Of course it’s entirely possible the listing for 333 Bush Street #3701 was intended as a red herring when priced at $1,600,000, then again that was four months ago and the asking price has subsequently been reduced to $1,500,000. Or perhaps 333 Bush Street #3801 really is “priced to sell” at $1,150,000. Only time (and SocketSite) will tell.

In either case, same agent, different expectations (or at least approach), and damn those price setting neighbors. Oh, and 333 Bush Street #4004 which is slightly larger (1,382 square feet versus 1,320) closed escrow on December 1 with a reported contract price of $1,150,000. Just another data point.

∙ Listing: 333 Bush #3701 (2/2) – $1,500,000 [MLS]

∙ Listing: 333 Bush #3801 (2/2) – $1,150,000 [MLS]

still fracking expensive

SocketSite, your by-now-overly-cliched “damn those [neighbors/comps/agents, etc.], whenever a lower price is announced in a neighborhood/building is getting awfully tiresome. Maybe this phraseology was cute 6 to 12 months ago when the majority of posters at SS were artificially bullish. But at this point, with prices (particularly condo prices) clearly having taken a major hit across the City, your formerly meaningful language has outlived its usefulness. In any down market, of course there will always be new listings that are lower than comparable listings from the day/week/month before. The lower prices in the market generally are not caused by this. The reason #3701 never sold is that it was signficantly overpriced, not because there were lower-priced comps in the building. Now that there are, it will continue not to sell, but that’s nothing new.

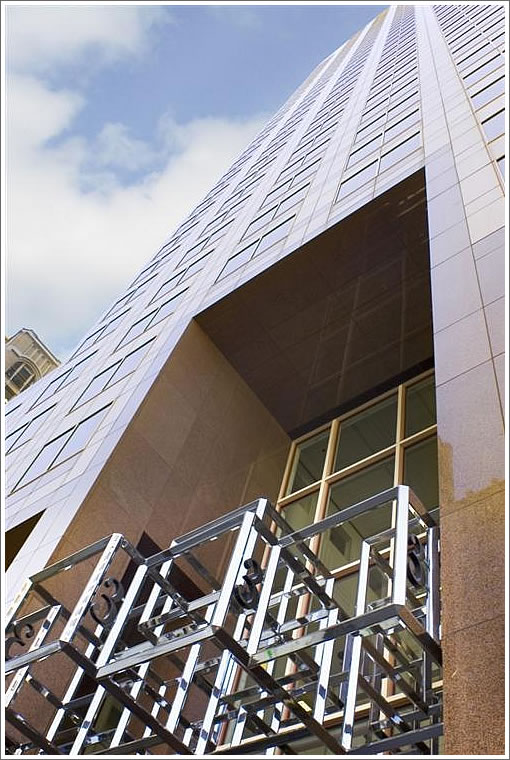

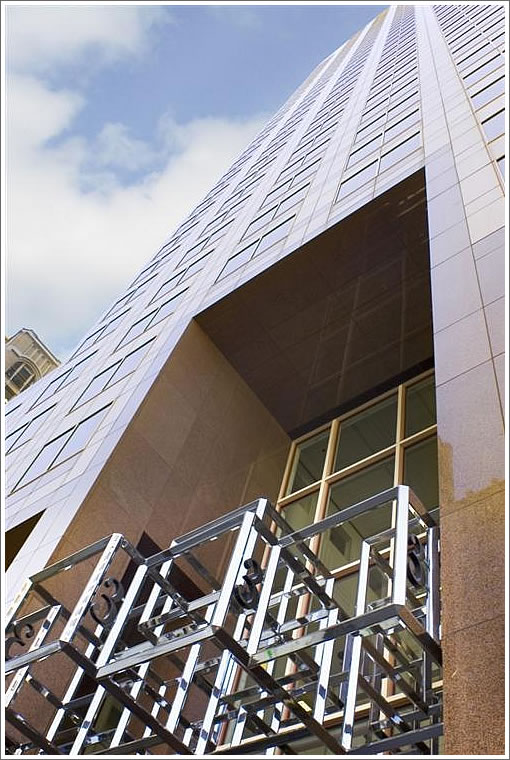

333 Bush has many great characteristics: It’s across from Belden Lane (Plouf, Sam’s,etc.) close to Union Square and in the middle of the finanicla district, big balconies, it’s intimate (45 units) and is one of the first of the newer high rise condos (1987).

The deal killers I have faced when representing buyers for the builidng: Leased parking, High HOAs (only 45 units), a little long in the tooth, some awkward floorplans.

Chuck Schwab owns / owned (not sure now) a couple of units there, Sharon Stone used to live there, Clint Eastwood’s daughter (if I rememebr right), etc.

It’s a good building for people want their privacy, and want to be close to the financial district and Union Square.

“333 Bush has many great characteristics: ”

Yes!

And if you wait until 2011 you’ll be able to buy a unit for half of what it would have cost at the peak.

333 Bush may have many great characteristics, but 3801 has all the same characteristics as 3701 and is asking 450k less.

I thought Sharon Stone used to live in the Sea Cliff?

“I thought Sharon Stone used to live in the Sea Cliff?”

Well, if you ask a realtor, Sharon Stone always used to live right next to the property that’s for sale. Of course, Sharon Stone also used to live in 333 Bush.

Sharon Stone did live there. I worked at 333 Bush managing a $26M renovation to 26-floors of a Top Ten law firm. She lived up above us and once got stuck in the elavator with her housekeeper, and when she was married to Phil Bronstein–the editor in chief of The San Francsico Chronicle. The fire dept came and pulled another elevator cab alongside and pulled her and her housekkeeper up and over into the other cab over a deadly gab. The building manager was steamed as she didn’t just let the emergency stop go…and it might shake on the way down but he thought safer. I don’t think I would have done that. She explained how very violent the shaking was…I would have been very spooked too. She is very gracious in person.

My kids went to school with Sharon Stone’s son, and if she owned a place here, I doubt she was ever there. She was always in LA (their nanny was really, really cute — blew Sharon Stone away). I think he goes to school in Marin now.

I’ve been in this building a thousand times. It’s where Heller Ehrman was before they imploded. It’s a nice office building but I had no idea it had residences. It would be a good location if you work in the financial district, but I have to think it would feel like you’re living in an office and not a home. Might be good for a rich guy who lives in Marin or farther away and just wants a place to sleep when working late in the city.

I like how the listing for 3801 doesn’t show a single picture of the unit.

Paul,

That was one of your best posts. It was informative, balanced, and spoke from personal experience.

Well done. The balance was especially appreciated.

Phil Bronstein + Sharon Stone, I believe. Maybe that whole marriage thing was a rumor too. Publicity stunt.

tipster,

I feel a warm fuzzy.

Wait a minute! She did live in Sea Cliff…

http://www.people.com/people/article/0,,615725,00.html

Both these units are in “original condition” meaning at least another 750k min to do a remod. Who wants to pay over 1MM to live in a place that has the insides of 1987? Not me.

Diemos made a really good point. When 333 was hot units here were easily going for double what is being asked now. No need to wait till 2011…

Most recent sales on both are interesting. 3801 was purchased in 1995 for 400k, and 3701 for 375k in 1996. Either way the sellers still stand to make some cash.

Well hello… I AM THE LISTING AGENT and most of you folks are WRONG about the building. I have lived there 7 years and was the manager of the building from 1997 to 2005. Here are some fun facts…

Sharon did live in the building (i moved her in and out). Yes 3701 is having difficulty with his numbers, but like we all know… write your offer and see where you end up!

3801 is indeed priced right in the 800’s psf. 4004 ACTUALLY sold for $1.250M, buyer paid $100K for furnishings/electronics and saved in taxes! ha!

The dues are low considering our comparable buildings.

If you’re really interested why don’t you make an appointment with me to view the property and get THE REAL SCOOP!!!

Chuck Schwab owned a unit and I sold it…

To Denise:

I like your objective, emotionally-detached views on this.

That realtor post is hysterical.

4004 ACTUALLY sold for $1.250M, buyer paid $100K for furnishings/electronics and saved in taxes! ha!

I love the “ha!” And you wonder why smart people like me call them “fraudsters”, lol.

Fun with Propertyshark:

3801 for sale 2009 @ $1.150M (“priced right” lol)

3901 (same square footage) sold 5/2000 for $1.125M

4004 sold 12/2008 @ $1.150M (plus the value of the electronics and furnishings I guess that were omitted to falsify the tax records and sales data)

4204 (same square footage) sold 12/2000 for $1.375M

Kinda makes my longstanding prediction that we will see 1999 prices (on average) for SF within 2 years (from now) not seem so outlandish anymore, at least for this building 🙂

LMRiM, would smart people like you include personal property such as furnshings in the recorded sales price of a property? There’s nothing fraudulent about selling personal property separately from real property.

LMRiM, would smart people like you include personal property such as furnshings in the recorded sales price of a property?

No, of course not.

There’s nothing fraudulent about selling personal property separately from real property.

Absolutely right. But do read what the fraudster wrote above: “4004 ACTUALLY sold for $1.250M”

So, Alpha, which is it? Did the unit sell for $1.15M (thereby making the fraudster’s post misleading) or did it sell for $1.25M minus some reasonable amount – way less than $100K – for the FMV of the equipment and furnishings (in which case it is most certainly an attempt to cheat the taxing authorities – not that I have anything really against that, if one is willing to take on the risk I guess – government just throws most of the money it collects away anyway, and “starve the beast” always seems a reasonable ex ante principle to me whenever approaching the question of the “ethics” of taxation :))

Alpha, I get the sense the Realtor’s statement that the buyer “saved in taxes” meant that the furnishings and electronics were probably hauled to the dump shortly after the sale, and were worth nowhere near $100K.

The parties assigned $100K to that part of the transaction so that the sale price of the property could be made to be lower than it really was, thereby reducing the property taxes paid.

The realtor attempts to have it both ways, by excluding them from the sale price, but WinkWinkNudgeNudge telling everyone she can that the real price was higher.

Maybe I have that wrong, but that’s how I interpreted the message.

Alpha, no, this is illegal unless you’re paying fair market value for the personal property. $100,000 for some electronics and furniture sounds steep.

is the agent saying that the agreed-upon value of the unit was 1.15M but the buyer shelled out additional 100k for the furnishings, which was rolled into the sales price to make it a 1.25M transaction. thereby, the buyer gets to finance the furniture through the tax-deductible mortgage?

Wait, I know.

How about we call someone a fraud in the meantime before we know the real story?

I think “fraud” = libel is probably a lot easier case to make.

Denise,

Do you often go on RE blog sites and post information about your clientele, or only when you want to name drop to boost your own credibility? I don’t know anyone else in the biz that would blast facts out into cyberspace about where their clients reside. Especially when they are high profile and/or a celebrity. So unprofessional. Instead of touting how wonderful these units at 333 are to all of us on SS (who are extremely in the know), why not hire a photographer to get some pics up on MLS? Just a suggestion. Do it with class. Paul did above.

I think it’s always a bad sign when a listing doesn’t have any interior photos, and neither listing does…I’m thinking the interior must be very DATED…….

I regret that some of you took my previous post as anything more than a quick summary of the history of 333. As for comments about “fraud” that’s just silly and petty.

There’s no reason to reduce this page which could be a worthwhile resource to a forum of name-calling. Your presence here shows you have an interest in the market and the building specifically. If you would like to sit down and have an open and mutually educational conversation, I’d be happy to share my expertise and listen to everything you have to say. 333 is a perfect example of why buyers and sellers need expert realtors. While there are conventional wisdoms that may be true in many markets when dealing with the SF market and a unique building like 333 – one needs an expert to help them navigate the process.

It’s been my experience that there are many “experts” (non-experts) in this field. I realize real estate is very emotional to buyers and sellers and take this seriously.

Denise Paulson

415/860-9585

fluj,

Don’t show your ignorance of legal principles. It’s embarassing.

The realtor has invited some problems for herself with her post above, not only identifying herself, but also implicating an identifiable client in potential tax issues.

Back off, fluj.

Your pictures are coming.

Touch a nerve, did we? You have no idea what the hell happened, and here you are with fraud this and fraud that.

I rest my case. At this juncture “Fraud = libel” trumps “tax fraud was committed in the sale of unknown personal property of unknown value.”

And judge, if I may, easy with the “fraudster” baloney.

fluj, c’mon now, you really can’t defend Denise on this one. Denise wrote “4004 ACTUALLY sold for $1.250M” then added after a comma “buyer paid $100K for furnishings/electronics and saved in taxes! ha!”

When I read that I assumed that the selling/recorded price must have been $1.25M — ie the ACTUAL selling price — and the buyer paid another $100k for other property. LMRiM pointed out the lie there. Either there was a tax fraud on the sale (the only real explanation as otherwise there would be no “saved” taxes (!)) or Denise flat-out lied about the ACTUAL selling price. Realtors should be first in line to condemn such dishonesty among their ranks. Don’t just reflexively defend the herd.

I’m not defending Denise. I didn’t care for her sales pitch or her language either. I do not know what happened, and neither do you guys. Personal property was included in the sale, so that means tax decuctions occurred down the line in the future? Who knows?

“but also implicating an identifiable client in potential tax issues.”

Totally morally reprehensible, right? And surely completely different from you posting an individual’s property tax late payment and speculating that said person was in a financially untenable position, all in a very visible forum?

Legally, maybe? who knows. The language was all vague?

Morally? you’re very much a hypocrite.

When I read that I assumed that the selling/recorded price must have been $1.25M

Trip, I read it as the recorded price was $1.15M, both for MLS purposes (as identified by the editor in the lead in) and for tax purposes (to get the lower tax basis and lower taxes going forward). I read the agent’s “ACTUAL” sales price announcement as – wink, wink, nudge nudge – the place was “worth” $1.25M even though the sales price was recorded as $1.15M. She has an incentive to promote this idea because she will earn a commission on the sale of 3801, and even 3701 (if the seller gets at all realistic). No big mystery here as to the actual language, implication and motivations.

Touch a nerve, did we?

Not at all. I was just trying to get you to stop highlighting what was obviously an ill considered post by another member of your “profession” (lol). Obviously, I failed, and you can be reliably counted on to step in it whenever you post, and no force on earth is going to stop that.

Oh, and I love the royal “we” in your attempted dig.

Me highlighting? Do tell. Looks a whole lot like you grandstanding from here, hypocrite.

These personal attacks are really getting old. This site is great, but some of the comments lately are really sad. You sound like children. Can’t someone be the bigger person and stop with the name calling?

I used to work in the building as well — the entrance is totally seperate.

The building was build to have multiple corner offices — the top floors are the condos — and indtead of corner offices they have massive terraces. You can see the terraces while sitting in Belden Lane and looking up.

I looked at 333 bush in 93. a 2 bed on the top fl 2 very large decks. asking 800k plus.

The look and feel was that of a cheap apt

I went over to 611 washington and bought a

1 bed 1900 plus foot that was much better

for 550 k

Denise is probably mostly right but sure doesn’t make her case very well.

if buyer says to seller “look, i’ll pay you $100k for your furniture if you sell me the condo for $1.15mm”. Is that tax fraud or unethical? any lawyers here?

The views from these units are amazing, though I recall the kitchens were extremely small considering the available floorspace.

if buyer says to seller “look, i’ll pay you $100k for your furniture if you sell me the condo for $1.15mm”. Is that tax fraud or unethical? any lawyers here?

Obviously, there will be questions of fact, the most important being what the FMV of the furniture is. Additionally, you are asking two questions: ethics versus “tax fraud”, and I think a lawyer should only really opine on the legal fraud issue, as in general ethics are personal issues. (Note, however, professionals in real estate holding a license are also held to a code of ethics that is independent of pure common law or statutory legal questions of fraud, although their behavior relative to that code would be an issue when determining whether legal fraud occurs.)

I’ll leave it to Trip to give the actual, practicing lawyer answer to this (if he is so inclined :)), but IMO this would likely satisfy the legal requirements of fraud, assuming that the FMV is materially below $100K.

Clearly, one of the key issues for fraud is intent, and paying well in excess of FMV in what appears to be a quid pro quo for a lower reported sales price creates a pretty strong inference. This would not be an issue in states where assessed value for tax purposes is determined independently of sales price, but for California, obviously prop 13 raises the states. Because the tax basis will be used to adjust tax payments mechanically in the future (2% increase only per year), arguably the fraud is a continuing one. In any event, the dollar amount of the fraud is larger at the outset, because (in the present example) it consists of the entire present value of the forgone taxes on the $100K as it grows at 2% in perpetuity. Additionally, there are transfer tax issues relating to the underreporting of the true transfer price, although these are likely to be small and one time.

The realtor, as well, in additional to participating in such a scheme (all hypothetical here), also has ethical considerations based upon his or her adherence to the professional codes and standards. These likely include a general proscription against participating in a fraudulent scheme, as well as any duties to report “accurate” sales prices (or at least not participate in a false or misleading publication of price data). Fluj seems up on his ethics – perhaps he can chime in here with the relevant section references.

(BTW, fluj, this situation being discussed is quite a different situation from reporting on an anonymous blog (by someone who does not owe any duty to the individual or entity in question) publicly available data on nonpayment of taxes. The corporate entity (very difficult to sue) in the situation you keep unwittingly highlighting is holding out the property to a generally unsuspecting public for rent, and in that context highlighting potential cash flow issues on a very visible blog is highly ethical.)

I hope that helps, sfrob!

Any information provided here is hypothetical, and does not constitute legal advice. Anyone seeking to act in situations that relate to issues raised herein should consult an attorney who is familiar with the specific facts surrounding the situation and can advise accordingly. Never trust random anonymous internet bloggers without independent verification!

When you sell personal items along with the sale of real property you are required to issue a bill of sale for anything that is not a fixture.

The differences you allude to I alluded to as well. We disagree on the moral question there, and that’s fine. We’ve both made our points. And I do appreciate you expressing yourself without being sardonic.

I only spent a few minutes on sfrob’s question. With all the disclaimers that nobody is my client here, this is not legal advice, etc., etc., yes, one would face significant risk of civil and criminal liability if a buyer paid $100,000 for property worth less than that in conjunction with a $1.15M sale of the property, then reported the sale price as $1.15M. This is because the true (or ACTUAL as Denise puts it) sale price was higher than that reported. See section 461 of the Revenue and Taxation Code:

461. Every person who willfully states anything which he knows to be false in any oral or written statement, not under oath, required or authorized to be made as the basis of imposing any tax or

assessment, is guilty of a misdemeanor and upon conviction thereof may be punished by imprisonment in the county jail for a period not

exceeding six months or by a fine not exceeding one thousand dollars ($1,000), or by both.

And as LMRiM notes, there would also likely be additional liability for underreporting the basis for, and thus underpaying, the city transfer tax.

You could get around this by fully disclosing the $100,000 component and seeing if the assessor is too lazy/stupid to adjust the tax basis accordingly. Maybe that’s what happened here resulting in the money “saved in taxes” to which Denise alluded . . .

buyer paid $100K for furnishings/electronics and saved in taxes!

This is obviously referring to the sales tax that would have been paid if these items were bought new… you’d have to be fairly devious to think it might be anything else 😉

Trip & LMRiM – to play devil’s advocate (which the buyer/seller/agent would surely do if sued) aren’t there many arguments against this being fraud? as in… buyer is convinced market will be 10% lower in 6 months, yet seller refuses the price. but buyer also thinks the furniture is perfect for the place, and wants seller to feel good about “giving away” the place, hence their offer. it’s all negotiation after all – everyone values things differently. as for the agent, she’s just putting a spin on it so she can try to sell the next place.

another – furniture may have cost $20k, but buyer values their time and effort in recreating it, and/or avoiding going through a move. and thinks $80k is a bargain in that regard.

and really stretching here… but if you can flip art and real estate for profit, why not furniture?

we, the uninvolved commenters, can’t know what went on in the minds of the buyers and sellers… but my guess is that it was more complex than a simple “gee, let’s avoid some tax”.

but i’ll agree on one thing… Denise’s post was ill considered. she had better hope none of her current or past clients see her post.

sfrob, you just proved that law school is a scam! (I only say that half-jokingly). Those are exactly the arguments I would make if I were representing this guy in a civil or criminal case. As LMRiM noted, the key issues are FMV of the property and intent, and those are questions of fact.

you just proved that law school is a scam! (I only say that half-jokingly).

You got it, Trip. In many ways, law school is sort of a scam….

Back when I went to Yale Law School, I took a course called “Blood Feuds” for credit, which was basically a literature course on Icelandic saga literature and how they settled their disputes, taught by a visting law school professor from Michigan. When I was a summer associate at a major NYC law firm (one of the “Big 3” back then – CSM, S&C, and DPW – rather not say which one), I did some contract work for them at about $100 per hour, 20-30 hours per week when I was supposed to be living in New Haven. My best friend worked there basically full-time in NYC that year, and he was a student at Stanford, lol. He showed up exactly 4 days in Palo Alto. I’m not kidding. Good memories….

So, I think we all agree that real estate licenses are not particularly hard to obtain.

Neither are driver’s licences.

Some of the indignancy on here could be directed at getting lousy drivers off the road instead of bashing realtors. The public welfare would be better served, IMO.

Just because you have a real estate license doesn’t mean you’re any good at selling real estate.

Heck, just because you passed the California Bar it doesn’t mean that you’re a good lawyer. It only means you’re very good at taking tests.

And just because you can post on a website doesn’t mean that you have anything worthwhile to say.

I’ll add one more:

Just because you try to spam someone’s informational real estate blog to discuss your listings at 333 Bush, doesn’t mean you won’t end up informing the readers of that blog in ways you never dreamed possible.

I couldn’t possibly agree with amused more.

tipster – that is a patently unfair criticism. She answered specific questions raised in the comments for an article about the building she discussed. Hardly spam.

This has been a fun diversion into ethics, but people should note that the realtor in question came on the blog saying that most “folks” here were “wrong” and correcting (so to speak) the editor’s lead-in that 4004 sold for $1.15M, which was what the MLS reported. Clearly, this was done to justify the $1.15M listing price for her listing, 3801, which is smaller and two floors lower than the one that just closed for the same price, yet “priced right”. No big deal. Just a variant IMO of the classic sales tactic of trying to explain away “inconvenient” comps. No sale = no commission. Remember that and you won’t go wrong!

I’m actually interested in the part of my 12:02 pm post above that listed the sales prices (from prop shark) from eight years ago, which basically look higher than today’s prices! Is this accurate? For people out there who know this building well, are we seeing 2000 prices here?

LMRiM, everyone knows that Yale Law really IS a scam (f***ers didn’t admit me, not that I hold unreasonably long grudges or anything).

And fluj, I wholeheartedly agree with you on the point about Bar passage being no guarantee — spend an hour in SF Superior Court and you’ll see an awful lot of boobs. But there is one significant difference — if lawyers pulled half the dishonest stuff that is routine (not universal, but routine) in the realtor world, they would be disbarred and could never work in that field again. Lawyers are pretty tough about policing the crooks in their midst. Realtors should pick up on this — that was my point when I suggested you not reflexively defend the near-certain fraudulent behavior that Denise flaunted in her very public post.

Good points about lawyers policing each other, Trip. For the most part, lawyers get ahead in the field by impressing other lawyers (partners, judges, corporate counsel, etc.). There is obviously some sales aspects, but the guild retains some of its historically anachronistic aversion towards overt mixing of “filthy lucre” with the profession. Realtors get ahead by selling, plain and simple. The way you sell is you do what you must to get someone to sign on the dotted line. “Referral” business and all that – sure – but for most real estate purchases are infrequent events, and given the opacity in the industry how can relatively unsophisticated purchasers know whether they were represented well or poorly?

I chuckled at fluj’s list above. Some really deep thought there, lol. Especially the part about lousy drivers. If deaths from lousy drivers suddenly exploded with such ferocity over a limited period of time that the entire US (and perhaps the entire world) economy was destabilized, I guess the “public welfare” might be better served by ignoring the role of the very ethically challenged realtor profession in the bubble, and concentrating on lousy drivers. They obviously weren’t the whole reason, and weren’t even really a large reason, but they fulfilled the role reserved to them by the master fraudsters (Wall Street, but above all the Fed and USG).

(I know you’re a partner, Trip, at a major law firm here. Find one of your partners who went to Yale when Calabresi was Dean and ask him or her to recount the “get off the treadmill” speech that Guido gave every year to the incoming class. You didn’t miss much academically, but there really were a collection of oddball smart people, and a whole lot of them from my class at least didn’t last very long as lawyers 🙂 )

The secret to being a happy lawyer:

quit.

I just find it odd that real estate agents keep getting blamed on this site for the inflated housing prices rather then the mortgage brokers and institutions that were giving the loans to anyone without a pulse. Why exactly are over inflated housing prices the realtors’ fault?!? Would they have been able to drive up housing prices if all those failing mortgage lenders had rational loan standards?

I’m amuzed how so many posters think they know so much about everything. Come on, if someone spends over a million dollars for an apartment, it is very possible that the drapes alone could be $100K. Furniture, electronics and who knows what else can be worth quite a bit. The last place I sold the buyer wanted everything the way it was and would have paid quite a bit. Since these were personal items I would not part with them. There are design elements that are worth quite a bit to some folks, specially those that can afford to live in high priced condos. Custom furniture is also sometimes needed in order to work with the typical smaller floorplans. Beats having to hire a new interior designer. Besides, some people do spend their money to create a home that they can really enjoy. It’s not all about fraud and taxes.

Take it with a grain of salt.

The people who say that it is impossible for interior design elements, furniture, and electronics to total 100K are the same people who will say that a bathroom costs 80K to remodel.

Back on topic, still no interior photos? I’ve walked by this building a hundred times and never knew it was condos. I’m curious what they look like inside, especially the views.

The point above about lawyers policing each other jogged my memory a bit, and I was able to dig up this article I read a while ago.

http://patrick.net/housing/contrib/ethics.html

Here’s a choice quote from the article:

”

NETHICS (noun): Ethics according to the National Association of Realtors.

First and foremost on this agenda is do not ever, ever, never under any circumstances give the slightest smidgeon of a passing thought that brokers fix commission prices. The first and only video we viewed trained us specifically

on the “commission objection”, to basically say whatever you want, other than “this is a typical charge for the industry” and certainly NOT “this is what everyone charges”. This message from NAR took up the first hour of a four-hour

training class on ethics. I was sitting there just shocked.

Secondly, we never ever under any circumstances say anything negative about other Realtors. What? If I have personal knowledge that some agent is a real snake, I can’t warn people? That’s right folks. Any and all such comments

must be sent to the “Ethics Committee” and dealt with behind closed doors. Hmmm. What about the public’s best interest? This second message took up another hour of this four-hour seminar.”

Another quote –

“As for me, I continue my pursuit of a more ethical profession. I’m pondering law school. (Just kidding.)”

. . . tangentially related . . .

I’m working on Title Insurance issues right now and would be interested in hearing from RE agents/brokers (or anyone) about their experiences with inducements from Title Insurers.

In the reports I’ve read, the business is dependent on inducements (kickbacks) for referrals from mortgage brokers, builders, and RE agents.

From what I’ve leaned, the title insurers’ customers are the RE agents who dutifully steer their principals to the insurer who best serves the agent’s interests, but is rarely the clients’ best deal.

So, I’m wondering what I would do if I were a RE broker and Title Insurer X gave me thousands of dollars worth of “educational” materials, rented an office in my building at above market rent, and printed all my flyers for me at below cost, and by the way, they’re also very quick and work hard to close the deal well.

Would I steer my clients to that Title Insurer b/c, after all, they’re good for the client b/c they’re very quick and work hard to close the deal?

Hard to say, but attorneys could never get away with that and RE agents/brokers do.

Rillion, because the buyer’s agent is supposed to have a fiduciary responsibility to his/her client. Problem is, in the last few years, agents have been knowingly pushing the buyer over the cliff and walking home with the commission.

“Don’t worry about it. You can refinance in 3 years.”

http://www.youtube.com/watch?v=Ubsd-tWYmZw

If the buyers’ agents actually did their jobs, moron buyers would not have dug themselves — or US taxpayers into quite as deep a hole.

Back to Sharon Stone…when I worked at one of the former Investment Banks in the BofA building during the dot com glory years she was always to be seen in Belden lane having a drink or dinner so I imagine she did live near by. I thought she was hotter in person too and was always very friendly with us office stiffs.

Sharon Stone is (was?) my father-in-law’s neighbor in Sea Cliff. She put her Sea Cliff house up for sale a few years ago for $12MM. Not sure if it sold or not. So she and phil (when they were married) kept a downtown pad at 333 Bush also???

yeah, a friend did some artwork for Sharon Stone’s place here in SF and became friends with her. I’m prety sure it wasn’t this place.

But when I was in L.A. recently I was surprised to see that she’s a featured celebrity (Sharon Stone, not my friend) on an ad for a “star map” of celebrity residences.

I wonder if her condo had $20K in furniture?

“My best friend worked there basically full-time in NYC that year, and he was a student at Stanford, lol. He showed up exactly 4 days in Palo Alto. I’m not kidding.”

Many non-HYS law school students have always suspected this.

“if lawyers pulled half the dishonest stuff that is routine (not universal, but routine) in the realtor world, they would be disbarred and could never work in that field again. Lawyers are pretty tough about policing the crooks in their midst. Realtors should pick up on this”

I am just beginning to understand how true this statement is. I am dealing with this issue every day. A large portion of the industry seems to run on kickbacks. Most RE professionals I talk to have no idea what “fiduciary duty” means.

“The secret to being a happy lawyer:

quit.”

Attorneys are the top profession for major depressive disorders.

The list price for 333 Bush #3801 bush street has been reduced to $1,000,000 or 13% under its “priced to sell” price last month.

No update on Sharon Stone.

Where’s Denise?

I saw this place, it looked really torn up.