arrondissements, following a number of years of what seemed irrational increases of 20 percent.

I would guess that the worst we will see in SF in the next five is a flattening of the rise.

I agree we’ll see a flattening of the rise in SF for the next 3-5 years. I feel like we’re in a flattening following a period of rapid appreciation. But not necessarily a bubble, but certainly prices won’t go up the next two years as they have been the previous 2-3.

Agreed, for the most part. Rates quickly getting out of hand would change this analysis, although that seems very unlikely to happen with this fed in this (worldwide) economic environment. It is easy to forget that rates have been dropping for 30+ years, not a trend that is likely to reverse in a fast, explosive way. The fed wants (needs?) inflation, major housing market declines are not in their plans. I think a plateau with the possibility of a small decline (in SF all this really takes is 1-3 bids per home instead of 8-10) seems like a reasonable expectation.

But if the interest rates rise in 2015, which the FED has indicated- wont that influence, how much people can borrow? Wont that reduce things, ever so little?

Yes, an interest rate hike should influence home prices (downward). Only 40% or less of home sales are all cash.

Ahhh yes… more reason to Ellis all the smelly hippies and send them packing to Tracy

But how much are they worth in Bitcoins?

CHINA!!!