About nine months ago 246 2nd Street #1306 hit the market with a list price of $939,000, quickly shaved $20,000 off the asking, and added the following line to the property description: “Now Best Deal in SOMA: GO!” As far as we know, nobody went.

Last week 246 2nd Street #1306 returned to the MLS with a list price of $859,000. The new line: “Motivated seller: priced to sell.”

Now about those bank owned comps that “don’t really matter”…

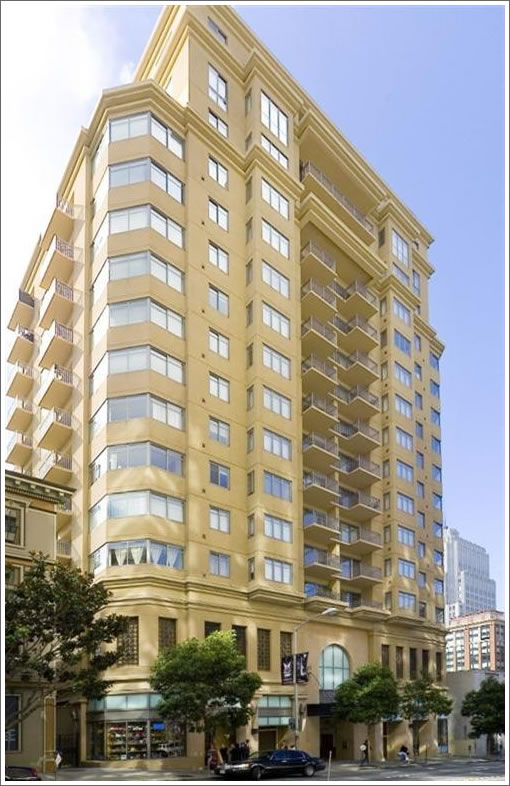

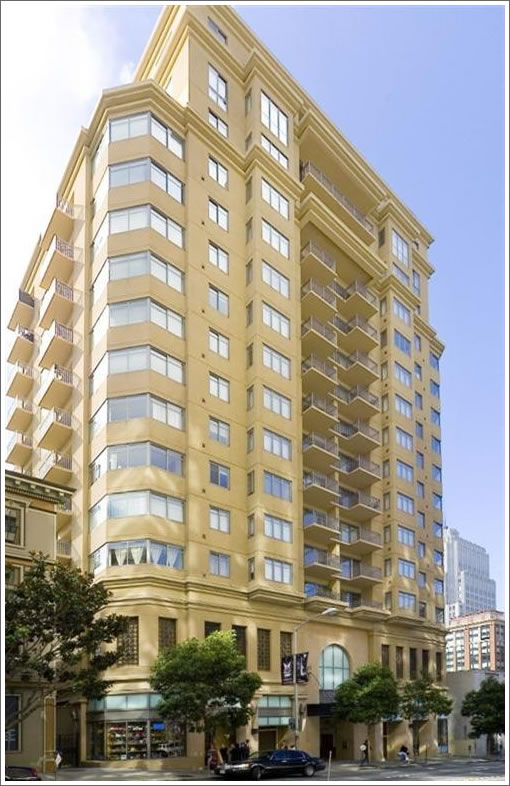

∙ Listing: 246 2nd Street #1306 (2/2) 1,101 sqft – $859,000 [MLS]

∙ Something Tells Us That “By Far” Wasn’t By Accident [SocketSite]

∙ It’s A Good Thing Those Bank Owned Comps Don’t Matter, Right? [SocketSite]

A truly motivated seller would drop the price on this one by another $60k, at least.

I will wait for the bulls to way in to let us know if this is a “real” comp, not like that silly 19th ave comp.

South views? Yawn. Chop another $75k-$90k and a year of prepaid HOA, then we’ll talk.

Oh I can’t wait for September next year when the Alt-A resets hit. It’ll be pacman time.

A real comp? Sure. Why not? If you can hang tight for a little while this is the relatively desirable part of town where some better buyer deals will be had.

It’s always amazing to me to see how people follow the market down. NINE months? WHAT were these guys thinking?

In those nine months, there have been 2 foreclosures in the building (at least), and the prices were basically back to 2000 prices for each of them.

This one (1306) sold in 2000 for $725K. I’d start dropping the price pronto to the mid-700Ks before credit and economic conditions worsen even further.

The current owners (per prop shark) bought this place in 2004 for $719K (note how the first purchasers lost a good chunk of cash – after commission – when THEY sold in 2004 to the current owners). So, there seems like some room to still get out with some gains for the current owners, even after commissions and selling expense. I’d act fast before this window of opportunity closes.

I’d act fast before this window of opportunity closes.

It used to be:

“Buy now or be priced out forever”

Time to coin a new slogan:

“Sell now or be overpriced forever”.

Where’s the 13th floor superstition discount??

These SOMA and South Beach condos are really going to continue to decline given the tightening lending standards (still room to debate other property types and parts of town). They were generally designed for younger, first-time buyers. By definition, this demographic has not yet acquired much wealth and intends to keep the place for a shorter time before moving up than other market segments. But you now need a $150,000 down payment and other assets to qualify for a loan, mortgage interest rates are higher and climbing, and only the most panglossian would predict that one would be able to sell these places at a profit within the next several years. So most would-be buyers simply can’t qualify, and those who could wouldn’t want to buy this type of place in a declining market. I think Satchel’s advice is sound — drop it another $125,000 and cut your losses now.

These SOMA and South Beach condos are really going to continue to decline given the tightening lending standards (still room to debate other property types and parts of town). They were generally designed for younger, first-time buyers.

Really? I live in the area and there are ALOT of empty nesters, affluent guppies, and DINKs in these buildings.

guppies?

geriatric urban professionals?

I rented in the building for a while– placed here by a corporate relocation company. There are a lot of investment property rentals in there rather than the first time buyer set. The parking lot was never more than 1/2 full…

‘It used to be: “Buy now or be priced out forever”‘

Another new slogan for the buyer: Act your wage.

(read on another site re: responsible borrowing)

Act your wage

guppies: geriatric urban professionals

LOL. That’s what a Friday is supposed to be.

“These SOMA and South Beach condos are really going to continue to decline given the tightening lending standards (still room to debate other property types and parts of town). They were generally designed for younger, first-time buyers.”

Half the people in my building are 40-50+, have multiple homes and $100k-$200k cars. Tightened lending standards don’t mean jack to a lot of residents in the area…

I have been in most condos in the area. No offense to anyone, but 246 2nd is not one of the most popular and is certainly not a good barometer of the market. Its pricing is reflecting people’s desires to live in a tower with more amenities like 24-hour doorman, gym, pool, etc.

I really like this building. Location is great, much better than ORH or Infinity, in my opinion. But I agree with scurvy that I’d rather have a northern or eastern view here.

And it is still priced to sit. Last sale of this floorplan was #706 in October of 2006. Lower floor, yes, but much crazier market. Banks were still doling out loans to anybody back then. Anyway, #706 went for $785K. Prior to that, this same floorplan sold for $755K in March of ’05. Looks like this purchase at $719K was 100% financed, too.

But it is a nice unit on a high floor. Wouldn’t surprise me if it sells somewhere in the $750-800K area. Sellers should break even provided they haven’t “liberated their equity.”

Anon, what building are you in? If fully half the people there have $100k-$200k cars, I would love to spend a couple hours in the garage gawking. I can’t imagine it is representative of SOMA condos, but maybe I’m wrong, and that must be an amazing sight in any event.

“The current owners (per prop shark) bought this place in 2004 for $719K (note how the first purchasers lost a good chunk of cash – after commission – when THEY sold in 2004 to the current owners). ”

I might take a nibble at this one if they came down to their purchase price of $719K. keeping fingers crossed.

“Act your wage”

Funniest and most appropriate tagline I have ever seen on socketsite. I nominate it as quote of the year.

“Anon, what building are you in? If fully half the people there have $100k-$200k cars, I would love to spend a couple hours in the garage gawking.”

Not this 2nd Street building, but my friend lives in the 300 Beale building, and this is certainly true.

They may have purchased for $719K, but I’m guessing they have a pay option arm loan, for which they made the minimum payment and are now into it for something approaching the 120% early reset point, which would be $862K. They probably owe $859K, just under the early reset limit, and if you add the realtor’s commission ($43K), that was about their last price.

My understanding is that you can avoid the early reset by simply not letting it hit that number: you start making the full payment just before it hits the 120% early reset limit, and you can avoid the reset for another six-twelve months. That’s probably what happened here: they started approaching the early reset limit when the balance would hit 120% and now they have to make the full payment, which is killing them, so they decided to put it on the market. The full on reset hammer is hanging over their heads (which occurs as a result of time from the loan origination, independently of the balance), which will drive the payment even higher.

I think a lot of us were expecting that people would blow past the 120% limit (which varies from bank to bank), and get hit with the early reset, driving people into rapid foreclosure, but of course, what I hadn’t thought of was that the rational person starts making the full payment when they are just shy of that early $ limit to keep from triggering the early reset: something a lot of us were not counting on (and which could add more time to the resets, and the tidal wave that is coming).

At this point, they are going to eat the realtor’s commission and try to just recover the balance of their loan. Doubt it will work.

But if this is indeed what is happening (all speculation on my part), then we’re in for another 6-12 more months of low inventory before the dam breaks if everyone does what I think these guys are doing: skating right on the edge of the early reset of their option arm loan, delaying the reset until the automatic time-based reset that occurs later.

Tipster,

You start with a wild guess. It is a convenient wild guess for you because it dovetails into your rationale of everybody losing money in this market. That’s despite what the numbers show for this property, the sellers on paper appearing to gain if it sells for anywhere near asking. Next, you expanded the guess outward and include everyone, forecasting catastrophe.

I don’t get why you are you such an uberbear propagandist. I guess that it is your hobby and that’s all there is to it. Because you seem like a pleasant guy, but wow, some of your stuff is beyond unfounded, intentionally misleading and misrepresentative.

“Half the people in my building are 40-50+, have multiple homes and $100k-$200k cars.”

If this is in fact true (I have my doubts) I would also not hesitate to guess that it’s definitely not representative of your average SOMA owner.

I agree with Dude, this is a great location…

I too nominate “act your wage” as quote of the week/month/year… better yet, quote of the decade!

Guys in my high school had multiple homes and $100k-$200k cars, it was no big deal.

I hope tipster is right, for the current homemoaners’ sakes. If he’s right, these guys got to live way past their means for 4 years at probably 1/2 the “true” cost of owning. It might even have been cheaper than renting (although doubtful over this period, when for the most part rents were depressed).

If tipster’s not right, and these guys had a conventional-type mortgage, they spent *way* more than it would have cost to rent an equivalent unit. And now they have the joy of a bunch of fools parading through their home every weekend and Tuesday, while they sweat out the market, all the while sliding down the “slope of hope”.

I watched a lot of people slide down like this in tech stocks as they wiped out 2001-03. Note to those who like to say that SF real estate is not like pets.com – “it won’t go to zero”. Yeah, that’s right. One’s investment goes LESS than zero, as the entirety of the downpayment gets wiped out (100% loss) with anything more than a slight decrease in nominal value. Imagine having a portion of one’s wealth *absorbed* like this and then having to dig into one’s own pocket to pay 5-6% to a realtor (and 1% to SF in transfer tax) just to avoid the sting of foreclosure? I’d almost pay extra in rent to avoid this possibility. Thankfully, the SF real estate market allows one to comfortably rent an SFH at 35-50% of the all in cost of buying it in my experience.

You’re speculating wildly too Satchel. In 2004 some outstanding mortgage rates were available. Your scenario of Tipster being incorrect is ridiculous because you actually have no earthly idea what happened. It’s like you guys simply hate seeing people do well in real estate, and I find it very odd to say the least.

Re “Half the people in my building are 40-50+, have multiple homes and $100k-$200k cars. Tightened lending standards don’t mean jack to a lot of residents in the area…”

I suppose that’s true until they want to sell….

fluj,

You might want to read what I said before you jump all over me. First I just took a guess as to how the person arrived at the pricing in order to point out that they probably don’t have much room to go further. That was the point of analyzing the loan.

Although they “lose” money on the loan, they made it up in smaller payments over the life of the loan (which they financed at favorable rates), so no I don’t believe they would lose money at this price, I just think it might be a long shot to get it. They will owe some money, but in a Neg Am loan, you can make money and still owe on your loan. Am I not correct?

But then I also pointed out that the homeowner had a way of dodging of his early reset that I hadn’t considered, which would delay the reset for 6-12 months, and pointed out that if others used the same technique, and it was only logical that they would, all of the resets from these types of mortgages would take longer to hit, benefiting the bulls position. I was admitting I might be wrong about the reset dates.

So no, I wasn’t forecasting catastrophe from this sale, what I was saying was that the homeowners has a loophole that I wasn’t paying attention to, and I am forecasting that others will use that same loophole to make the minimum payment as long as they can, but avoid the reset from having the loan balance hit the maximum. The only thing I was forecasting was that others in their position would likely do the same. That’s not catastrophe for anyone but the bears, as the longer it goes on, the longer it will take for prices to really fall, and the more probability that something else intervenes to “save” them.

Satchel,

Your analogy with stocks is very relevant.

You can still have to dig into your own pocket if you use margin or borrow the money to buy your stock.

In RE, you can have a 5 times margin (20% down, 80% loan) or even much bigger like 20 times (5% down, 95% loan) or even no money down. A mitigating effect is the fact that you can be foreclosed and the debt forgiven, whereas the only way out of a losing margin stock bet is either an extra cash loss or bankruptcy.

Tipster,

I understand what you said fully. OK, sure, the “dam breaks” is delayed 6 to 12 months.

But dude — you don’t know what happened here. You say so, and you use it as a jumpoff to theorize and predict. This is all done with an underlying assumption of that a mistake was made.

You essentially said: unknown, unknown, unknown, if and only if unknown.

$100-$200k cars eh? I wonder if they paid cash or used mortgage equity to it’s fullest… Any guesses into how much HELOC’s have pumped up the economy the past few years?

According to the listing the sellers are relocating. Maybe there’s a simple explanation for why they’re selling–they’re moving!

Well, yes, I repeatedly guessed and said so and it’s perfectly to theorize as long as you say so. I can’t see anything wrong with that. The numbers DID sort of match up, so it’s probably a decent theory.

And no, if it sells at that price, no mistake was made at all. The buyer paid a fraction of what it cost to rent and bailed out with a payment to a real estate salesperson that still did not make up the rental price, so they win. The bank gets their money back so they win. The loan would have done exactly what people said it was supposed to do: insulate the buyer from payments that actually covered whatever price they paid by making it up in appreciation. Although they weren’t planning on paying anything out of pocket (based on their initial two prices), even with that payment, I suspect they still come out very close to where they’d be if they rented, depending on their tax situation. So it wasn’t a loss or mistake at all.

But that assumes they get their price. 780 psft: good luck with that.

Why assume a neg/am? Why not assume 20% down paying like 560K and change at a good rate for four years? That would likely put the payments at sub-rental rates. Tack on the relative savings rent would have otherwise cost extra as “Opportunity Gain.” Factor in the deductions. Win win win. Then, seeing as how this property didn’t go down the tubes, I do the opposite of you. I expand to say that everyone who bought real estate in the last few years who could afford it will make a lot of money in the next year or so if they sell.

I can just as easily say that as you can say what you’re saying. But I won’t because we don’t know.

“According to the listing the sellers are relocating. Maybe there’s a simple explanation for why they’re selling–they’re moving!”

Could be. But I wouldn’t trust anything a realtor puts in a listing. They started trying to sell this place NINE MONTHS AGO. That’s quite a long time for a relocation, isn’t it? And a long time to wait to get out of SF and into a new job. I wonder what was keeping them here that long? Tipster’s scenario is becoming more likely the more one thinks about it.

Similar place at this address (maybe even THIS place?) for rent on craigs list for $3600.

http://sfbay.craigslist.org/sfc/apa/805475989.html

I don’t even need to use the various rent vs. own calculators. You come out way, way ahead by renting rather than buying. No way any sane person would pay this price.

“Why not assume 20% down paying like 560K and change at a good rate for four years?”

Because PropertyShark clearly shows zero down on the 2004 purchase. First mortgage is also variable. I’m not saying tipster’s theory is right, but it’s plausible. Besides,

Seller relocating?” Isn’t most everyone selling real estate technically “relocating” somewhere?

anon,

The place looks different. Probably the same floor plan/orientation but on a lower floor. Walls are of different colour, view shows no sky, the plasma is mounted on the wall on the MLS.

But interesting comp nonetheless. Cheaper to rent if you’re not in for the long run, imho.

“Why assume a neg/am? Why not assume 20% down paying like 560K and change at a good rate for four years?”

Simple. Because we KNOW that they didn’t. Per propertyshark: 100% financed, $575,200 (variable); $143,800 (fixed). Lender on both: Greenpoint Mortgage Funding (they are a captive lending sub of Capital None, which I have been happily short for a while 🙂 )

From Greenpoint’s website today:

“Please note that effective August 20, 2007, GreenPoint Mortgage has ceased accepting new residential loan applications.

Please note that effective October 5, 2007, GreenPoint Mortgage has ceased accepting new commercial loan applications.”

http://www.greenpointmortgage.com/

I just LOVE deflation. I love it.

Fluj, you’re really reaching here. We’re all just speculating and having fun on a Friday. But your attempt to paint this as a “glass half full” picture is misleading because it conflicts with the facts we KNOW. Let’s wait to see where it sells. I’m guessing this is going down MORE.

As an aside, it’s funny that no one is mentioning that the last two foreclosures at this building wiped out all apparent gains back to 2000.

I know appraisers like to talk about how foreclosures are not “comps”, but let’s face it, everyone has to make a living and all, but appraisers as a group are a pretty plodding group of ponderers. I mean, the cash/credit used in a purchase is just as green and IT doesn’t know it’s being used in a foreclosure, does it?

Or, another way of looking at it, if you think foreclosures are not “arms’ length” because there is some distress or stigma, well, why should a “comp” count when a foolish buyer buys with no skin in the game at 100% financing using a stupid bubble financing scheme that literally PUT THE LENDER OUT OF BUSINESS within a few years of starting to make these loans, as Greenpoint/Capital None here??

San FronziScheme, you’re right. Looks like a different unit with about the same layout. Nevertheless, pretty on-point comp as far as rental value goes. The only difference I have with your post is that at this asking price, you come out ahead renting even over the long run unless you expect both significant real estate appreciation and a low upside potential on other investment opportunities. I don’t see the first happening for at least several years in SF. Need about a $200,000 further reduction to make the rent vs. own analysis worth digging into even with a long-term perspective.

Oh, I’m reaching? I’m reaching and you are taking it as a given that they paid the minimum payment as long as they could. Funny.

I looked the property up too and I didn’t see 100% financing in the tax records. What I saw didn’t show the details.

But hey, by using a fake millionaire loan, they got to live in the place for less than renting for a few years. That probably left them enough money each month to lease a nice Land Rover or M5. Their neighbors got to walk through the garage and think, “Wow, everyone in my building is so rich! Look at these $100K cars!”

Well, fluj, if they didn’t make the minimum payments they probably paid more than it would have cost to rent it. If they sell it up here ($850Kish) they’ll do fine. As it goes lower, it turns less fine. At around $775K they start to bleed all over their finances, because they face around 7% in selling costs (the additional $$ they “threw away” owning this place over the cost of rent is gone already in this scenario). First a trickle, then if the price goes even lower the spurts begin, and before you know it, it’s arterial. No free lunches in econ.

BTW, what do the tax records show as to financing? Are there lenders’ names listed and amounts of loans? Why aren’t you guys as realtors looking at the prop shark data to suss out what the true situations are?

hahahah. You guys will not admit you don’t know what happened. It kills me. Yeah lenders names are usually listed, and the amount.

“true situations are?”

Right.

anon,

Yeah, I haven’t run the numbers and you’re probably right.

Some facts that need to be taken into account: 560 in HOA that will come straight out of the rent. Property taxes probably around 900/month. 40% of the rent is already gone and you haven’t even started paying down the mortgage.

To be honest, a few points in favor of owning:

1 – If your mortgage interest is fixed, that’s a given amount and it’s pegged forever. The rent is whatever the landlord wants it to be (it’s a recent building, no rent control). That’s a plus for

2 – If you expect hyperinflation in the medium-long term, buying is often a good option. Think of people who got into debt up their eyeballs in 1970 (my parents). Inflation made their mortgage payment look tiny 15 years later.

The seller probably recently spent $75 at Macy’s to buy a new shirt. By the way the agent worded the ad for this condo, I suspect it was a blue shirt. Despite the growing number of days on market, the seller confidently made the shirt purchase (allegedly) because of his new job in Boston (probably) where he will make somewhere between $107,000 – $112,000 per year. (I can determine this just by looking at the angle from which the photos were taken by the real estate agent.) Once the place finally sells, the owner plans to by his mother a new Kitchen Aid mixer for her birthday. They are on sale at Amazon… I think he plans to pay with cash but he may apply for the Amazon credit card because of the cash back feature. We’ll just have to see…

100% Financing. This is a candidate for the rogues gallery of “Satchel’s heros”.

Fluj, ol buddy. Everyone thinks this was a brilliant investment on their part. They got to rent an apartment at a subsidized rate AND they got to gamble with other people’s money (OPM). If the house price goes up they get to keep the money, if it goes down they walk away and dump the loss on the bank/taxpayer. Heads I win, tails you lose.

America! What a country!

“Act your wage”

I really like that one.

I saw another one somewhere that was pretty funny in a black humor sort of way. Back in December 2007, Paulson and the other fraudsters were trying to convince both new buyers to contribute their real cash downpayments to the coming credit bonfire as well as existing homemoaners to keep sending in their copecks on their underwater albatrosses. Part of this scam was the “Hope Now Alliance” bailout that of course they knew wasn’t going to make a bit of difference.

Hope Now poster:

“WANTED: DEBTOR ALIVE”

Well, *I* thought it was pretty funny…

It’s like you guys simply hate seeing people do well in real estate, and I find it very odd to say the least.

Sour grapes.

“Half the people in my building are 40-50+, have multiple homes and $100k-$200k cars”.

IF this were true, it would be worse, but it still shows how much “the city” has changed. Expensive cars sitting in garages of multiple home owners (think Cindy McCain), but could someone tell me again how this makes San Francisco interesting? I am all for making money, but am more interested in living in a city where I can be around people that don’t need a 200k car in a garage to feel complete. If I wanted to live in Newport Beach, I would be down there right now since the weather is better, but I was hoping San Francisco was a little bit more mature, interesting and urban. Sigh.

Has anyone else noticed the “relocation” is the excuse dejure for why people are ‘motivated’ these days?

I am not saying that it doesn’t happen, clearly it does, but there seems to be a lot of relocations. Which is odd considering the slow down in the economy.

“Which is odd considering the slow down in the economy.”

Picking up and moving to another town is odd considering an economic slowdown? Most people would say the opposite is true: Go where work is found.

There’s nothing odd about relocation being an excuse for motivated sale. What’s steadily not becoming all that odd any longer, but what is relatively new, is the amount of scrutiny private citizens are subject to in this day and age.

“What’s steadily not becoming all that odd any longer, but what is relatively new, is the amount of scrutiny private citizens are subject to in this day and age.”

Yeah, things were much better back when only RE agents knew how to get people’s info. Darn all that public access!

Yes, I second that Foolio. Darn all that public access!

“Yeah, things were much better back when only RE agents knew how to get people’s info. Darn all that public access!”

I made a flat and true statement. I left it to the peanut gallery to make a value judgment. You didn’t disappoint.

“What’s steadily not becoming all that odd any longer, but what is relatively new, is the amount of scrutiny private citizens are subject to in this day and age.”

Yeah. Real Estate transactions have always been a matter of public record but you used to have to go down to the county court house and whip out the microfiche reader to find out.

I’m not sure from a public policy standpoint whether it’s good or bad to make every property’s records available to anyone with an internet connection … but it sure is entertaining, isn’t it?

“What’s steadily not becoming all that odd any longer, but what is relatively new, is the amount of scrutiny private citizens are subject to in this day and age.”

I think ALL real estate info and pricing should be made public and MORE accessible. Wall Street and the banksters have made housing into an “investment”. As such, the public has an overriding ineterest in the accuracy and transparency of the information. Fraudulent misrepresentation of pricing data, trends, etc. should be actionable, just as they are (in theory) when securities are offered to the unsophisticated public.

It might make sense, though, to protect the privacy of individuals’ names in those records. That’s a public policy issue that should probably be explored. In stock and securities pricing, it is generally pretty hard to get the names behind the transactions (except for the dealers’ names of course who are acting as market makers or clearing agents).

“In stock and securities pricing, it is generally pretty hard to get the names behind the transactions”

Stocks are identical and interchangable. I suspect it’s necessary to list the property’s owner so that scamsters don’t start trying to sell houses they don’t own.

Incidentally, that’s why the lien holder is there in the records. Not to make the buyer’s finances public but to show who actually owns the house.

fluj: It’s like you guys simply hate seeing people do well in real estate, and I find it very odd to say the least.

NVJ:Sour grapes.

No, it’s not all sour grapes. I’ve made a killing 2 years ago (and was a bear since 2004-2005, the main reason I sold) and am just like most people waiting for prices to go back to an affordable level to jump (back) in because the simple rules of economics have to apply even in stratospheric markets. Things have corrected already nationally and sometimes over-corrected in very local markets. But in a few enclaves a small number of people are still denying the rule of gravity.

Thanks to SS and other industry-independant sites we have another voice than the “RE advertising supplements” either online or in print always coming from the top down. Denounce this as “sour grapes” if this makes you feel better, but the shift is real and could ( and I emphathize “could”) hit us sooner than later.

@fluj:

“scrutiny private citizens are subject to in this day and age”

Right, no loaded language there…good ol’ disingenous Fluj. Never change, bro!

Foolio,

Come on man. Look at what I said. I said it’s happening more frequently but it’s a relatively new thing.

I said it in response to someone querying the believability of people moving from San Francisco in a down economy. Hi. Down economy? Move to a job. San Francisco — a transient town if ever there was one.

Or perhaps your issue was with the word “scrutiny” ?

Is not looking up someone’s tax info scrutinization? Scrutiny is neutral. My language was neutral. I called it like it is, flatly.

I’ll tell you what isn’t neutral tho, was this:

“”Yeah, things were much better back when only RE agents knew how to get people’s info. Darn all that public access!”

I’ve made a note. You’re an inveterate realtor basher, you go out of you way to be like that, and you called me disingenuous. Thanks brah. All while supporting somebody who doubted “all this needing to relocate for work.”

Pick your spots man. Jeez.

“Scrutiny is neutral.”

Totally. I think you should have gone with another neutral option like “informational proctology examination” instead. Hey, just the facts…

LOL. Thanks for the humor. How could I be a realtor basher (BTW, I’m actually closely related to an RE agent, FWIW) when you keep me in stitches? I love it, keep em comin.

OK, sorry SocketSite for the interlude. And now back to the 2nd street condo…

Look it up, holmes. It’s a dispassionate term. So was my post. Not so your realtor bash. Take it greasy.

Well, how about some predictions as to where this 1306 unit will sell, assuming of course it stays out of foreclosure?

I’ll bet $765K. It’s only “worth” what the other foreclosures in this building recently sold for, ie 2000 prices, ie $725K, but I bet some clever realtor manages to convince a sucker that foreclosures are not real “comps” and therefore the sucker should not expect to pay the market value in today’s market, but rather a little more….

Sounds about right. My guess, as I posted above, is $750 to $800K.

Positives: Nice unit in good condition, high floor for the building, good size, great location.

Negatives: Views are unspectacular (with small windows), high HOAs for a building with no amenities, and lots of options for SOMA condos these days.

By rough math, sellers break even above $750K (not counting inflation or time value of money, but I doubt they’re considering those anyway).

Back of the envelope estimate: this rents 3000-3500 easily. Say 3250. With a 100 rent/buy ratio, adjusted to a SF delusional index of 50% + a “gravity doesn’t apply here” index of 40% I am getting 682K which is already 10 times median salary.

@fluj

I dont understand why you say ‘sour grapses’ to people enjoying real estate prices falling. If you’re an investor and you’re looking for lower prices (like fronzi and (mebbe) Satchel), then of course you want prices to fall. To crash even. If you are a seller you want the opposite.

If you decided to forego investing in 2004 when the market took off as u considered the prices too high, then of course you would be delighted for prices to come down. Surely this is just investment psychology 101.

I own property that I dont wish to sell. Im also in the market for another property. I take great glee in seeing prices falling. The further the better as my next real estate transaction will be a buy and (hopefully) not a sale. Reasonable?

Not odd at all 🙂

Does anyone remember what the PE ratio or Rent/Buy ratio was during the last real estate troughs in early 80s and 90s? Is there where the 100 or 150 comes from?

Thanx

I didn’t say sour grapes regarding prices dropping. In fact, I’m on record saying that older SOMA condos prices are indeed likely to drop. The sour grapes thing came in when I wondered why some posters seem to hate seeing people do well. Another poster quoted me and said that.

I’m not sour grapes, that’s for sure. People who think real estate was generally a good investment after 2003 or so probably don’t know much about investment, or just how well almost every asset class on the planet did since that period.

For me, I like to see people who have misjudged asset prices lose money. It fits in with my world view – those who are good at asset price estimation should profit, those who are poor at it should lose capital realtive to others (and sometimes in absolute terms as well). This process – if left alone without interference by foolish policy makers – will lead to a better and more rational economic landscape, and consequently a stronger and more resilient country that has to exist in a very dangerous world.

Anything that speeds this process along is a welcome development in my view, especially visible losses. Most people don’t have the patience or inclination to think abstractly, and only learn from personal experience or highly visible failure of others. I saw a posting on another blog recently that summed up this idea, attributed to Will Rogers:

“Some learn by reading.

A few learn by observation.

Most learn by peeing on th electric fence.”

I dont understand why you say ‘sour grapses’ to people enjoying real estate prices falling

No one said that. There are plenty of reasons to be happy to see real estate prices fall.

The statement was “It’s like you guys simply hate seeing people do well in real estate, and I find it very odd to say the least.”

Why do some posters on here get so upset to see others do well? I think I summed it up succinctly and correctly.

BTW, it’s in contract already!

246 2nd Street #1306 closed escrow on 9/26/08 with a reported contract price of $852,000 ($7,000 under asking but $133,000 over its last sale in 2004).