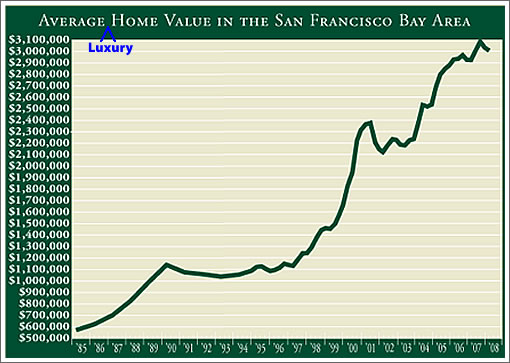

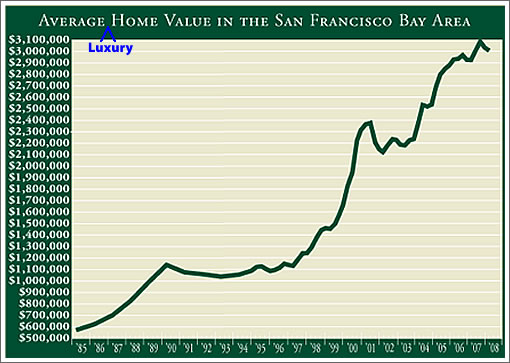

According to the First Republic Prestige Home Index for “San Francisco,” values for properties worth at least $1 million fell for the second straight quarter (down 0.8% from Q4 ’07) but remain up 2.9% on a year-over-year basis.

Keep in mind, however, that the Prestige Home Index for “San Francisco” includes eight Bay Area counties. And in a nod to a microcosm of mix (which shouldn’t affect the Index, but will affect the median sales price): “The higher end of the luxury market is the most active.”

∙ Prestige Home Index: San Francisco [First Republic]

I don’t see anywhere where they define their index well enough for it to be of any value whatsoever.

Yeah, that pretty jives with the Case Shiller Index

Agree that without more disclosure on definitions and methodology, this is not a data point that is worth anything of note.

However, it does illustrate an interesting concept. At this price range, even a small decrease can result in pretty staggering real numbers. The hypothetical $3,084,670 home bought in 9/07 was now worth $3,007,703 in 3/08. That’s only a 3% drop. But it reflects about $12,500 a month in lost value. If your spouse is urging you to buy in this price range and you think it makes more sense to wait given the current downward trend (as do I), you might offer a $5000 a month additional spending budget in the interim and you still come out far, far ahead.

Not trying to steal thunder from a potential future post, but DQ has April numbers out today.

In San Francisco, sales up 6.5% YOY, prices down 5.1% YOY. And our price drop was the best performance in the bay area (Marin median down 13.5%).

http://dqnews.com/News/California/Bay-Area/RRBay080520.aspx

Trip – you think in apples and oranges. If you can afford $3mil, you don’t care about $10,000. It is a rounding error.

Boy I wish I bought in 2002, 2003, 2004, and 2005 according to this chart!

I’ve seen so many high end places jump HUGE over the past two years, i.e. 20-30% higher. What was $2.1 mil, is now $2.5-2.9mil. It’s nuts in the high end.

I think a good apples to apples comparison for Pac Heights/Cow Hollow is 2828 Divisadero. It sold back in 05 for $5.25 million and even had a reduction or two during the comparatively lengthy time it spent on the market. It just sold again for $7.5 million a couple of weeks ago. It was never really on the open market and it hadn’t undergone a significant remodel in the interim. That equates to about 10% annual appreciation, right? Of course, there could be a back story here that I don’t know…