Single-family home values within the San Francisco MSA slipped another 0.2 percent from August to September but remain 7.9 percent higher than at the same time last year, according to the latest S&P Case-Shiller Home Price Index.

While the aggregate index for San Francisco home values has gained 65 percent since early 2009 it remains 11.1 percent below its 2006 peak and the year-over-year gain as measured in September was the smallest in two years.

While the bottom third of the market gained 0.4 percent in September, up 14.8 percent since September 2013, the index for middle third of the market dropped 0.6 percent, the largest drop since January 2012, and the top third of the market slipped 0.3 percent. The index for the middle third of the market remains up 6.6 percent higher on a year-over-year basis, up 8.5 percent for the top third.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA are back to just below May 2004 levels (29 percent below an August 2006 peak); the middle third is back to just above January 2005 levels (12 percent below a May 2006 peak); and values for the top third of the market are 2.2 percent above their previous peak in August of 2007, slipping 1.6 percent over the past three months.

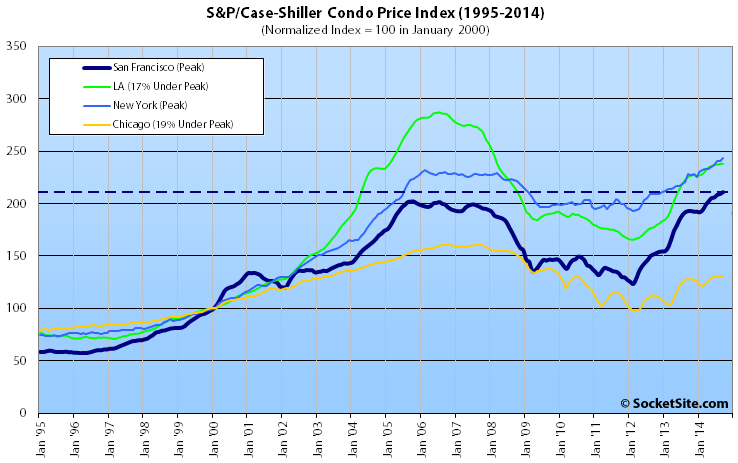

While single-family home values slipped in San Francisco, condo values ticked up 0.8 percent in September to a new all-time high, up 9.3 percent over the past year and 4.4 percent above the previous cycle high reached in October of 2005.

For the broader 10-City U.S. composite index, home values were unchanged from August to September but remain 4.8 percent higher on a year-over-year basis, the slowest year-over-year pace since 2012 and still 16.6 percent below their June 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Good news that things are starting to flatten out. Was getting too crazy to avoid an(other) ugly correction.

Condominiums are largely in different neighborhoods than homes located in San Francisco. Condos are typically located in the newer neighborhoods and are they themselves newer; i.e. new construction. It is not surprising that the new construction trades at a higher price point than more mature product.

paul, thats really only the case for SOMA. all across the city, there are a ton of condos intermixed with SFHs.

The number of condos sold recently in SOMA may be disproportionally skewing the current results, but your general comment is not true

The condo category is really a proxy for San Francisco proper (or way more of a proxy than the single home index). While the single home index is still below peak (particularly for bottom third), the condo index is now above peak…mirroring the experience in SF of both condos and sf homes in most neighborhoods.

But the single home index has been above peak at a few points over the past year, correct?

The Case-Shiller index doesn’t include first-time sales and it measures changes in value – not prices – on an apples-to-apples basis, unlike a number of other condo “indexes” that have recently been making the rounds and are extremely susceptible to changes in mix and are more a measure of the type of units coming on line versus actual changes in value.

It is interesting how the each segment of the housing group has closed in on the SF Aggregate as opposed to during the bubble when the bottom third popped up on inflated appraisals and mortgage fraud.

I noticed that as well and see at an indication of things finally returning to a more sane state after the bubble’s divergence. I’m not sure what it says about prices overall, just that it looks like the market is fully over the bubble’s effects.

Condos serve more of the zeitgeist now for yuppie city living. People want efficient spaces in ultra desirable neighborhoods where they can walk/bike to everything and are ok with smaller spaces and more density, but they don’t want to compromise on high-end design and features. Condos works very well for today’s high-earning, upwardly mobile couples and young families, and I would invest more here. Especially if you can offer desirable features (roof decks, outside space, turn-key tricked out kitchens and baths).

Everyone I know wants a big house with a garage and a yard. Now many cannot afford that in the neighborhoods they like, so they end up with a flat or condo. Look at the market for big, re-modeled homes. It’s been crazy in SF.

“People want efficient spaces…”

“…ok with smaller spaces…”

Ah yes, the dream of all yuppies, living in a small apartment at high price per square foot.

Sounds more like the dream of a broker or developer.

Note that the rich, and aspiring rich, in all times and places want big houses to live in. This includes tech people.

Meh…

I’m sorta young (I’m 34). And I’m sorta rich (nothing I would ever say in public, and rich is all subjective, but I make around $240K, with a net worth of around $2M). Oh, and quick side note, these wealthier years I’ve experienced over the past 4-5 years have also been my most unhappy. Anyway, I have to disagree with conifer on this. Certainly for myself and many of peers, smaller spaces in good areas with nice amenities and cool finishes/features is exactly what we want. I have no idea how to manage a home. I have shitty taste and don’t trust myself to decorate anything. I don’t have the time or patience to understand what’s going on with the older water heater. I just want it easy and done and nice looking.

Good work, that’s an excellent amount of savings. With the cut the government class takes, it’s hard to put away 2m even with a 240k income.

You can’t easily save 2M with a 240K income. There has to be wise investments and probably some leverage. Maybe also some windfall from stock options? I used all 3 to reach a similar outcome.

I bet Mittens did not get 2M from savings or leveraged investments. Maybe from stock options, which could be a one-time income and not repeatable, or at least not guaranteed to repeat.

That said, I can understand that more and more people now prefer a condo in the city over a big house in the suburb or even west side of SF.

At 34 he went through 2 major run-ups in RE prices. I have ridden 2 major cycles and bought at the trough on both, with property values dwarfing the amounts borrowed. I guess with the proper moves, you can make a couple of mils in 10-12 years and still sleep at night. Disclaimer: imho it’s too late in this cycle to get in the game.

Mittens can be a woman. Let’s not automatically assume someone is male.

^^ Or, just marry well and hope your spouse can take care of these things.

Not as much as mittens, but I built up $1 mill net worth on a salary of $145 K in my 30s primarily through moving through management at a growing company and accumulating stock options and selling them at the right time. Without the options, I would have done well, just not as well as quickly. I have friends my age with old houses in the west part of the city, but prefer the look and convenience of my friends with tricked out condos in the east part of the city. I’d rather spend $1.2 on a modern condo in a walkable part of town near all the action, than $1.5 on a house in the Outer Richmond. I don’t really need the space, but I do want to be near best restaurants, action, etc.

Are you married? Planning on having kids? Some people are willing to raise kids in a high rise, but not too many. Your housing desires change throughout the course of your life.

Good points. Almost all the people that have had babies in my MDU building in the more urban side of SF moved out to less densely populated areas by the time their kids were toddlers.

Same for transportation. When I was a kid and even a teenager, almost everyone my age relied on a bike to get most places they were going. But once we became adults, almost all of us bought cars and use them much more than bikes. I guess for most people transportation desires change throughout the course of their life too.

I was at an extended family’s home in Fremont for Thanksgiving and their home (parents w/ four teens) was huge. I counted a large living room (with a baby grand piano,) a giant dining room, kitchen, and a second living room (family room) just on the first level. The guest bathroom was bigger than most masters in SF. The second level consists of four large bedrooms (all with a separate area with built-in bookshelves and desks) and two other open living rooms. Multiple wrap around back yard decks with a gazebo and separate pen area for raising chickens. So serene. I could camp out @ their backyard for a week. I ate a kale and greens salad grown from their backyard. The family (worked in tech) had lived there for eight years and I asked if this was too much space for them. They shrugged and said if an opportunity for a nicer and bigger place came up, they would take it.

SF condos have a demand right now. For people decide to have no kids, the demand will be always there. My concern is that majority of people will raise kids at a later stage of their life and the majority of the parents will move out the SF condos to suburbs, Noe or Richmond/Sunset.

Will the demand for SF condos be there for the long term?

im 40. almost all my friends with kids moved to Marin or the East Bay in the last few years as their kids reached school age. the peninsula market is so high, they have chosen to commute from sausalito or mill valley, or orinda and commute.

I’m 40 and we have an 8-year old. At this stage I don’t feel I need a large house and yard and would rather live in a smaller place in a more desirable location (close to work, child’s school, etc.). Commute is everything. I can’t stand spending time in a car and my husband (40+) does most things on a bike. But we’re also fit and able to walk, bike. I do know some people through my kid’s school who seem to do everything by car. We don’t see the appeal, have no desire for a gazebo, etc., but to each their own.

I bicycle 15 minutes each way to work and get to spends hours more a day with my family than those those who endure long grueling commutes. We all share one bathroom but it is a small sacrifice for a better quality of life for the whole family.

So perhaps those many many buyers who are taking shuttles 1 hour each way to work in the South Bay should also move closer to work ? I would say they should, and NO, San Francisco is not obligated to absorb all the population and job growth of the entire Bay Area. Also, regarding all the finger wagging of being able to bike to work, have you given up owning and using a car yet which you admitted was “necessary” because you had children?

Yes, absolutely they should move closer to work. Or convince their companies to open offices in SF (as is happening more and more – I’ve worked for two companies that did this after enough employees complained).

why should they move closer to work? why is that your business? a lot of them want to live in the city, and they have every right. People should be happy about the buses. They are keeping hundreds of cars off the roads. And for those who argue that the buses allow people to lvie in the city, that is BS. Ive been working on the peninsula for 20 yrs (not in tech), but most of my friends are in tech and all live in the city (until kids get to be around 4). They lived here before the buses and all commuted. they live here for the restaurants, walkability, culture, nightlife. The job is just a place to go during the day. they live their life in the city. they have the same rights as the lifelong san francisco who lives 2 blks from his job.

“San Francisco is not obligated to absorb all the population and job growth of the entire Bay Area. ” no one said anything about obligation. We are a market based economy, so if someone can afford it, they have the same rights to live here. that means an engineer or executive working in Cupertino has the same rights to lvie in SF as the teacher working in the inner city schools, and the Cupertino worker probably can afford it and thats OK. The teacher can live in Oakland and commute and the engineer can live in SF and commute. Again, we live in a capitalistic country and have the freedom to lvie wherever we want as long as we can afford it.

San Francisco has no obligation to provide low income housing for the entire bay area.

San Francisco has no obligation to provide for the homeless population for the entire nation.

Everyone can choose where he or she lives. It is illegal to forbid someone to move into or out of San Francisco.

San Francisco does not provide low income housing for the entire bay area.

San Francisco does not provide for the homeless population for the entire nation.

There will always be a demand for SF condos (so long as jobs are plentiful in SF.) Condos serve the needs of high income singles, dual income, no kids married couples, or well to do middle age + couples downsizing. Plenty of options exist for people in those categories. Whenever rent prices exceed a certain level, demand for rentals will decrease when it becomes cheaper to buy. Building more housing, be it condos, rentals, or single family homes has the effect of increasing supply and lowering costs.

Would I ever buy/live in an SF condo.? Most likely not. The HOA fees are too expensive in my opinion and condos are too expensive. I have the option of living in a nice home in SF which I can always renovate to my high standards and tastes. Parking is never an issue for visiting friends and it is somewhat quiet and peaceful (not as much as the suburbs.) But I can go away on vacation for the ultimate in rest and relaxation.

I just put up my holiday lights in the large picture window of my home. It looks stunning (to me.) I like how they light up the entire room indirectly at night so drivers, neighbors, and pedestrians could share in the joy. Wouldn’t have the same effect if I was in a high-rise apartment or condo.