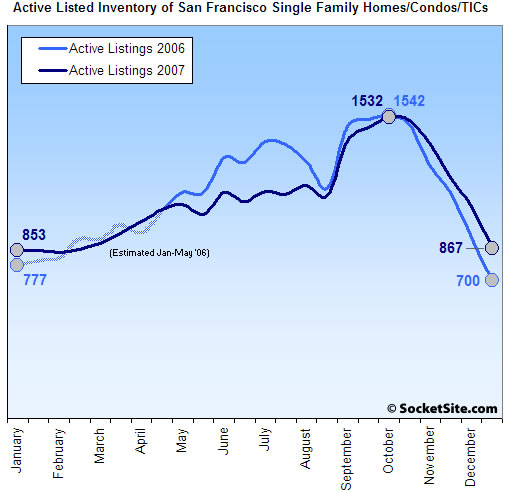

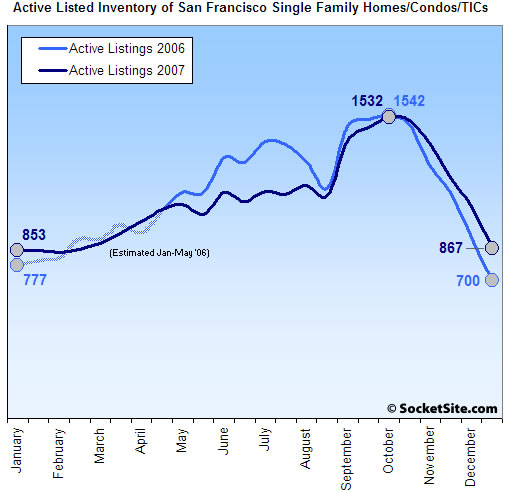

The year (2007) ended with an inventory of Active listed single-family homes, condos, and TICs in San Francisco that was 23.9% higher on a year-over-year basis. And more specifically (and possibly telling), 59.9% higher for single-family homes (driven primarily by slowing sales in Districts 2, 4, and 10) versus 1.4% higher for condos and TICs.

The percentage of active listings that were reduced at the time of year’s end was also up on a year-over-year basis (from 26% to 31%), with the absolute number of reduced single-family home listings up 104% (from 73 to 149 listings). Once again, driven primarily, but not exclusively, by District 10 (which includes Bayview, Crocker Amazon, Excelsior, Outer Mission and Visitacion Valley).

∙ Listed San Francisco Home Sales Volume Down/Down In November [SocketSite]

Condo inventory is looking great, almost non-existant at the moment. Many buildings have zero units for sale, which is a far cry from how most other markets in the U.S. look right now.

We’ll see how Jan and Feb shape up but the SF condo market in 2007 was extremely resiliant, failing to take the hits that so many had predicted.

Wait for the layoffs. Condo inventory in SF will be fine until the big layoffs start at the tech giants. Probably not until later in 2008.

Anon 1:59 — on what do you base your statement that condo inventory is “almost non-existent at the moment”? The numbers I see show 568 condos listed, about 40% higher than at this time last year, with an average DOM of 87 days (I don’t have the exact 2007 figure).

… and of course a big chunk of the non MLS-listed inventory is new condo construction.

“..until the big layoffs start at the tech giants.”

I dont buy that. Sure tech companies that depend on the financial industry for their bread and butter might cut forcasts and blame it on the mortgage industry (as Cisco did last quarter) but I am not convinced that hard times will spread into the more diverse tech industry in the valley. Or maybe I am just hoping.

Check out Oracle’s numbers which were just released a few weeks ago, certainly not indicative of a slowdown. Did you see Netsuite’s insane IPO? Anyone could have gotten in under $26 by the way.

Is there a ‘Months of Inventory’ figure for SF? It might be interesting.

Also I have to agree with muu; I don’t see any large scale tech layoffs in the near future.

A full 25% of existing inventory is located in District 10. Also, I’ve noticed quite a few properties in slightly more prime areas being pulled over the last few weeks.

The total listed sales count for December stands at 304 (132 SFH’s + 173 condos). The count will increase a little as final December reportings are made – but, based on the active inventory of 870, this equates to about 2.9 months of supply.

Below is a breakdown by MLS District. The columns are MLS District, Active Listings (based on a Jan 2 snapshot), Sales Count for Dec 07, and Months of Supply (Active Listings / Dec Sales Count):

1: 49 21 2.3 (Northwest)

2: 53 28 1.9 (Central West)

3: 58 12 4.8 (Southwest)

4: 32 22 1.5 (Twin Peaks West)

5: 49 55 0.9 (Central)

6: 33 17 1.9 (Central North)

7: 31 22 1.4 (North)

8: 89 35 2.5 (Northeast)

9: 186 60 3.1 (Central East)

10: 226 32 7.1 (Southeast)

All: 806 304 2.7 (All SF)

Note that the Active Listing total right now is 806 (411 SFH’s + 395 condos). The months of supply ranges from .9 for District 5 to 7.1 for District 10.

Why does the inventory peak at summertime every year?

Why does the inventory peak at summertime every year?

Buying peaks during the summer, so that is when people list homes for sale. The cold and wet of winter really do discourage many buyers.

I can tell you that for what we have been looking at lately, the inventory is terrible. There is little to nothing decent to see.

Hi movingback, can you share your opinion on the pricing? Do you get the impression that there are more motivated sellers than not? Thanks.

viewlover – I think it all depends on the neighborhood and property in particular. In District 5, for instance, I don’t see much motivation because of the demand for the area. We are only looking in Districts 5 & 9 so my observations are limited to those 2 areas. Open Houses we are going to are very busy.

“movingback” – what brokerage do you work for?

movingback at November 2, 2007: “DavidQ – we live just a few blocks away from this house. We have watched the ongoing remodel and it looks fantastic. Yesterday, here in Noe Valley, the sky looked just like it does in the picture – oh, let me look out the window now – yes, looks the same today. Gorgeous blue sky and a few fluffy clouds.”

https://socketsite.com/archives/2007/11/another_contemporary_remodel_and_resale_in_noe_4400_24t.html

Is an airline a brokerage?

Here are the December 2007 SF sales figures as reported by http://www.lubasf.com/blog/

To those who argue that medians prove prices are as high as ever, you have to back to late 2004 or early 2005 to find median SFR sales prices this low. I’m not going to repeat this error and argue this is “proof” that three years of appreciation have now been wiped out.

Single Family Homes

* 140 Homes Sold

* Median Sale Price was $797,000

* Minimum Sale Price was $365,000

* Maximum Sale Price was $16,000,000

* Median Selling Price was 99% of asking price

* Median Days on Market was 46

* Median Selling Price for homes that sold within 30 days was 102.5% of asking price

Condominiums, Lofts & Co-ops

* 124 Homes Sold

* Median Sale Price was $744,500

* Minimum Sale Price was $1,000 * An error maybe?

* Maximum Sale Price was $2,720,000

* Median Selling Price was 99% of asking price

* Median Days on Market was 48

* Median Selling Price for homes that sold within 30 days was 99.76% of asking price

TICs

* 53 Homes Sold

* Median Sale Price was $625,000

* Minimum Sale Price was $255,000

* Maximum Sale Price was $1,850,000

* Median Selling Price was 99% of asking price

* Median Days on Market was 54

* Median Selling Price for homes that sold within 30 days was 125% of asking price

Trip, do you have any historic numbers as a comparison for this? Dataquick numbers won’t come out for another couple of weeks, but this doesn’t look to be down from LY in total. It could even be UP.

Per last year’s dataquick numbers, the SF median was only $753K or so (SFR and Condos). These ’07 figures average out to flatish or even up to LY depending on whether you include TICs.

I’m actually the one that posted the figures that “movingback” posted in his comment. Some median prices are lower this year than the same time period in 2006, but not by as much as you’d think. And they’re still mostly higher than they were in 2005. In fact, take a look at this data pulled from the San Francisco MLS.

2006 median prices for December were:

SFR at $800K (a whopping $3K more than this year)

Condominiums, Lofts & Co-ops at $750K (a whopping $5,500 more than this year.)

TICs at $525K (a whopping $100K LESS than this year)

2005 median prices for December were:

SFR at $803K (a whopping $6K more than this year)

Condominiums, Lofts & Co-ops at $697K (a whopping $47,500 LESS than this year.)

TICs at $579K (greater than 2006 but LESS than this year)

These numbers really don’t say a damn thing about the market because they’re the median for ALL areas of San Francisco, and I am not the first to point out that all real estate is local, and with the various niche neighborhoods you find in SF, it’s even MORE local.

This article in SF Gate was timed pretty well. You may as well read the details, but in a nutshell, the median sales price in the “hotter” neighborhoods has gone UP, while the mortgage crisis HAS affected the low to medium priced neighborhoods of San Francisco and has forced prices further down in those areas, which has ultimately dragged the overall median prices down in SF as a whole.

Finally – the numbers I posted where for December. Real estate is not only LOCAL, but it’s also SEASONAL. So when we’re talking about median prices, let’s compare apples to apples. These prices alone do not indicate a failing market. In fact, there just aren’t any indicators that the SF market is falling into the crapper and frankly, there aren’t any indicators that the market is doing fabulous either.

Time will tell where the market ends up, but my prediction is that it ain’t gonna be all bad. And keep in mind that if you look at the predictions from the same time last year, they also all predicted a crash in the SF market, which we just didn’t see this past year, and likely won’t see in 2008 either.

Luba, thanks for the great post. This was very informative and a welcomed change from the “sky is falling” posts that dominate these days. What I found most interesting is how the SF median price really hasn’t fallen even with the credit crunch and RE crisis that’s happening these days. Also, the article that you posted mentions the fact that sales are mixing more heavily into lower price homes given market conditions. This is intuitive to me, and like I’ve said over the last couple of months – mix should be lowering citywide median prices at this point. The general feeling of most posters here was that mix was weighing prices up….which doesn’t seem intuitive or logical. Although it did provide some defense on why we weren’t seeing a drop in average prices if there was a bubble bursting.

I think (and this article helps validate) that the reason that we aren’t seeing a lower the median is due to the relative strength in the “better” neighborhoods. I guess time will be the real judge on how things play out, and it’ll be interesting to see how it all ends up.

My bet is that median prices remain flatish (+/-5 percent)over the next year in SF. And that implies that prices will have to increase somewhat in better neighborhoods to offset the weakness of the Southeastern part of the city. Of course, I also realize that my opinion is in the minority of posters here. Either way, thanks again for the post.

It’s my pleasure Lance. I don’t consider myself to be overly optimistic about the market. As an agent, I’ve lost several listings because I was honest and gave the seller a lower assessment of their property than they were prepared to accept. (And then watched as the properties sat on the market with one price reduction after another). I found this to especially be the case when dealing with a seller that bought within the last year or two and is trying to make a profit – that just ain’t happening right now, especially when you consider that there are costs to selling (average seller costs are between 7-8% of the sale price). So I’m not one to give you an inflated or even rosy view of the market.

But I am realistic, and the more desireable neighborhoods are still going strong and will continue to see more appreciation (albeit slow and steady), while the Southeastern areas will see lower prices, and frankly, some bargains for the right buyers.

Buying a home in San Francisco is a great investment over the long term, but don’t go buying hoping to make a quick buck by selling in a year or two.