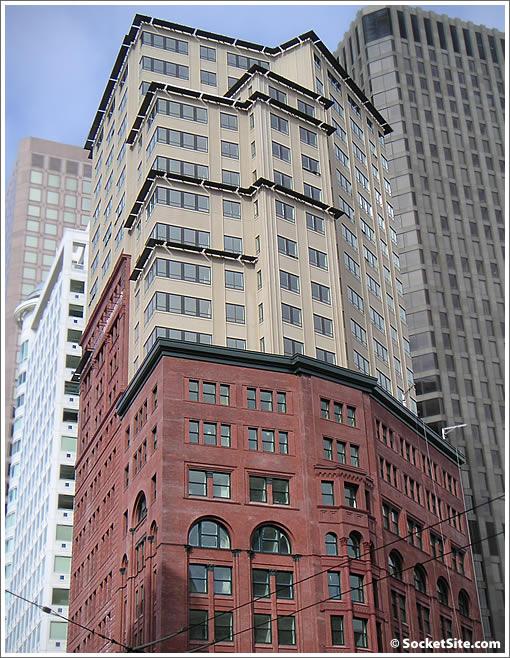

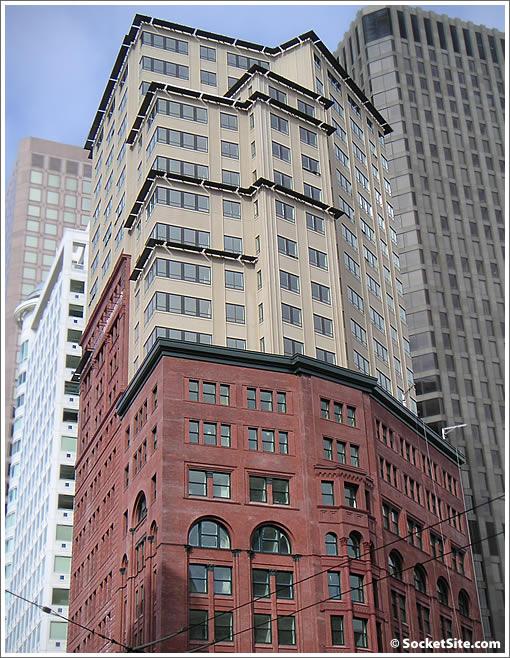

Scheduled to hit the courthouse steps at two this afternoon, it’s a plugged-in tipster that notes the previously published opening bid of $1,407,739 has just been dropped to $1,144,024 for the two-bedroom Ritz-Carlton condo known as 690 Market #2003.

Purchased for $1,890,000 ($1,320 per square) in September 2007 with what would appear to have been a $1,322,978 loan and 30 percent ($567,022) down, the 1,431 square foot luxury unit was listed for $2.35M in 2008, reduced to $1.9M in 2009, and then reduced to $1.69M before being withdrawn.

We don’t consider courthouse auction prices to be “apples-to-apples” on account of their all cash and no contingency nature, but as our reader notes, it will be a 39 percent haircut in value if it sells for its opening price of $799 per square.

That being said, 690 Market #1502 which was purchased for $1,481,000 in October 2007 ($1,239 per square) and then taken back by the bank is currently pending having last been listed for $949,905 ($795 per square), a sale at which would represent an apples-to-apples 36 percent decline in value for the luxury unit over the past three years.

And once again, while “still not cheap” at almost $800 per square, we’re guessing that’s of little solace to those who were sold on $1,200 $1,300 per square or more.

UPDATE: While still noted as pending on the MLS, a plugged-in reader reports that 690 Market #1502 actually “sold for $805K, plus the auction fees, in early December.” Once again, the condo originally sold for $1,481,000 in October 2007.

UPDATE: With no bidders yesterday at $1,144,024 ($799 per square foot), 690 Market Street #2003 is now bank owned. Once again, the luxury two-bedroom Ritz-Carlton condo had originally been purchased for $1,890,000 ($1,320 per square) in September 2007.

∙ Puttin’ On The Ritz (And Pressure) At Under Eight Hundred A Square [SocketSite]

Even the new price is too high, considering the outrageous HOA fees. 1502 was sold for $805K, plus the auction fees, in early December.

Anyone know what these would have gone for 10 years ago?

Sarcasm aside, the price drops are even more stunning when you factor in that some of these sold as empty shells, and required the buyers to spend a few hundred K to finish their “vision.”

I remember years ago there was a poster who claimed that this building would do fine because it was a “luxury” building and all the people were rich so would never come under selling pressure. we all saw how that turned out.

IMO this market segment is tough because many of the people were either speculators, 2nd home buyers, or people with high income but not substantial wealth.

the building itself is fine and the location is great for many people… close to transit, close to luxury shopping…

I think $800/sq ft is not an outrageous price for a true luxury condo, although I can’t remember if the finishes of this condo are really luxury… or just another normal condo with the “luxury” designation slapped on it.

The 2007 buyer of #2003 only put down 30%? Yawn. Since when is losing $567,022 on two bed condo a big deal?

The funniest part? “…the 1,431 square foot luxury unit was listed for $2.35M in 2008” Sorry, Mr. Former Owner, no greater fool for you!

“Look. $1000/sqft is the new price point. That’s just what it is. If you wanna be a playa you’ll man up and pay it otherwise you can go back to being a wannabe renter with your nose pressed up against the glass. Women will scorn you. Dogs will pee on you. And every morning for the rest of your life you’ll get up, look in the mirror, and wish that you had had the balls to “swing for the fences” and had paid $1000/sqft for a soma condo while you still could.”

sorry… I couldn’t resist

Mr. former owner is a she, and she’s a real estate professional. I’ve yet to punch up an original owner of the building who wasn’t.

$567K, plus however many payments she made, was probably most of her life’s savings. Live by the sword. Die by the sword.

Poof, a lifetime of hard work is gone.

A lifetime.

This is serious money and you can lose it all.

^ thanks for that additional info. A realtor? Now I don’t have to feel even the slightest twinge of guilt for my schadenfreude.

She’s a commercial retail leasing agent.

I’ve seen realtors, mortgage lenders, you name it, they all seem to have some connection to the real estate industry.

I think they just got caught up in the hype, watched others making enormous paper profits and then finally gave up and jumped in.

I’m always flip about it, until I see their photos and then I feel really, really badly for them. Her life is basically ruined. All because she bought SF property when it was overpriced.

Like it is right now.

Tipster, I enjoy your comments but please…here you’re being overly dramatic.

I’ve never met the woman in question and haven’t read a thing about her, but I am certain that her life is NOT “basically ruined”. I’m sure, unlike people whose lives are ruined that we see on the street everyday in The City, she still has a fully-funded 401(k) or other retirement vehicle. She still has supportive friends, family and co-workers. She still has health insurance and can see a doctor at will. She probably still has her “cash cushion” of at least three months and probably nine months of living expenses in cash sitting at the bank with 100% liquidity. Hell, she’s probably living in another property that she owns, and has refinanced it at a lower interest rate recently despite this place going back to the bank and showing up on her credit report.

Given that she’s a real estate professional, this was probably an “investment property”, she’ll write off 100% of the loss as a business expense and can probably carry that loss backwards in time to get even more of a refund on taxes (I’m not a tax attorney or accountant) that she already paid. She won’t get a 1099 in the mail after this is all over requiring her to pay taxes on the amount of the deficiency even if it wasn’t an investment property.

When and if she’s spending the night in a homeless shelter or worse, crashing in the bathrooms at a BART station, then I’ll believe that “her life is basically ruined”. Until then, I’ll ignore the violin music on the soundtrack.

Brahma wrote:

> Tipster, I enjoy your comments but please…here you’re being

> overly dramatic. I’ve never met the woman in question and

> haven’t read a thing about her, but I am certain that her life is

> NOT “basically ruined”.

Tipster is a little more bearish than I am and also a little more dramatic, but I can tell you that it is not fun to lose a half million dollar life savings when Real Estate drops in value. It didn’t “ruin” my life, but it sure did “change” my life when apartment values and rents dropped (and I became a “former” apartment broker) in the early 90’s (back when a half million was a bigger deal)…

> I’m sure, unlike people whose lives are ruined that we see on the

> street everyday in The City, she still has a fully-funded 401(k) or

> other retirement vehicle.

I know nothing about the former owner of this condo, but in my 30 years of working as a real estate broker and with other brokers (both residential and commercial) I can tell you that you are more likely to find a guy waiting for work out in front of Home Depot with a bachelors degree than to find a real estate broker paid on commission that has a “fully-funded 401(k) or other retirement vehicle”…

Yeah, she looks to own several other properties in SF, the $500k she lost on this probably hasn’t ruined her life. But better her than me.

This might be the best quote of all from an older thread (and perhaps Mr. Fox’s mom is European to boot), but perhaps things will turn around significantly by 2013, and his prediction will be right:

Actually you all are wrong. There are different types of ownership including FULL ownership. I know this because my parents recently bought a place on the 13th floor. My mother bought the place in raw condition and is doing her own build out as she is an interior designer. For an investment standpoint, the condos will be worth double 5 years from now. If you need further information, contact the Ritz sales staff directly.

Sincerely,

Greg Fox

Posted by: Greg Fox at January 14, 2008 10:08 AM

https://socketsite.com/archives/2008/01/real_reductions_and_returns_at_the_ritzcarlton_residenc.html

1502 at $805K appears to be under $675/sqft. What was going for $675/sqft during the boom?

UPDATE: With no bidders yesterday at $1,144,024 ($799 per square foot), 690 Market Street #2003 is now bank owned. Once again, the luxury two-bedroom Ritz-Carlton condo had originally been purchased for $1,890,000 ($1,320 per square) in September 2007.

No Peter Coyote ad to pump this unit up this time…

Ritz 1502 finally closed. 46% off. $674 psft.

Thank goodness the high end is immune!

High end, as in literally feet above sea level?