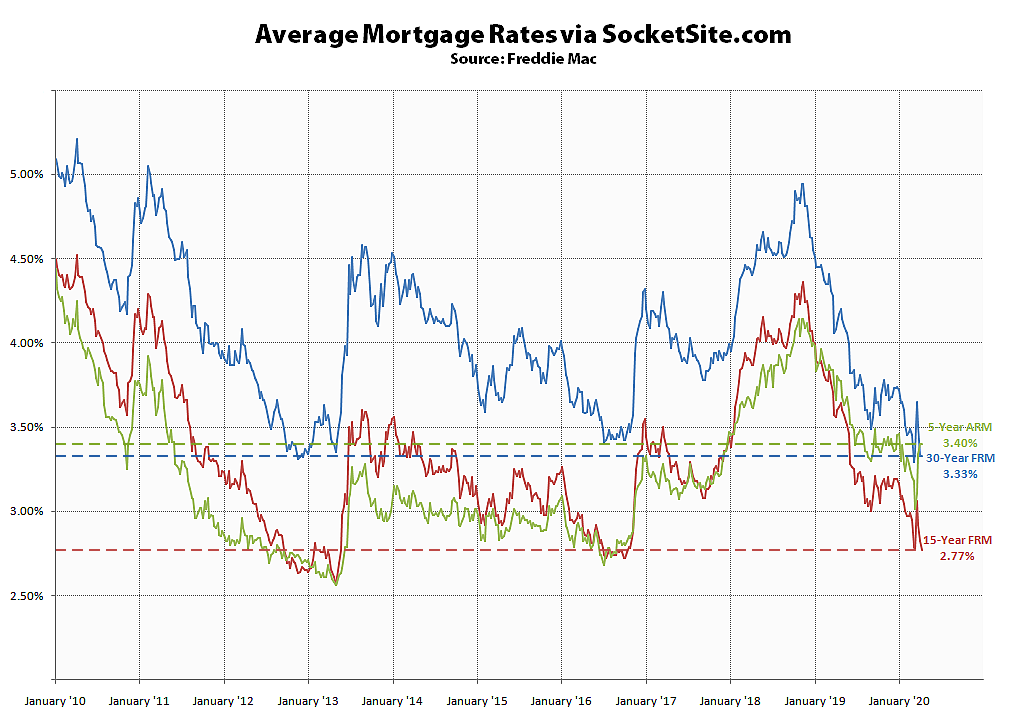

Having dropped 32 basis points (0.32 percentage points) since mid-March, the average rate for a benchmark 30-year mortgage is now holding at 3.33 percent, which is 79 basis points below its mark at the same time last year and within 4 basis points of its all-time low, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has shed another 5 basis points for an average rate of 2.77 percent (which is 83 points below its mark at the same time last year), while the average rate for a 5-year adjustable has held at 3.40 percent, which is 40 basis points below its mark at the same time last year and an “inverted” 7 basis points above the benchmark 30-year rate for the second week in a row.

From April 13, 2020, Homeowners Seeking Mortgage Relief With U.S. Economy Shuttered:

It will be interesting to see how far that mark goes. And of course, the commercial market will be even more interesting, as landlords who are renting to restaurants with no revenue explore their options.