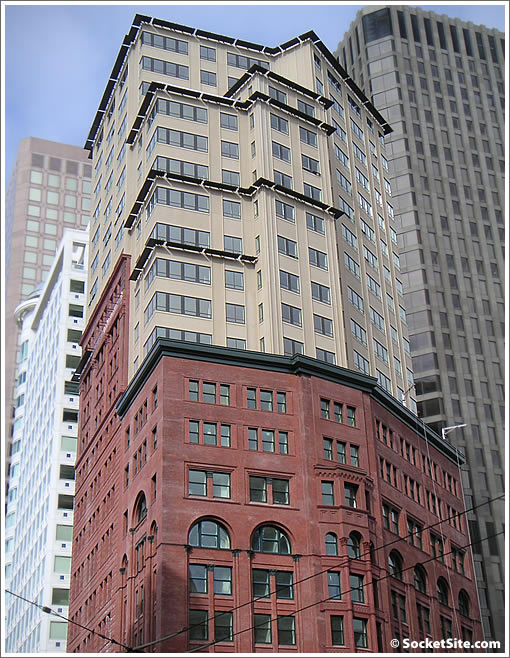

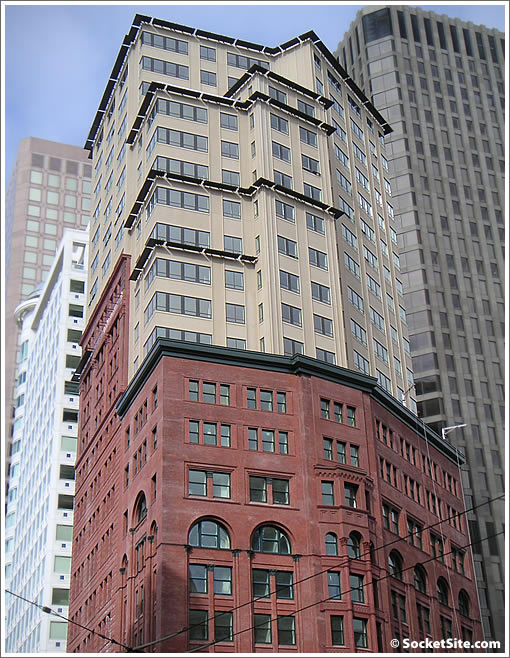

Purchased for $2,201,500 in March 2008 on the penultimate floor atop the Ritz-Carlton Residences in San Francisco, 690 Market Street #2301 returned to the market listed for $2,299,000 eight months later.

Reduced to $2,099,000 in February 2009 and then to $1,999,999 that April, the 1,660 square foot two-bedroom was withdrawn from the market that June.

It’s now two years later and 690 Market Street #2301 has returned to the market listed for $1,350,000. Recently rented asking $6,800 per month in rent, but delivered empty at close of escrow according to the MLS, it’s not a foreclosure, nor a short-sale. And if a reader is correct, the buyer in 2008 paid cash.

We’ll note 690 Market Street #2201, the same two-bedroom a floor below, was foreclosed upon in 2010 having been purchased for $2,173,000 in 2007 by way of a $1,500,000 loan.

And having been listed for $1,326,000 last November, the resale of #2201 closed escrow this past March with a reported contract price of $1,050,000 (52 percent below 2007).

∙ Listing: 690 Market Street #2301 (2/2) 1,660 sqft – $1,350,000 [Redfin]

∙ Reductions And Returns At The Ritz-Carlton Residences (690 Market) [SocketSite]

HOA Dues: $2,621

lol.

Yeah, every time I see these Ritz-Carlton listings, I wonder what you get for those luxurious dues.

The Ritz has to be one of the most failed developements in SF, views and thats about it, poor fixtures and finishing. these foreclosures are no surprise

At about $630/sq foot, you’d think this is comparabley starting to seem reasonable for a 23rd floor unit.

As above, however, the HOAs still don’t due the cash flow any favors from an investment perspective.

Once again it shows how potent the Kool-Aid was even into 2008.

^^$813 per square by my math?

Here’s a example of the Kool-aid 2008 (from the comments):

Posted by: Dan at January 14, 2008 9:56 AM

Actually you all are wrong. There are different types of ownership including FULL ownership. I know this because my parents recently bought a place on the 13th floor. My mother bought the place in raw condition and is doing her own build out as she is an interior designer. For an investment standpoint, the condos will be worth double 5 years from now. If you need further information, contact the Ritz sales staff directly.

Sincerely,

Greg Fox

When one of the top executives of a major bank takes a $900K+ hit and lists a property two days before Thanksgiving, that should give you an idea of what he sees coming down the line.

He has access to information none of us will ever have and he just threw in the towel. That speaks volumes.

@tipster, Maybe it has nothing to do with real estate. Maybe they need a tax break. Maybe they owe someone money. Maybe they have an investment idea and need capital. Maybe…

I noticed that at the top of the Redfin listing it says the unit is 1660sf and $813/sf at the current price. Further down under Public Facts, it says 1515sf. Which is it I wonder and why the difference? Seems to me it should at least be consistent in the listing.

If it is really 1515sf, then at 1660 they are basically saying it is 9.6% larger than it is. And the asking price would represent more like $891/sf.

What do people get for those dues? Just about anything they want. That is the whole point of high end service, and it doesn’t come cheap. Perhaps that is silly, but concepts of value vary pretty widely. In this age of the very rich it may make sense to focus on the most costly market segments.

Calling this a failed development doesn’t make sense. Everything that hit the market at that time ended up with bubble problems and mania hangovers. The location is hard to beat if you want access to downtown, embarcadero, and south beach.

Tipster,

Are you saying the owner of 2301 works for a major bank?

Not from what i can see. Looks like a marketing guy to me.

“. . . .the condos will be worth double 5 years from now. If you need further information, contact the Ritz sales staff directly.”

That cracks me up. “I’m going to be rich!! I know it’s true because the saleseman told me!”

Although not representative, I remember posters being laughed off SS for suggesting that such drops were even possible in SF.

These condotels were always an obvious flop for many reasons, but they served their purpose… To lower the investment needed by the Ritz.

But the actual units are pretty nice and amenities are there. Worth it? Who knows, people pay hordes of money for all sorts of dumb things, even me!

Ritz always brings back some old tune…

http://www.youtube.com/watch?v=IFabjc6mFk4

Re: p3p’s question: …every time I see these Ritz-Carlton listings, I wonder what you get for those luxurious dues.

I got dragged to see the flick Tower Heist last weekend and when Ben Stiller’s character, the general manager of a luxury residential condo/co-op unit in Manhattan, is breaking in a newly-hired elevator operator (!), he tells him the average multi-million dollar price tag of a unit in tbe building is really buying them; the slavish attention of the staff.

That bit of dialogue made me think of these Ritz-Carlton places immediately. It’s not about the finishes, the location or whether or not the price of a unit “will be worth double 5 years from now.” People who think in those terms aren’t rich enough to be the target market for these units.

People who think in those terms aren’t rich enough to be the target market for these units.

although I agree with you that the target market for Ritz is as you say, I also think that the actual buying market was very different than the target market.

The rah rah days of the 2000’s saw a lot of middle and upper middle class people striving to spend like they were upper income, and a lot of slightly upper income people striving to spend like they were the 0.1%.

The marketing of places like this says it’s for people who don’t have to look at or care about the price tag, but the reality of these places was that upper middle class people and people in the lower levels of the affluent society sometimes (often times?) stretched to get into these.

I have a friend who is a bus driver who drives a BMW, and recently I found myself in Bvlgari, Chanel, and Louis Vuitton in Barcelona (long story, not it wasn’t for me, I get most of my clothes from Costco or Lacoste). These stores are luxury stores. Yet the people shopping in them were not as affluent as I would have expected. In the Bvlgari store I overheard a couple discussing about putting a ring on a credit card that they couldn’t pay off immediately. My first thought is why on Earth they were even in there.

The same thing happened with RE. There just are not enough uber affluent people who want this type of product. This is partially why Ritz and Millenium struggled (as did other high profile luxury highrises across the country like Trump Chicago and Chicaco Spire).

“Although not representative, I remember posters being laughed off SS for suggesting that such drops were even possible in SF.”

From the boom times I remember people laughing off far smaller declines then 52%!! A great many people seemed to think that any decline was unthinkable and mere single digit appreciation would be bearish!!

“although I agree with you that the target market for Ritz is as you say, I also think that the actual buying market was very different than the target market.”

The fact that the double in five years quote was referring to an interior designer would seem to be a good example of your point.

At the listing price of $1,350k, that’s not even 50% off the 2008 purchase price. I hope there are more cuts coming – the 2008 buyer deserves an even bigger loss for the supreme folly of paying cash.

Redfin shows 2010 property taxes were over 35k! This will be a 7 figure loss no matter how you slice it.

the owner has a pretty nondescript name, don’t think you can know which linkedin resume is his for sure. marketing guy or west coast head of big bank.

Does “penultimate” mean “top”?

“Does “penultimate” mean “top”?”

Nope.

“declines then 52%!! ”

You’re, like, stunting, and you still can’t use the language properly. Yet you write as if you expect folks to check for you. Hilarious.

Very roughly relevant to this thread, here is a telling chart from the WSJ on the current rent vs. own situation in a number of markets after the massive housing price hits (like the one on this thread):

http://online.wsj.com/article/SB10001424052970203764804577060502694077494.html#project%3DHOUSINGAFFORD1111%26articleTabs%3Dinteractive

Buying looks good in Atlanta. In SF, not so much.