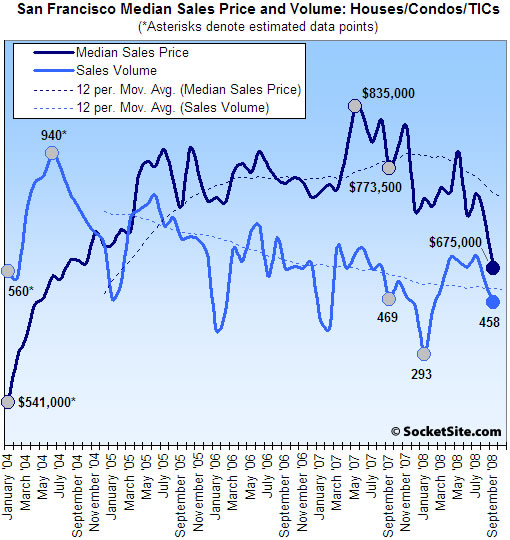

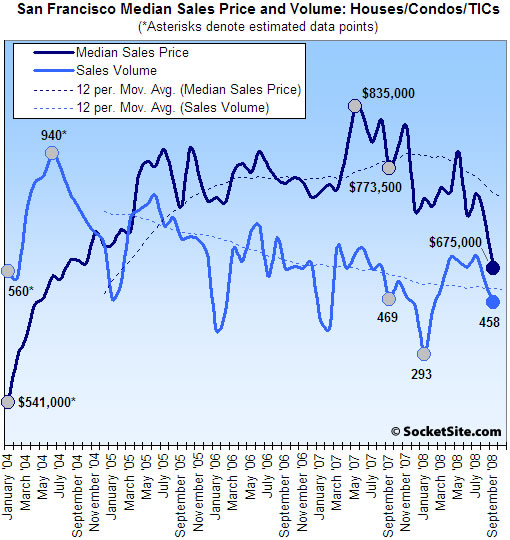

According to DataQuick, home sales volume in San Francisco fell 2.3% on a year-over-year basis last month (458 recorded sales in September ’08 versus 469 sales in September ‘07) and fell 13.4% compared to the month prior. San Francisco and San Mateo were the only two Bay Area counties to record a sales volume decline.

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) many months or even years prior and are just now closing escrow (or being recorded). And based on our calculations, listed sales activity is currently running 30% lower on a year-over-year basis.

San Francisco’s median sales price in September was $675,000, down 12.7% compared to September ’07 ($773,000) and down 6.9% compared to the month prior.

For the greater Bay Area, recorded sales volume in September was up 45% on a year-over-year basis and increased a nominal 0.5% from the month prior (7,271 recorded sales in September ’08 versus 5,014 in August ’07 and 7,232 in August ’08), while the recorded median sales price fell 36% on a year-over-year basis, down 10.5% compared to the month prior. Once again, think foreclosures.

At the extremes, Solano recorded a 101.2% year-over-year increase in sales volume (a gain of 325 transactions) on a 35.7% decrease in median sales price, while Contra Costa recorded a 94.3% increase in sales volume (a gain of 874 transactions) on a 45.6% drop in median sales price.

∙ Bay Area home sales up 45% over ’07; median price falls to $400K [DQNews]

∙ San Francisco Recorded Sales Activity In August: Down 8.3% YOY [SocketSite]

∙ SocketSite’s San Francisco Listed Housing Update: 10/13/08 [SocketSite]

Can you find some data that breaks it down by district?

That’s a pretty staggering drop in the median. However median seems to be a pretty noisy data series and will likely pop back up next month.

Still, there is a clear downward trend here that can no longer be explained away. SFRE is no longer a viable short term investment. Its utility for housing will drive trends in the near term.

I’ve got to think that the sale of foreclosed properties that is creeping increasingly into the mix is driving the median down (just as it has much more profoundly in the East Bay). For that reason, it would be interesting to see district statistics.

@ nic: Here is a link/address to a report for SF city that breaks it down by district:

http://www.rereport.com/sf/

It shows median prices for SFH in SF city down about 11% from Sept 07 and median condo prices downs about 3%.

This is pretty good news, right? Strong sales activity shows significant demand in the market despite economic uncertainties and prices becoming more affordable, without crashing.

From an MLS pull:

For Districts 1-10 (all of SF), the change in the median price for a 3/2/pkg SFD between the first half of 2007 and 7/1/08 – 10/15/08 is a decline of 8.4%.

For Districts 1-8 only, the change in the median price for a 3/2/pkg SFD between the first half of 2007 and 7/1/08 – 10/15/08 is a decline of 6.6%.

For District 5 only, the change in the median price for a 3/2/pkg SFD between the first half of 2007 and 7/1/08 – 10/15/08 is an increase of 14%.

It reminds us that real estate values –in the country, California, the Bay Area, within the city itself — are local, completely specific to the property’s exact location.

These are real estate districts, not political districts. Feel free to e-mail me for a map of the districts.

In all the SF analyses, over 40% of the 2008 period sales went pending within 30 days, to close at an average sales price that was approximately 3% – 4.5% over asking.

Sales in the upper end have all but dried up, so for the time being the fall is mostly going to be mix. But that only takes you so far.

From an earlier SS article, regarding a very nice Marina Home:

Purchased for $2,100,000 in May of 2005, 1968 Greenwich in the heart of Cow Hollow (District 7) is back on the market today. Asking $2,100,000 (with nary an alley, moldy carpet, or fire station in sight).

It’s now asking 1.975.

We are now UNDER May 2005 pricing. Medians aren’t sales, but the fall in medians is to about January 2005, which is at least where one home in district 7 seems to be.

It will be interesting to see what will happen to the October data, post stock market crash/financial services industry meltdown, which will be followed by the November post pharma/tech initial layoffs.

There are three things that can affect housing prices: subprimes, which weren’t a big part of SF out of district 10 but is starting to end, jobs and stock market issues, which problems are just beginning, and alt A, which hasn’t really begun. Pretty good news, SFTim? I don’t think so.

@Katy Dinnar

“It reminds us that real estate values –in the country, California, the Bay Area, within the city itself — are local, completely specific to the property’s exact location.”

Well, yes and no. To deny the macroeconomic trends that drive prices that are not local and completely specific to a certain neighborhood, street, or address is very much missing the point of what is happening today.

You would have to believe that the way loans are now being structured, the amount down buyers now have to put, the amount of money buyers have access to after a 40% stock market pull back, and rising unemployment would all have nothing to do with what a house garners on the market because of what street it is on. That is patently ridiculous.

Yes, all properties have specific values and some will hold value better than others depending on a whole host of factors, but the larger issues will effect the entire marketplace. So, although there may be some divergence, the whole market will be on the same secular trend. From 2002 to 2007, that was up. We will see what 2008 onward brings, but we can all pretty easily surmise. It is fools gold to look at District 5 and say, ah, I have found the district that will not also be pulled down by recession.

The Bunk,

I don’t see where your opinion differ from that of Dinnars.

You both acknowledge that the macro driver impact everybody, but to a differnt degree.

The bunk,

Here in south bay, Palo Alto went up 4% this year, and Santa Clara droped 35%. the two cities are 10 minutes apart from each other.

I guess you can marco conditions impact all players, but that “different degree” factor is making a big difference for sure.

“There are three things that can affect housing prices: subprimes, which weren’t a big part of SF out of district 10 but is starting to end, jobs and stock market issues, which problems are just beginning, and alt A, which hasn’t really begun. Pretty good news, SFTim? I don’t think so.”

Yes, I agree. But here’s the thing to remember: the big concern for everyone in Real Estate was the subprime issue, NOT the stock market. Don’t get me wrong, it’s bad. But it will rebound significantly in the next 18 months. That’s a blip on the real-estate radar. We thought that Subprimes would have a ten-year impact. Clearly they are having very little impact at all in the desirable parts of the Bay.

Ester is correct.

When people worry about Real Estate, they specifically buy in high-desirable / limitted-supply areas. AND the moment prices drop in areas like Pac Heights, people swoop in for bargains.

That’s exactly why I just bought a place in Russian Hill, as opposed to The Beacon or one of the ten other cheezy Soma condos that go up every month.

Russian Hill wasn’t my most desired place to live. I have more fun going to ballgames or the Mission. But an investment is an investment.

Some people see bad news no matter what the data is and some people see good news no matter what the data is. . . On both sides, you can choose the right district, right time comparison, and small enough neighborhood without giving the sample size to see if it is at all meaningful . . .

For me, it’s getting harder and harder to see the good news. . . .

NewBuyer,

What did you buy in RH and for how much?

I bought a 2/1 in RH earlier in 2008 on short sale from Bear Sterns for $700K. I am like you, RH is NOT my favorite place. Looking back, I wish I have bought in Pac. but it does make financial sense for me. Monthly outflow of $3700 (this is everything included), income of $3200.

since no one has pointed it out in a long time I guess I will post this little reminder;

Medians are NOT prices.

Medians simply tell you how much people are spending, they tell you nothing about the value buyers are getting for their dollars.

Using the median to gage market health or direction is always always always a mistake. It is a deeply flawed number that should not be used to gage RE value. Which is exactly why the banks use comps, not medians, when making lending decisions.

Ester, yours is a condo, right? Has parking?

condo,no parking

@ ester

I am aware of how things have been playing out over the last year, and the story of PA and Santa Clara is happening everywhere. Bayview is just 10 minutes from Noe Valley, so what’s the point? What logical conclusions can be drawn from that?

I do not agree that real estate values are 100% local as Katy states, that is just not true. You may be able to show a property or district here or there that is currently an out layer, but there is no property that can resist a secular downward trend all around it. It may hold up more than it’s neighbor, but it won’t continue up while it’s neighbor falls off the cliff over the long haul. Why do foreclosures drive neighborhood prices down? Because they are the new comps in the neighborhood. That same concept happens through a large area too, it just takes longer to see as there is more resistance.

What we are talking about is looking at something that will take a few years to unwind, and saying that since it has not yet, that it won’t, because all markets are local, and see, here is the proof (district 5 between first half of 2007 versus the last 3 months).

Something very similar happened here in 1993-4, the straw finally broke and there were great deals to be had, my parents got one on Nob Hill, they paid 25% under asking and 30% under what the condo had just transacted for 2 years earlier. It is a premier location. So, saying that the premier places won’t fall as well is just not true when looking at history.

“Here in south bay, Palo Alto went up 4% this year, and Santa Clara droped 35%. the two cities are 10 minutes apart from each other.”

New construction/remodel investment per square foot is substantially higher in PA vs. SC. That has some effect on the perceived “appreciation”.

The PA housing stock contains a high proportion of upgrade homes. Whole neighborhoods in SC are crumbling away under deferred maintenance. Plus SC is much more impacted by subprime.

For those SFers who are unfamiliar with those towns, Palo Alto is roughly like PH or the Marina. Santa Clara is more like Excelsior.

“Here in south bay, Palo Alto went up 4% this year, and Santa Clara droped 35%. the two cities are 10 minutes apart from each other.”

ester,

I don’t mean to be piling on, but to add to what Thebunk and Milk are saying, implied in your statement is median prices. Sometimes median is not a true indicator of the price trends. In other words, prices could be dropping, but median can be going up due to shifting mix of the properties that are selling.

One thing the DQ article seems to suggests is that when prices fall to certain levels, [a level that will differ for each county/neighborhood] buyers will be attracted enough to lower price points to pull the trigger and purchase. Surely this is what is happening in places like Solano County – not sure how else to explain the 100%+ increase in sales. Would it be unfair to say that in Solano county [and likely Napa and Contra Costa too] that prices have hit at least a short term ‘V’ bottom given the huge surge in sales volumes? I don’t think so.

With sales still falling in San Francisco and San Mateo, it’s likely the bottom has not yet been reached. Some may believe it has to fall as far as Solano before a bottom is reached, but I think those -35%+ price levels are unrealistic. That said, the credit crisis and possibly some impact from Alt-A will still be felt, although the impact of Alt-A may depend on how effective the Fed/Treasury’s actions are to moderate the crisis and return credit to the system.

I concur with SanFranTim in that I had expected the picture to look far worse, given the overall level of negative rhetoric, particularly on this website. Also, anyone got an explantion for these numbers, which even bulls would likely find hard to believe?

http://www.blackstone-sanfrancisco.com/199.html

P.S. – As the ghost of Error 500, I am considering making an appearance on this ‘new and improved’ server as well. Error 500 will rise again. 🙂

“Also, anyone got an explantion for these numbers, which even bulls would likely find hard to believe?”

https://socketsite.com/archives/2008/10/two_cow_hollow_apples_on_greenwich_get_a_little_less_gr.html

Mix. Median prices are up but values are falling.

I can’t blame any individual for being biased, one way or another. There are people who belive in RE and there are people who don’t, and neither is wrong.

The editor, however, is biased in my judgement. Just look at how many times he posted on property that sell less than before.

I can’t say for all areas of SF, but at least for 7&8 that I am watching, for every one that sold for less, there are probably two that sold for more. He never listed those apples.

That is partially why SS is more negative on RE than the average Joes.

[Editor’s Note: As much as some would like to believe we pick and choose our apples looking for “negative” examples, we don’t (although we are often looking for food for thought). And if you’re holding a bushel of quality examples please feel free to share. But do keep in mind that we’re looking for relatively short-term holds. The whole point is to isolate current movements in the market rather than demonstrate a long-term trend.

And call us crazy, but when it comes to investing we tend to prefer analysis over simply “belief.” And if the results of said analysis suggests a weakness in the market, we don’t consider that being “negative,” but rather simply being plugged-in.]

ester:

there is no doubt that the editor has some bias. we all do.

however, you can counteract this.

post your apples to apples increases

The problem is that people whine about not having “positive” apples to apples, and then don’t post their examples. Or when they do we find it was a massively renovated home. (where they added 1000 sq ft, demolished out the kitchen etc etc etc)

I would be intensely interested in seeing positive appreciation apples, as would others on the board.

===

@ Ghost:

That said, the credit crisis and possibly some impact from Alt-A will still be felt, although the impact of Alt-A may depend on how effective the Fed/Treasury’s actions are to moderate the crisis and return credit to the system.

I agree with you here. Although it will likely also require Congress.

Alt A is a bigger problem than Subprime was. And it comes at a worse time as well- lots of money lost on Subprime, we’re seeing a lot of money up in smoke on CDS and also money market funds and banks not to mention school and auto loans and credit cards etc. there is also the pension fund problem (e.g. Calpers) and the entire muni market debt and the Commercial Paper market. Not to mention soveriegn nations are in trouble (Iceland, Hungary, Argentina, other Eastern Block countries, etc).

This is not to say they can’t change the trajectory: they can. they simply need to nationalize all the banks and force them to lend. thus far they are unwilling to do this. Instead they will give lots of money to the banks so that the banks can give themselves big bonuses ($70billion of the $700 billion bailout will go to bonuses).

they could also do it by buying up all the bad debt and letting people live for cheap in their homes. they seem unwilling to do this. partly it’s moral hazard, but partly it’s because they want to keep “the system” intact. That’s the system where taxpayers raise a bunch of money, give it to the banks to pay the bank salaries and ‘recapitalize’ the banks, and then hope that the banks trickle down a little of that to the taxpayers.

watch what they do and not what they say. we may have a change of direction after January, but I’m not holding my breath.

but it is astonishing how large the credit problem is.

ester,

Positive apples are hard to find… no one has found and posted one, although this has come up many times. I have come to think of this as Satchel’s Challenge because he was the first one to pose it. Here’s a quotation from trip from July-

“Several months ago, Satchel posed a challenge that was something like to find any home in SF bought in the last three years and resold within the last 6 months at a higher price that had not been remodeled (i.e. was a true apples to apples comparison). I don’t recall that anyone ever met the challenge.”

Posted by: Trip at July 17, 2008 8:18 AM

chuckie – I think NVJim managed to find one that was up like one or two percent since beginning of 2005 (though technically it’s outside the three year window). That’s the closest I’ve seen.

How about 480 collingwood. That sold a few times, and nothing has been done on that place.

How about 465 Hoffman? That sold like 4 times in the last 6 years.

they are out there if you want to find them:

3042 Jackson #3

Bought 4/2005 for $1.026MM

Sold 12/2007 for $1.98MM

it was a friend’s place, he didn’t put any money into it. he is happy as can be to be out of there, and feels that even with that appreciation, he just broke even, he could have rented a similar place for less than half what his mortgage was.

Two examples – Units 2202 and 2602 at ORH were ‘purchased’ [or at least had deposits placed in mid 2006] at prices of approximately $1.02m and $1.06m respectively. They sold mid 2008 at $1.3m and $1.35m and I believe SS confirmed the aforementioned numbers. Granted others have tried similar flips and failed, so the pool of buyers is admittedly not deep. Nonetheless, I think these two would qualify.

oops, i meant $1.198MM above

Yeap, there are tons of them out there, most people don’t bother to post.

There is one 2/1 in RH that sold last month for more than what it was sold for last year.

Can’t remember the exact address without looking up MLS again.

1839 taylor,RH

sold in 7/07 for $760K,

sold again in 7/08 for $812K

Mathitically,I never understand how rent can be half of one’s mortgage. Maybe $0 down and 15% interest rate.

Can someone give a real life example??

ester – wow, really? the property i list above is a 2 and 1 apartment. what do you think that costs to rent? especially back in 2005, you could get it for between 3-4k easily, closer to 3. now, take out two loans after putting down only 5% on that much money, both adjustable (nearly a million dollars in loans, plus HOA and taxes). that will get you your answer. the whole model only made sense when homes were appreciating north of 5% a year, now that whole model is dead, and that is why you are going to see prices come down everywhere. (except in district 5 on a certain street in a victorian home with a remodeled kitchen and parking)

Later tonight I’ll pull up what I can find on these apples in public sources and post on here. I doubt if there’s anything available on the ORH apples in public sources… maybe someone with MLS access or even better “plugged-in” can help.

I wonder whether the calculations for these “apples” should take into account commissions and other selling costs.

you can go direct to DataQuick

the time of buy now, get rich in 6 mos. is well over, where have you been?

sanfrantim.

where does rerportsf.com get his data?

foolio,

the price reported is gross amount the seller got, his net is different

I don’t quite get why some people think this is all a blip on the radar and everything will be honky-dory in six-eighteen months.

I am reading the headlines and it looks like we are going to fall into a ‘deep recession.’ This means the stock market may go down farther or, on a more optomistic level, just not go up for a long time.

So…let’s see…companies will not be doing well…there will be lay-offs soon. People in the market don’t have the cash they just did a month ago for a down-payment…

Hum…

I am betting on a downward trend in housing prices for at least one full year…

Ester, look at any unit in One Rincon, for example. Rent on those places is less than half the monthly cost of ownership at the prices they got those buyers to pay. It doesn’t take $0 down or 15% interest, just the ridiculously high prices in recent years and relatively low rents.

“Mathitically,I never understand how rent can be half of one’s mortgage.”

It’s called a credit fueled asset bubble.

Anon, I don’t where One Rincon is, so I can’t disagree with your above posting.

If One Rincon is in SOMA, I agree with you. Like I mentioned before, a friend was renting in Metropolitan and paid $2900. He said that the owned paid $900+K for it. If you bake in the high HOA, the owner is getting $2100 a month for a property that costs him $900K. This is all about 3 yrs ago.

But that is exactly why I have been bearish on SOMA (sorry I offended any one that bought in that area). Other than SOMA, for areas that I am more familiar with, it is NOT 2X the rent so sure.

GO take a look at the current 2/1 condo in Pac. A number of them are listed at $700Kish, and they can rent for $3000ish. that is not 2X.

Regarding biases.. . Yes, everyone has them. But lot of people really appreciate these apples to apples comparison and would look at the positive and negative both. I guess my bias is to appreciate the negative apples to apples comparison more simply because prior to something like socketsite, the sources of information were so limited– the NAR, CAR, and the dribble from the two realtors I’ve used– guaranteeing that I was going to double my money on one property. It amazes me the stuff that is even legal. I get the impression the NAR spends a lot of money lobbying and in legal actions trying to keep the industry “self-regulated.” You can pretty much say anything about any property or any situation in the bidding process for a property.

The unit I just bought for well under $700k in RH can be rented for $3500. I know this, as a building across the street with identical floor plan (and worse views) just rented for that.

$3500 = my mortgage + HOA + property tax.

My unit’s buy : rent ratio is about 16 : 1, which is conservative even in normal times.

In fair disclosure, I paid an above-typical downpayment. But still. It’s nice to know that if I lose my job, I can just put this puppy up to rent and have a tenant cover all my costs.

But I’m very happy here and job is going great, so that probably wont happen!

Monthly outflow of $3700 (this is everything included), income of $3200.

WOW! Sounds like a sure path to riches! Lose $500/month, but make it up in volume 😉

@suzyq:

Yes, that’s precisely my point. Shouldn’t net to seller be the proper calculation for an “apple?”

So, has Satchel’s challenge been met?

If I read chuckie’s summary correctly, a place meeting the criteria can have been bought anytime in the last three years, but it has to have been sold in the last six months, without remodeling or upgrades, for a higher price. I see some proposals above, but they don’t meet the criteria, i.e.:

465 Hoffman – sold more than six months ago (March 2007)

480 Collingwood – bought before three years ago

3042 Jackson #3 – both dates out of range

1839 Taylor – sold in June 2007 but no recent sale? Appears to be for sale now…

This is all just based on my looking at Zillow and Redfin and drawing conclusions, so if you guys know more (and you probably do) please chime in!

PoHillJeff,

Collingwood sold in 4/08 and 9/08.

How’s this one 485 Elizabeth: sold on 11/30/05 for $860K, and sold on 4/2/08 for $1.4M

Po Hill,

Zillow is always 3-6 month behind. Per MLS, 1839 closed escrow already at $812K. I am sure it will be reflected on zillow in another 3-6 month.

Newbuyer,

I am happy for you that you got a good deal. Is it condo? with parking?

I could be wrong, but my 2/1 rented for $3200 only. But I did 3 people competing for it at the time, with one offering a 6 month prepay, another offering $200 over asking.

I ended up picking the current tenant who is part timer because he is travelling 2/3 of times being a CEO for a boutique fashion line.

Ester,

My unit is a Fractional TIC (majority owner-occupied, conversion eligible), and yes it has parking.

I really wanted to get a Fractional TIC, because the specter of converting it means that there’s a chance of getting an instant 20% appreciation, even if markets don’t go up much in the next decade. I’m not “dependent” on it converting. I think it’s a great investment either way. But I like the fact that it has the possibility.

It’s off Polk street.. I’m very paranoid about buying in any liquification zones 🙂

thanks Newbuyer for sharing, I am not holding anything aginst TIC , I have a TIC in pac as well.

Tic tended to be discounted.

If I compare my TIC and condo now, my TIC is losing more money than condo, partially because I got a 7.5% rate, partially because the rent control etc.

but the appreciation in the last few years more than covered the monthly loss that I am incuring every month now.

I was approached and offered 6.5% rate, but too lazy to refi since the monthly saving is only $200 ish a month, I am waiting for rates to come down to below 6% to refi.

I wonder how many TIC owners actually got converted.

I think ester and sparky are correct… looking around on Redfin I found several positive apples. Redfin shows sales within last 3 months, and in Russian Hill, I see both positive and negative apples. Here’s a link:

http://www.redfin.com/search#pt=3&sf=&sold_within_months=3&v=3&lat=37.80194703481068&long=-122.41874548231745&zoomLevel=14®ion_id=2352®ion_type=1&market=sanfrancisco

Maybe I shouldn’t be as surprised by this discovery as I am, but it certainly appears to be that a fair price for a property is what a willing and able buyer will pay.

Looking on the bright side, the bulls vs. bears discussion can rage on 🙂

I should note though that we don’t know if these are true apples. In other words, how much work was done between the two sales.

chuckie,

how can you expand the time frame on this ??

About 485 Elizabeth being an “apple”:

“Sale Price: $1,400,000

Close of Escrow April 2008

Exceptional redevelopment opportunity involving a 3,000 sq. ft. RH-3 zoned lot. As a stipulation to the sales contract the Seller agreed to deliver neighborhood 311 approval for two 3,000 square foot units over parking. Located on Elizabeth Street between Sanchez and Noe Streets – phenomenal location. The property was not formally marketed – this was an off-market sale. Estimated resale value upon completion of development of approximately $4.5MM.”

http://www.pacoeassociates.com/properties/buyer_representation/

In the 2005 sale, there were no permits. The 2008 sale is expressly conditioned on the approvals being obtained by the seller. Look at the picture – obviously a tear-down.

http://www.trulia.com/homes/California/San_Francisco/sold/317819-485-Elizabeth-St-San-Francisco-CA

And obviously not an apple….

ester,

Click on Price,Beds… link and select 3 months, 6 months, 1 year etc. Here’s the same link with 6 month selected:

http://www.redfin.com/search#pt=3&sf=&sold_within_months=6&v=3&lat=37.80194703481068&long=-122.41874548231745&zoomLevel=14®ion_id=2352®ion_type=1&market=sanfrancisco

Sparky, I’m not sure about 480 Collingwood. According to Zillow the “sale” in April of this year was for $586K, followed by another sale in September for $1.1M. Something seems fishy there… perhaps the owner died and it was transferred to an heir at the current assessed value, then sold last month? Or if there really was such a huge price increase, I’d suspect some incredible type of renovation 🙂

thanks chuckie

1839 Taylor seems like it meets Satchel’s criteria (thanks Ester). Also, from Chuckie’s data, 1101 Green #903/4 (appears to be a combined unit from the sale dates?), 54 Bret Harte #1, and 2121 Taylor #1 (some kind of amazing flip?).

Dear socketsite:

I thought you stated last Thursday (pre-server meltdown) that we would be getting the complete inventory index (CII) last Friday.

any update on timing?

[Editor’s Note: Key phrase: pre-server meltdown. And it was actually supposed to be this week (but we’re now a week behind).]

“I should note though that we don’t know if these are true apples. In other words, how much work was done between the two sales.”

@chuckie: Good point. Don’t we also have to examine a host of other potential “value adders,” like whether an owner move-in or buyout removed a difficult tenant, whether the unit converted from TIC to condo, etc.

The tight 6-month timeframe makes some of these unlikely, but you know what happens when we assume…

Foolio,

To channel the editor, bingo 🙂

Not to discount the myriad other possibilties like a foreign buyer, a googlnaire or a savvy investor 🙂

Having said that :), there seem to be plenty of positive apples that need closer examination.

I will recommend that the editor elevate some of these to main page and let the “plugged in” members examin them.

[Editor’s Note: In terms of “positive” apples, there’s also another good place to look, our own apple archive. Another point of fact, we typically feature apples that haven’t yet sold and could just as easily sell for more or less. It’s the market that decides their outcome, not us.]

Ester,

My TIC was financed at 6.5% (fixed for 5 years, variable after that). I’m pretty happy with that rate, and I think that it is competitive with loans for condos.

As I’ve mentioned once before, the price might go down a bit from here. But how much lower can we go than my purchase price of $580/sqft? Maybe down to $500/sqft?

Fact is that my stock portfolio (that I liquidated to finance the place) WOULD HAVE been down $60k. This means that my home could fall 10% in price, and it still would have been worth it.

As for how things will look in 3 years… who knows! But I feel like I dodged a bullet by selling all my stocks when the Dow was “only” at 11,500.

newbuyer, the price of your hom could go down well below 500/sq ft, and you are hihly leveraged. stocks are safer that your downpayment is.

Socketsite, thanks for update on CII. Looking forward to it 🙂